Your Fundraising Weapons - UTSA College of Business

advertisement

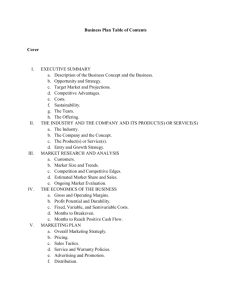

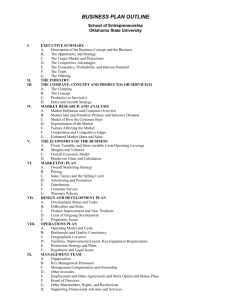

David R Clark Director of Investment Services Pop Quiz I want to start a new venture because: a)My invention/discovery will help mankind. b)I want to build a company dominant in the market. c)I want to get rich. d)All of the above Recommended Documents (In order of importance) 1. Investor Presentation 2. Elevator Speech 3. Business Plan 4. Executive Summary 5. One Page Summary 6. Customer Brochure Recommended Documents (Probable Chronology) 1. Business Plan 2. Elevator Speech 3. Investor Presentation 4. Executive Summary 5. One Page Summary 6. Customer Brochure Venture Investment 101 What they want to know 1. What is the technology? 2. How big is the market? 3. Who is on the Management Team? 4. Is this a good deal? Investor Presentation • Single most important aspect of fund raising • Play to your audience • Be respectful of time • Business attire • Objectives: – Not to close the deal – Invitation to ‘talk’ – Build investor confidence in you Typical South Texas Format • Presentation: 20 minutes • Q&A: 20 minutes • Investor discussion: 20 minutes – You’re not in the room • Timekeeper usually present • BTW: This is a ‘somewhat’ universal format for angel groups Content Elements • • • • • • The problem? Product/Service Value proposition Market Competition Competitive advantage • Management team • Revenue model – Revenue received • • • • Funding request Uses of funding Funding milestones Pre-money cap table Content Timing • Every deal is different • It’s your message and your deal • However, – Management – Technology – Market – Financials Coaching Tips • • • • Show passion Show confidence Demonstrate knowledge Minimize hyperbole – Name dropping • It’s a business deal not an invention • Presentation Team members • Consistent team attire More Coaching Tips • Graphics, color, & photo’s • No hard to read slides – 10-20-30 rule • Do not read the slides – Watch the audience • • • • • Well choreographed Numbers all ‘foot’ Copies for audience “show & tell” Practice timing Q&A Coaching Tips • Short direct answers • No ‘piling on’ • Backup slides – Cheat sheet • Curve balls – May be asked for a term sheet – Avoid technical discussions – Don’t get defensive or angry Après-Presentation • Do a post mortem on each presentation given • Build an inventory of slides • Be prepared to give many presentations • Remember you are only looking for a few investors • Expect ‘stay in touch’ Why a Business Plan? Business Strategies Product Development Sales & Marketing Financial Others Management in sync (Equity Funding World) Sell the venture Due Diligence Preliminary Remarks No proprietary warnings About 20 pages without exhibits About 6500 -7500 words 10 or 12 pt Times New Roman Spellchecker Flesch-Kincaid Readability <30 Table of Contents and page numbers Technology Detailed description of the problem Set up the Value Proposition What is the solution 5th grader rule Product Description FeatureFunctionBenefit Intellectual Property State of Development Market Market Need Market Size Competition Direct & Indirect Differentiators Pricing Strategy Sales Strategy and process Revenue sources Management Team Who is on the team Domain Expertise Entrepreneurial Experience Board of Advisors Attractive Investment Pro Forma P&L – To Exit (5-7 years) Assumptions driving the numbers 20X N5 Pro Forma Balance Sheet Cap table Funding Request Pro Forma Cash Flow The ‘Deal’ and Liquidity Events Use of Funds Integrated timeline Integrated Timeline ($K) Development Alpha Sales & Mkting Cash $20 Investment $150 $110 Beta Production Hire Sales Sign 1st Distr $15 $350 $205 1st Sale Continued Sales $120 $90 $135 Cosmetics & Presentation Lots of graphics and color Puppies & Kittens Professional binding with heavy paper Double sided printing May want to consider a Marketing Communications advisor The objective is make it easy to read What really happens 1. Read the first paragraph 2. Look at the financials Is there a ‘hook’? How much & 20X N5? $ Revenue line 3. Look at the Management Team Can they pull this off? The Elevator Pitch • Origins in “.com” period around 2000 • Short pitch which tells potential investor about the deal • Objective is to get an invite to present the deal • Could be investors ‘first cut’ 23 Key Elements • Early ‘hook’ • Brief description of the product or service • Revenue model • Management team • Competition • Competitive advantage • Call to action 24 Sample Pitch Hook SeekingCapital.com is changing the future of private equity investing. Private equity is a $100 billion a year market, with over 400,000 entrepreneurs aggressively seeking capital at any given time. SeekingCapital.com offers entrepreneurs and investors an efficient and uniquely interactive method for obtaining or investing capital in pre-IPO companies. Product/ Service SeekingCapital.com is not an "Internet only" company, but supports its online community with local franchises in the United States and internationally. Our team has decades of experience in the securities industry, investment banking, private equity, and executive management. My partner and I have worked together side by side for several years co-managing and running the entire Internet operations of a publicly traded brokerage firm. Our competitors such as XYZ Corp. and ABC Capital have had much success-ABC Capital was recently valued at $550 million . . . despite several limitations. SeekingCapital.com isn't just a listing or matching service, we offer a community that breeds interaction, education, and discussion. We work with companies globally, through all stages of funding, and across all industries. We are anticipating $XXX million this round to be used for employee building, increased office space, and marketing. Market Revenue Management Competition We have a compelling two page executive summary that I would like to send you. Can I get your address? Advantage Call to action 25 Coaching Tips • • • • Show passion Show confidence Minimize hyperbole It’s a business deal not an invention • Google “elevator pitch” 26 Biggest Mistakes by Entrepreneurs 1. Too much on the technology 2. Too little on the Management Team 3. Failure to abide by the ‘5th grader rule’. 4. Failure to articulate the Value Proposition 5. “There is no competition.” 6. “This assumes only a 1% market penetration.” 7. Too much or too little detail on the Pro Forma 8. Does not state ‘The Deal’ David Clark Director Investment Services Startech 210.458.2523 drc@startech1.org