RECOVERY AND NPA MANAGEMENT

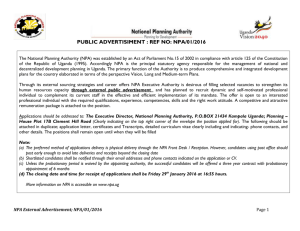

advertisement

Recovery and NPA Management Presentation by A.L.Paranjape RECOVERY AND NPA MANAGEMENT Preventive Methods The preventive methods includeMore careful and responsible scrutiny and appraisal. This includes timely sanction, realism in fixing repayment schedule and adequacy of credit with efficient delivery. Evolving a broad loan recovery policy and implementing through the cadres with adequate accountability and empowerment. Regular and effective follow up with borrowers and timely action on sensing the likely default Title, value, etc. and additional security are to be investigated before the disbursement of loan. More detailed information about the borrowers is to be obtained in terms his/her family background such as i) size of the family ii) number of dependents in the family iii) earning members in the family iv) standard of living v) length of residency in the area, etc. Reviewing the advances in time and taking appropriate immediate action. Sending demand notices in time. Contacting the borrower before the harvest or cash inflow. Proper supervision of the borrowal account through personal visits and calling for periodical returns to get incipient signals of default. Efficient MIS system on the borrowers and on the branches Credit rating of clientele. Developing an early warning system for identifying potential weakness in the accounts. Strict observance of time schedules. Timely extension of period of limitation through debt acknowledgement, partial payment, renewal of documents etc. Timely rephasement or rescheduling of loan in the event of natural calamities. Recovery Strategies effect recovery compromises to improve recovery status of account partial write off adjustment of collateral securities pressure on guarantor special recovery drive help from revenue authorities Rephasement of loans or Rescheduling of demands Rehabilitation of potentially viable units Compromise with borrowers for final settlements Calling up the advances and filing of civil suits Approaching debt recovery tribunals Settlement of claims with Deposit Insurance and Credit Guarantee Corporation of India (DICGCI) and Export Credit Guarantee Corporation of India (ECGCI). Write off the outstanding SARFAESI THE SECURITISATION AND RECONSTRUCTION OF THE FINANCIAL ASSET AND ENFORCEMENT OF SECURITY ACT 2002. The act was passed in 2002. It has three segmentsa) Securitisation & Asset Reconstruction Company. b) Central Registry c) Enforcement of Security Interest It was passed to strengthen the hands of the bankers for recovery of NPA. SARFAESI Act 2002. Security Interest ( Enforcement) Rules,2002. The Enforcement of Security Interest and Recovery of Debts Laws (Amendment) Act 2004. Security Interest It means right, title and interest of any kind whatsoever upon property, created in favour of any secured creditor and includes mortgage, charge, hypothecation and assignment. Criteria for invoking SARFAESI ACT 1. 2. 3. 4. 5. Before invoking provisions of the act , please ensure that following conditions are fulfilled in the a/cContractual dues are = or> Rs.1.00 lakh. There is default and a/c is having NPA status. There is security interest in favour of bank. Documents must be valid & limitation up to next one year. Period stated in notice should 60 day 6. Security document should be complete in all respect & are enforceable. 7. We should be sole banker or in case of joint lending, bankers with at least 75% stake should agree for invoking provisions of SARFAESI. 8. In case of multiple banking where security is exclusively charged to the bank, bank can invoke the provisions of the law. Exemptions Following advances are exempted under the act: A/cs with contractual dues less than Rs.1.00 lac. When the security for the advance was created on agriculture land. Where the contractual dues are < 20% of the principal dues. Assets are charged by way of pledge or lien. Assets financed on hire purchase and lease terms are beyond the purview of the act.