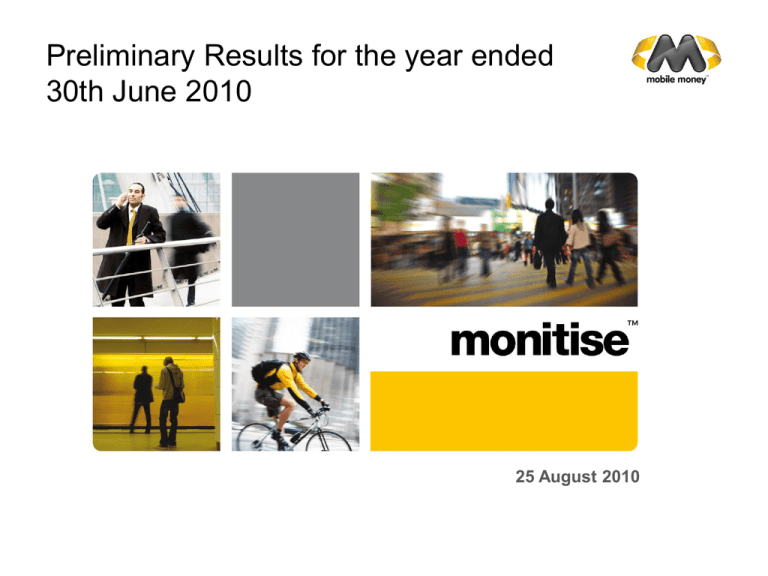

Headline - Monitise

advertisement

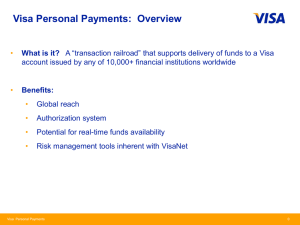

Preliminary Results for the year ended 30th June 2010 25 August 2010 George Osborne in India Click to play 2 Agenda • Introduction • Market update • Company update • Finance update • Summary Introduction The Network Effect UK iPhone launch Page number New Media Age winner ‘Best Use of Mobile 2010’ Lloyds TSB “Say Hello” campaign O2 16 apps press campaign Multi state roll out during the tax season 5 Overview • Mobile money market - large, validated and fast-growing global market • Monitise platform established as a market leader • Gaining significant traction – Strong UK track record with platform already adopted by RBS Group, HSBC & Lloyds & available across all mobile phone networks – Customer base growing rapidly – International partners include Visa, SCB, Travelex & FIS – JVs in place to access fast-growing markets of USA, Asia Pacific & India 6 Overview Continued • Strengthening of relationship with Visa – Equity investment increases shareholding to 14.4% – Extension of Global Alliance Agreement (GAA) and licensing of new strategic territories (Mexico and Russia) • Cash raised provides funding for Group until cash generative – UK operations expected to reach cash break-even by December 2010 – Current live operations expected to reach cash break-even during FY12 • Significant opportunity to cement leading international position 7 Market update Mobile Money and the Opportunity • Mobile Money is securely accessing your finances through your mobile phone • Mobile Money gives you the freedom to bank and pay on the move – Direct connection to accounts – Ability to make payments/transfer funds • The scale of the opportunity is enormous – There are 2.2 billion people using financial services in the world (Financial Access Initiative, McKinsey 2009) – There are 4.6 billion mobile phone users in the world (International Telecommunications Union, “Measuring the Information Society” 2010) 400m The number of subscribers who will use their phones for mobile banking by 2013 (Juniper Research, 2010) 108.6m The number of people who will make payments by mobile phones in 2010 – up from 70.2m in 2009 (Gartner, June 2010) $250bn The value of mobile payments by 2012, growing globally at 68% p.a. from 2008 (Arthur D Little, 2009) 9 Company update Group Overview Global opportunity Banking & payments touch the lives of billions of consumers worldwide Blue chip business partners Adopted by major UK and other financial institutions Wide platform applicability Any phone, any network Via SMS, Java, Brew, Browser, iPhone, Blackberry, Android Broad range of services From balance enquiry to instant payment Account management, payments, mCommerce 11 - A Key Strategic Partner Visa Inc. • A global leader in payments • A key strategic partner for Monitise • Mobile channel is a major strategic imperative for Visa • • • • 16,000 financial institution customers 1.8 billion Visa cards (31 Dec 2009) 64 billion total transactions $2.9 trillion payments volume Source: Visa website. Figures as of 31 March 2010 unless stated otherwise Strengthening of Global Alliance Agreement (GAA) • Equity investment increased to 14.4% in Monitise plc “Mobile – the next payments frontier” (Visa Inc.) • Extension of Global Alliance Agreement • Term increased to 2015 , minimum fee commitment increases from $13m to $16m • Monitise to grant Visa Inc. license for further deployment in Mexico and Russia – licence fee of $1.5m anticipated for FY10/11 • Appointment of Elizabeth Buse, Group Executive, International, for Visa Inc. to the Monitise Board 12 Our managed services make the complex simple… Patent Protected 12 Monitise Customer Propositions Advanced 28% Essentials 24% Feeder 48% Customers who have multiple services Customers who have downloaded an app Customers who have registered for text alerts services Customers who have registered for account updates (via text) Typically customers who have registered for our pre-paid card and card activation services (£7+ ARPU) (£2-3 ARPU) (<£1 ARPU) 14 Typical Feeder Services • Debit and credit card activation by text • Pre pay card balance notification • Update and event confirmation text messages 15 Typical Essentials Services • Pull an account Balance via text • Weekly Text Update • Low Balance Text Alerts • Actionable Alerts • Overdraft Sweep • PayDay Sweep 16 Advanced Services • App Stores: Apple, RIM, Ovi, Android • Secure Browser alternative • Bank Accounts, Prepaid Cards, Credit Cards • Account Management • Set & Manage Alerts • Lock/ Unlock Cards • Branch/ATM Locator • Bill Present & Pay • Payments: Pay Anyone & P2P • Reloads: Airtime top-up Transit, Prepaid • Cross Sales/CRM Prompts • Loyalty • 2FA for secure log in • Stock Trading • Coupons & Vouchers • Lottery • NFC Ready Live Future roadmap 17 Emerging new customer behaviour Advanced segment usage trends •Banking channel of choice, with 16 transactions a month •App usage highest between 7am and 9am (on the way into work) •Usage peaks on Friday’s and Monday’s and at the end of the month (‘have I been paid yet?’) •90% of customers who download it, go on to use the app regularly 18 Unlocking the Potential In the developed world, factors that drive addressable market are: Adult population % banked or with prepaid cards % pop with mobile phone Asia Pac (Inc China) 400m+ Consumers India 230m+ Consumers USA 212m Consumers UK 36m Consumers In the developing world, factors that drive addressable market are: Adult population % pop with mobile phone % with banked or with prepaid cards but also offer an m-wallet for the unbanked if the regulations allow Time 19 Finance update Business Evolution UK 2007 Americas 2008 Visa Global 2009 Asia Pacific 2010 India 2011 Africa 2012 TECHNOLOGY Investment Areas Live Operations Live 21 Financial Summary Revenues FY08 to FY10 Revenues by Type • Revenues of £6m, up from £2.7m in FY09 (↑125%) £6.0m • H2: £4.3m, up from £1.6m in H2 FY09 (↑170%) 6.0 • Transactional revenues gaining traction (↑490%) 5.0 Live Operations 2.9 £m 4.0 £2.7m • Reducing losses from H1 to H2 3.0 • Driving towards profitability 2.0 • UK operation on track to cash break-even by Dec 2010 • Monitise Americas close to cash break-even Transactional Revenues 0.5 £1.5m 1.7 License Fees / Royalties 1.1 1.0 0.0 0.4 Development Revenues 1.0 1.1 1.4 FY 08 FY 07/08 FY 09 FY 08/09 FY 10 FY 09/10 Investments H1 FY08 to H2 FY10 Transactional Revenues • Increase in investment spend H1 to H2 • Asia Pacific JV • Enhancement of platform capability • Growing appetite for mobile payments • Retaining / extending our technological advantage Cash 2.5 2.0 1.5 £m 2.1 1.0 0.5 0.8 • Cash balance of £13.2m at 30 June 2010 • Cash balance, post fund-raising, in excess of £42m 0.0 H1 FY H1 08 FY 07/08 0.1 H2 FY H208 FY 07/08 0.2 H1 FY H1 09 FY 08/09 0.3 H2 FY H2 09 FY 08/09 H1 FY H110FY 09/10 H2 FY H210 FY 09/10 22 Segmental Performance – Year on Year FY 10 FY 09 Year Year Revenue Op (loss)* Revenue