File

advertisement

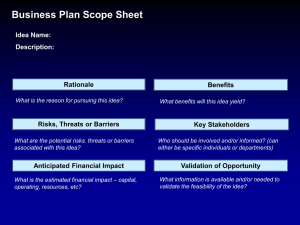

A Business Plan for Africa Breakaway Sessions 1: Africa Inc. Product Mix Session 1: Agro-Industry – From Food Security to Global Food Basket November 7th, 2013 POLICY RECOMMENDATIONS WITHIN THE AFRICA 2.0 MANIFESTO Systematic registration and user right certification. Integrated Water Resource Management (IWRM). Action Plan and associated Integrated Irrigation Improvement and Management Project (IIIMP). Establishing of Commodity Exchange market. Develop strong agro-industry. Government PPP agreement with the Private sector. Encouraging the consumption of local produce. 2 KEY FACTS AND FIGURES Fact 1: Agriculture and agribusiness, including food retailing, together account for nearly half of GDP in Africa. Fact 2: Agricultural production is the most important sector in most African countries, averaging 24 percent of GDP for the region. Fact 3: Agribusiness input supply, processing, marketing, and retailing add about 20 percent of GDP. 3 LEVERAGING STRENGTHS AND OPPORTUNITIES, ADDRESSING WEAKNESSES AND THREATS IMPLICATIONS WEAKNESSES 1. Erratic policies in agricultural output and input markets and trade (see Brenton 2012). 2. Limited access to land and respect for community land rights (see Deininger and Byerlee 2011). 3. Poor infrastructure and high transportation costs (see the World Bank flagship report on Africa’s infrastructure - World Bank 2010). 4. Difficulties for smallholders and small firms to access technologies, information, skills, and finance (see the World Development Report on agriculture - World Bank 2007d). According to FAO Statistics, import of commodities such as wheat, maize, rice, palm oil, sugar, soy oil, soya beans and milk increased from a cumulative amount of $35.8 billion between 2001 – 2003 to $92 billion between 2007 and 2009.The FAO report projects Africa’s import of same commodities to a cumulative amount of $200 billion by 2013 and 2015. 4 Growing imports of commodities to address gaps in local market supply. LEVERAGING STRENGTHS AND OPPORTUNITIES, ADDRESSING WEAKNESSES AND THREATS THREATS IMPLICATIONS Relative disadvantage of Africa Inc. Competitiveness as crudely measured by Africa’s share of global agricultural exports has fallen for most countries and for many export commodities. AFRICA AGROINDUSTRY GLOBAL AGROINDUSTRY 5 LEVERAGING STRENGTHS AND OPPORTUNITIES, ADDRESSING WEAKNESSES AND THREATS STRENGTHS AND OPPORTUNITIES Demand 1 Resources Private sector 2 Of the 500 companies listed in the Jeune Afrique ranking, 111 are active in at least one segment of the agro-food value chain. The range of income among them is extensive, from revenue of more than $11billion to a minimum of $90 million. 6 60% of the world’s uncultivated arable land BEST PRACTICES Ethiopia, about six million households have received title certificates in a costeffective way through the implementation of systematic registration and user right certification procedures. In Egypt, the Integrated Water Resource Management (IWRM) Action Plan and associated Integrated Irrigation Improvement and Management Project (IIIMP) is the first large-scale application of the irrigation modernization program, which has introduced continuous flow of water to agricultural land. South Africa has an internationally recognized commodity exchange and Ethiopia has developed a successful spot market exchange. Commodity exchanges help remove or reduce the high transaction costs often faced by entities along commodity supply chains in developing countries. A case study of four African countries (Ethiopia, Kenya, Tanzania and Uganda by the African Development Bank) revealed that an integrated strategy is needed to promote smallholder agricultural growth, and that the government should play a more central role in providing investment in rural infrastructure, improving the marketing chain and assisting adaptation to climate change. 7 KEY QUESTIONS TO ADDRESS IN TODAY’S SESSION How is the Agro-Industrial Sector of Africa Inc. in 2063? How to finance agro-business in Africa? How to facilitate access to inputs and technology? How to enhance access to land and tenure security? How to upgrade infrastructure using public-private partnerships where possible - ? 8 ACTION PRIORITIZATION MATRIX AND STAKEHOLDER ENGAGEMENT MATRIX Complete the Action Prioritization Matrix below with the key short, medium and long-term leapfrogging actions. For each identified leapfrogging action, complete the Stakeholder Engagement Matrix below: 9