TeamB+GARMIN+Presentation+FINAL

advertisement

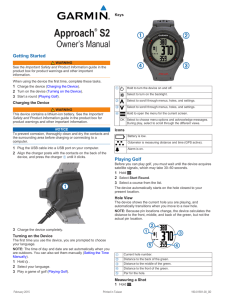

Capstone Project Presentation Presented by: Team “B” - Synergy Scott, Irene, April, Simplicious Company Overview Garmin is founded on the principles of innovation, convenience, performance, value, and service by cofounders Gary Burrell and Dr. Min Kao. From their world HQ in Olathe, Kansas, Garmin’s employees design their innovative products with the customer in mind. Sidestepping the stress of navigation or travel begins with easy-to-use menus, logical options and intuitive features. Continual innovation and focus on research and development Keys to Success Employees must design, market and sell the product and use it in all of its applications Marketing Strategy P R O D U C T P L A C E R&D focus ensures the latest features reach market quickly; frequent product refreshes. nüvifone to keep company relevant with GPS now pervasive on cell phones; significant execution risk in competitive industry. Adoption of GPS service by wireless carriers could cannibalize sales of Garmin's personal navigation devices. Average sale prices for Garmin's navigation devices continue to fall as competition increases -- adversely affecting their market share. Garmin recently benefited from lower input costs affecting their ability to remain competitively priced. (Pricegrabber, 2008) P R I C E P R O M O T I O N Garmin’s distribution network includes 3,000+ independent dealers and the largest electronics retailers. Garmin's consumer products are marketed through local distributors who resell to dealers. Garmin's distribution reach diminishes as retailers such as Circuit City close stores. Promotional focus is on increased consumer awareness of the Garmin name. Efforts include typical media placements (periodical ad space, billboard, radio) Media partnerships with OEM’s PEST Analysis •NAVSTAR US Only Dependency •EU Admin of Tariffs •China VAT unpredictable •Market Shrinking •Increased Competition •World Economy • Margins lower POLITICAL • Public awareness and desire for navigation increasing • Green Compliance SOCIAL ECONOMIC TECHNOLOGICAL •US Air Force Concerns •China adoption of manufacturing standards SWOT Analysis Strengths • Leverages GPS technologies and in-house manufacturing • Efficient after sales service • Good leadership • Leader In GPS devices • Great US mind share • Largest dollar share of GPS market Weaknesses • GPS devices are only accurate to within 15 meters • GPS satellite monitored by US Defense Department • Seasonality of sales cycle Opportunities • Brand awareness drive to increase visibility • GPS trend has caught on with the masses • The need for all in one devices Threats • Emergence of new entrants providing PND’s • Long-term inoperability of GPS satellites • Market saturation of GPS devices because of their long life cycle and usability Competitive Analysis Target Markets Porter’s 5 Forces Aviation Marine Degree of Rivalry/ Competition Threat of Substitutes •Weak •Very Strong Outdoor/fitness Automotive/mobile Suppliers Power Buyer Power •Strong for data supplier and Weak for manufacturing •Medium Financial Analysis Summary INCOME STATEMENT SUMMARY PERIOD ENDING 27-Dec-08 29-Dec-07 30-Dec-06 Gross Profit 1,553,515 1,463,255 882,386 Operating Income or Loss 862,017 907,351 554,559 Net Income 732,848 855,011 514,123 $732,848 $855,011 $514,123 Net Income Applicable To Common Shares BALANCE SHEET SUMMARY PERIOD ENDING 27-Dec-08 29-Dec-07 30-Dec-06 Total Current Assets 1,984,425 2,332,775 1,169,084 Total Assets 2,924,581 3,291,460 1,897,020 Total Current Liabilities 479,176 801,883 337,682 Total Liabilities 698,727 940,846 339,121 2,225,854 2,350,614 1,557,899 $1,994,900 $2,154,584 $1,490,319 Total Stockholder Equity Net Tangible Assets CASH FLOW SUMMARY 27-Dec-08 29-Dec-07 30-Dec-06 Total Cash Flow From Operating Activities 862,164 682,088 361,855 Total Cash Flows From Investing Activities (56,349) (175,695) (226,385) Total Cash Flows From Financing Activities (808,051) (136,117) (132,650) Change In Cash and Cash Equivalents ($11,354) $370,368 $2,969 PERIOD ENDING •Healthy financially although less efficient over the last 2 years. •Current equity return and profit margin is above the S&P 500 average •Carries almost no risk to solvency and its ability to cover its liabilities as the •Has more than 4.5 times assets to liabilities. •Carries no debt. Because Garmin’s growth trend has slowed significantly it will need to become more efficient and expand its revenue base either through a better use of cash or a reduction of inventory for a better return on capital. Critical Success Factors Leverage Use of Cash and Control Expenses • Garmin has the strength afforded a company with significant assets and no long-term debt. • Garmin could put price pressure on smaller competitors by becoming even more efficient with its own expenses and use of inventory and build up a stronger cash position to reduce prices or use the cash for purchase into a marketplace through its competitors or incentives to partners. • The popularity of smart-phones and online mapping software is a risk to Garmin’s business model as there will be less desire to purchase stand-alone navigation devices. Diversify Product Line • Garmin must either diversify its product line or find a new way to collaborate with auto and boat manufacturers. • Garmin can continue to compete in the phone space or expand nüviphone partnerships. • Garmin has sufficient cash to diversify in the phone market or buyout a smaller competitor that has valuable IP such as TOM-TOM.