General Mills, Inc - GeneralMills

advertisement

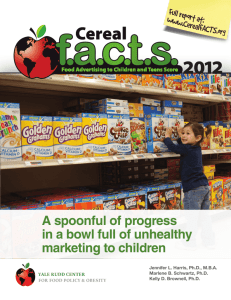

By: Sandra Ramirez Company Overview • • • • • • • • • • • • • Headquarters in Minneapolis, Minnesota. Incorporated in 1928 79 manufacturing locations, 49 in U.S. Social Involvement, leadership development, health concerns Consistent dividends Longevity & Well- recognized brands, trust, loyalty Large variety of products Stable position, little stock volatility Not too much bad press High commodity prices in the food industry (grains, oats, etc.) Many recognitions/awards High debt, debt financing through bond issuances Accounts receivable growth is greater than revenue growth (happens through acquisitions: Yoplait) Products Offered • Product mix includes: baking products, dough/pastries, fruit, cereals, ice cream, meals, organic/natural, pasta, pizza, snacks, soups, vegetables, and yogurt. • The cereal product line includes the company's Big G cereals, which are: Cheerios, FiberOne, Chex, Lucky Charms, Wheaties, Cinnamon Toast Crunch, Cocoa Puffs, Total Raisin Bran, Kix, Honey Nut Clusters, Count Chocula, Trix, Whole Grain Total, Cookie Crisp, Golden Grahams, etc. • Another product line would be soups, which include: Progresso and Muir Glen. And one last example would be its' vegetables product line including: Green Giant, Cascadian Farm, and Muir Glen • Wiki link: http://generalmillsmgt111hn1project.wikispaces.com/Product+%26+Services Cash Cows • • • • Cheerios Chex Wheaties (Big G Cereals) Star Products • • • • • Progresso Soup Green Giant vegetables Yoplait yogurt Betty Crocker Haagen Dazs Failed Products • • Basketball-shaped cereal, “Dunk-ABalls” Home bread mixes Products in questions • Organic products • Ready-to-eat meals Market Positioning • • Sector: Consumer Goods Industry: Processed & Packaged Goods • Major competitors: Kellogg’s, Kraft, ConAgra Foods, Danone, Campbell Soup, Seneca Food Corporation • Ranks real high in the industry because… • Top #1 selling cereals • Stable operations • Shareholders trust • High value to market • Products essential to everyday life • No matter what, people need to eat • Shows ranking based on different criteria • http://biz.yahoo.com/ic/ll/342qpm.html Comparison showing General Mills being about 7.86% of the total industry market cap Profitability • Income Statement Trending of Stock Prices • Started off low • Stock price and volume increased when quarterly earnings report was released, results better than expected • For the most part, stock price remained stable between $37-$39 • Volume ranged from 2 million to the highest of 11 million; mostly stayed within 3-4 million • Right now, reached $40 • When market almost went into a bear market, GIS remained stable along with other food processing competitors • No high volatility; consumers always need food • Do well even during hard economic times Current Business Issues • • • • • Dealing with the high commodity costs Expanding in online marketing/promotions Reduce sugar grams in its’ products Lower its’ debt Competition from store brands: not advertised, but cheaper Recommendations for Business Improvement • • • • • • • • • Further research to compete against Kellogg’s and ConAgra Foods Change all factories to biomass-powered energy source; be more environmentally sustainable Keep technology up to date Increase in promotions and online marketing Increase in targeting older generation Make sure demand for products does not outpace their production capacity Control their expansion, focus on long-range planning Expanding their over dependence on the U.S. market to other countries. Hire new personnel to meet demands associated with new production and new marketing campaigns