Op (loss) £m £m £m £m Live operations 4.8 (2.5) 2.1 (2.0)** Future Ops/Technology/Corporate 1.2 (11.8) 0.6 (10.0) Total 6.0 (14.3) 2.7 (12.0)** *Before Share Base Payments/Exceptionals ** Prior year loss for live ops includes 50% share of Monitise Europe. Like for like Group operating loss is broadly flat year on year 23 Segmental Performance – FY10 H1/H2 Revenue & Loss Trend H1 H2 Year Revenue Op(loss) Revenue Op(loss) Revenue Op(loss) £m £m £m £m £m £m Live Operations 1.6 (1.6) 3.2 (0.9) 4.8 (2.5) Future Ops/Technology/Corporate 0.1 (5.3) 1.1 (6.5) 1.2 (11.8) Total 1.7 (6.9) 4.3 (7.4) 6.0 (14.3) 24 Segmental Performance – FY10 H1/H2 Margin & Overhead Trend H1 H2 Year £m £m £m Revenue 1.7 4.3 6.0 Gross Margin 0.9 2.9 3.8 Total Overheads (7.8) (10.3) (18.1) Operating Loss (6.9) (7.4) (14.3) 25 Key Milestones Year to 30 June 2011 UK operation moves to cash break-even Hong Kong launch China pilot launch India launch First Monitise enabled Visa product launch First Visa transactional revenues Year to 30 June 2012 All existing live operations at cash break-even (UK / N America / Visa) First Indian transactional revenues First deployment of live services in China Further rollout within Asia Pacific region 2013 Onwards Group cash generative Major mCommerce launch 26 Summary • Fast growing demand for mobile money worldwide • Established market leader with 8 years of investment in technology and relationships • Highly motivated team supported by experienced Board, strengthened by new appointments • Blue chip partners & strategic investors – Facilitating global access – Deepening relationship with Visa • Transactional revenues growing rapidly • UK operations expected to reach cash break-even by December 2010 • Fundraising enables Monitise to – Retain and extend its technological advantage – Fund new areas of operation – Take the Group to cash generation Right partners, right team, right technology, right time 27 Appendix Global Footprint Monitise Europe Monitise Americas • JV with FIS to tackle world’s largest consumer markets • Launched 2008 • Over 200 financial institutions signed up Monitise Asia Pacific • Launched in 2006 • • UK as flagship home market before international roll out Recent JV formed with First Eastern • • Significant customer growth in 2010 Showcase launch planned for Hong Kong as springboard into China • >55% of UK retail banking market coverage • Available through all mobile networks Monitise India • New JV formed with Visa Inc. Monitise Africa • Development underway supported by grant funding (Africa Enterprise Challenge Fund) 29 Driving Transactions in a Mobile World Enquiries Payments Information Financial Transaction Processors Bank Accounts, Savings Accounts, Credit Card and other Accounts VISA Payments FIS VocaLink Payments Consumer interface Cheques POS 30 The Mobile Evolution If you don’t establish the secure link now it is lost Importance of mobile commerce to the Banking industry Phase 2 mCommerce Mass market payments Network extension of A2A Cheque replacement mCommerce - Proximity “NFC” person to person payment “text money” Phase 1 mCommerce Extend payment reach mCommerce – Remote “text to buy” Vouchers & offers (add revenue) Leverage payment infrastructure Defend payment position Account to account payment Mass market self service channel Cost reduction & service enhancement Account information/money management Foundation for driving asset value Database MSISDN - PAN 31 Mobile Money will be a massive market ‘‘ The number of mobile subscribers