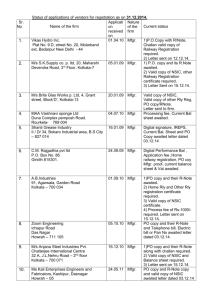

3.NSIC - district industries center

advertisement

1 An ISO 9001:2008 Company 2 VISION To be a world class organization fostering the growth of small enterprises MISSION To enhance the competitiveness of small enterprises through a blend of promotional and commercial activities 3 NETWORK OF OFFICES Head Office Zonal Offices (9) Branch Offices (35) NTSCs (5) SUB OFFICES (26) Foreign Offices(1) Software Technology Parks(2) NSIC Services backed up by more than 500 professionals spread across the country 4 INTEGRATED SUPPORT Marketing Credit Information Technology 5 Tender Marketing Govt. Stores Purchase Programme MARKETING SUPPORT International Marketing (Exports) Exhibitions & Buyer-Seller Meets Consortia Marketing 6 MARKETING SUPPORT •NSIC provides diversified marketing support to SSIs through various marketing assistance schemes for reaching multidimensional and multi-locational markets in India and abroad. •NSIC acts as a nodal agency to bring SSIs closer to various Government purchasing agencies, the largest buyer of various types of products and services, with the intention of creating confidence in the purchasing agencies about SMEs and their capability to supply goods and services of requisite quality, competitive prices and adherence to agreed delivery7 schedules. SINGLE POINT REGISTERATION SCHEME Enhance the share of purchases by the Central as well as the State Govt. and its institutions from the SSI sector 8 Single Point Registration Corporation enlists small-scale units to undertake supply of various items to the Govt. Departments. The units registered with NSIC are considered at par with those registered directly with the purchasing agencies. The registration, thus avoid multiplicity of registration with various government agencies. 9 Facilities / Benefits Issue of tender sets Free of Cost Advance intimation of tenders issued by DGS&D. Exemption from payment of earnest money. Waiver of security deposit Issue of competency certificate consideration of price preference upto 15% for items reserved for MSEs 10 TENDER MARKETING SCHEME 11 TENDER MARKETING NSIC participates in tenders of Central & State Government and Public Sector Enterprises on behalf of small scale units. It is aimed to assist MSEs with ability to manufacture quality products but which lack brand equity & credibility or have limited financial capabilities. 12 Benefits: MSEs provided with all requisite financial support depending upon the units’ individual requirements like purchase of raw material and financing of sale bill Enhanced business volume helps MSEs to achieve maximum capacity utilization MSEs exempted from depositing earnest money Ensures fair margin to MSEs for their production MSEs assisted technically for quality upgradation and new product development in addition to testing facility Publicity to small industries products 13 CONSORTIA MARKETING NSIC explores market and secures orders for bulk quantities. These orders are then farmed out to small units in tune with their production capacity. Testing facilities are also provided to enable units to improve and maintain the quality of their products conforming to the standard specifications. 14 EXHIBITIONS & BUYER SELLER MEETS NSIC organises and participates in domestic and specialised product & technology related & international exhibitions to help MSEs in marketing their products and projects in both national and international arenas. These exhibitions facilitate: Marketing of products and projects of MSEs Closer interaction between technology seekers and offers. Development of mutual contact to discuss all issues involving technology transfer,technical collaboration etc. 15 INTERNATIONAL MARKETING ASSISTS,DEVELOPS AND PROMOTES EXPORTS OF PRODUCTS AND PROJECTS OF SMALL SCALE SECTOR 16 RAW MATERIAL ASSISTANCE Raw Material Assistance Scheme aims at helping Small Scale Industries/Enterprises by way of financing the purchase of Raw Material (both indigenous & imported). Raw material is financed on Credit as per the needs of the unit against Bank Guarantee. 17 Advantages: Convenience of short term finance to save interest cost Non Fund Based limits of banks is converted into fund based limits Easy and quick disbursement Flexibility of repayment at any time 18 PERFORMANCE & CREDIT RATING SCHEME FOR SMALL INDUSTRIES 19 BACKGROUND A Performance & Credit rating Scheme for Small Industries formulated with involvement of Rating Agencies & Indian Banks’ Association (IBA). NSIC appointed Nodal Agency by Govt. of India. The scheme has the approval of IBA 20 INFOMEDIARY SERVICES 21 Infomediary Services 1. Tender Information with email alerts 2. Global Trade Leads 3. Prioritized Listing in Manufacturer Directory 4. Technology Search 5. Chat with Experts 6. My Work Place(member home page) 7. Discussion Forum 8. Jobs@SME 9. Auction Room 10. Online Help Center 11. Privilege Card from Apollo Hospitals 22 Tender Information Search for all live tenders Approx 400 new tenders per day Email alerts on tenders of chosen product lines/ sector Global Trade Leads Access to Global Trade Leads New Leads every fortnight Contact Details of Buyers 23 Manufacturer’s Directory Sector and Sub-Sector Classification Prioritized listing of members URL to member’s web site Visitors can send email to Members Technology Search More than 1000 technology profiles Source: R&D Institutions in India 24 My Work Place Members are given secured, password protected pages to manage information about them, they can host their web site (6 - 7 Pages) All the members are provided functionality with easy to use self development tools to make a small website within NSIC portal. Jobs@SMEs Facilitating members to advertise their vacant positions on NSIC portal. Job seekers can post their CVs free of cost. Members have the privilege to access the online database of job 25 seekers Co-Branded Privilege Card Premium Healthcare Services In-patient and OPD Upto 20% discount All major Apollo Hospitals in India Facility to Proprietor/Director’s family 26 NSIC TIE UP WITH COMMERCIAL BANKS FOR SANACTION OF CREDIT LIMITS TO MICRO, SMALL & MEDIUM ENTERPRISES 27 NSIC has entered into a strategic alliance with banks to facilitate long term/ working capital financing requirements of MSMEs Applications from MSMEs forwarded by NSIC will be considered by the branches of these banks. 28 Banks will consider/ sanction these proposals forwarded by NSIC with in 30 days on priority basis. All credit requirements i.e. Term Loan, Working Capital, Bank Guarantee, L/c, Export Credit, Deferred payment, Bill Financing will be sanctioned without any upper limit. Existing units having inadequate credit limits at present, or bank is not providing adequate credit limits, the unit can shift the existing account subject to banking rules. 29 NSIC AURANGABAD OFFICE MASSIA, P-15 MORE CHOWK, MIDC WALUJ AURANGABAD-431136 PH: 0240-2552300 FAX:0240-2563799,2555141 E-Mail: boaurangabad@nsic.co.in WEB SITE: www.nsic.co.in 30 FROM DY.GENERAL MANAGER NSIC LTD. 31 AURANGABAD