who use their phones for mobile banking will exceed 400m globally by 2013, according to a new in depth study by Juniper Research. This equates to double the number of users this year. Juniper Research, July 2010 'The number of people using their mobile phones to make payments is set to grow from 70.2 million in 2009 to 108.6 million this year, a 54.5% rise. Gartner, June 2010 ‘‘ 'New types of SMS mobile banking alerts will help to treble the volume of mobile banking messages to almost 90 billion per annum by 2015, equating to one message every two days for every mobile banking user. Juniper Research, August 2010 32 Emerging new behaviors % 33 Understanding their finances sets them up for a day 34 Appealing to a mass market 35 NatWest iPhone Proposition Q2 16 apps press campaign App store home page 36 August Lloyds TSB collateral 37 Example live apps. CSB Mobile Money Health Mobile – Wealthcare PyraMax HIB Mobile – Highlands AmBank Mobi - ABT Magna Mobile Avidia Bank Stoneham bank 38 Recent milestones Q2 ‘08 Q4 ‘08 October 2008: 1st 1 million transaction month June 2009: Visa 5 year global alliance signed Q1 ‘09 Q2 ‘09 Aug 2009: Monitise breaks 750,000 customer barrier and takes 100% control of UK joint venture Nov 2009: Monitise launches Smartphone platform Q4 ‘09 Q1 ‘10 Q2 ‘10 Q3 ‘10 June 2010: Agreement signed with VISA for India JV March/April 2010: Monitise hits 2 million customers and JV in Asia Pacific agreed with First Eastern July 2010: Further £32m raised on capital markets Dec 2009: Monitise breaks 1.5 million customer barrier 39 Financial Results: Summary Cashflow Year ended 30-Jun 2010 30-Jun 2009 £'m £'m 10.1 9.7 Cash utilised in operations (13.9) (11.4) Fixed asset purchases (1.1) (0.3) Cash from fundraising 17.9 11.5 Other movements 0.2 0.6 Increase in cash in the year 3.1 0.4 Closing cash balance 13.2 10.1 Opening cash balance 40 Leadership Team Remove detail Executive Team Alastair Lukies CEO • Co-founder of Monitise; co-founder of Epolitix.com (portal for Westminster, Whitehall and devolved institutions) John Brougham CFO • Formerly FD of BT Transformation and BT Global Services Lee Cameron CCO • Formerly General Counsel of Morse PLC Tom Spurgeon Co Sec • Formerly FD of Morse UK Non-Executive Directors Duncan McIntyre NED • Formerly CEO of Morse plc David Dey NED • Founder of Energis, formerly BT PLC board member Colin Tucker NED • Formerly Deputy Chair Hutchison 3G & Technical Director Orange Peter Radcliffe NED • Formerly MD First Data Asia Pacific Elizabeth Buse NED • Group Executive, international, for Visa Inc Jan Verplancke NED • CIO of Standard Chartered Bank Other Advisors : Lord Mervyn Davies, Lord Digby Jones, Christopher Rodrigues (ex President Visa International), Andrew Harrison (UK CEO The Carphone Warehouse ) 41 Monitise: Investor Centre 22p (23 Aug 10) AIM MONI.L £151m (23 Aug 10) 692,727,757 (23 Aug 10) 30000 30 25000 25 20000 20 15000 15 10000 10 5000 5 Profile of major Shareholders (% held)* 14% 5% Price (p) Share price Market Ticker Market cap. Ord. shares in issue 6% 6% 55% 7% 7% 0 Ju n0 Se 7 pNo 07 v0 Ja 7 n0 Ap 8 r-0 Ju 8 nAu 08 g0 Oc 8 t -0 Ja 8 nM 09 ar M 09 ay -0 Au 9 g0 Oc 9 t -0 De 9 cM 09 ar M -10 ay -1 0 Ju l-1 0 Volume (000's) • • • • • 0 Visa 14.4% Standard Chartered 5.5% Other 56% 3i Group 4.6% First Eastern 6.8% UBS Global 6.0% Norges Bank 6.7% Sub 3% holdings reflect increased base of institutional shareholders following recent placing (Standard Life, Fidelity, Schroders etc) *Shareholders as at 23rd Aug 2010 42