Avigilon - UW Stock Pitch Competition

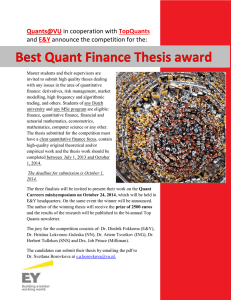

advertisement

UWFA Stock Pitch Competition: Avigilon (TSX: AVO) March 8, 2014 Presented by: Varun Bhambhani and Irene Liu Introduction Company Description Avigilon (TSX: AVO) is a Canadian-based manufacturer of high definition and megapixel network-based video surveillance systems and equipment for the security market worldwide. The company was incorporated in 2004. Avigilon’s system is promoted by its sales staff and sold through a global network of security installers and dealers. Key Financials • • • • • • • • • • • Product Lines • • • • Video management software High-definition IP cameras Recording hardware System accessories Share Price: Market Cap: Enterprise Value: Revenue LTM: EBITDA Margin: Capital Structure: Shares out. (mm): 52 wk High/Low: Diluted EPS: Dividend Yield %: Beta: $31.83 $1.37B $1.26B $155.1M 16% 100% Equity 43.0 34.5/11.011 0.45 N/A 1.36 Normalized Performance 800 700 600 500 400 300 200 100 0 SPX Index AVO Company Overview YoY Revenue Management Team Revenue (in millions CAD) Annual Revenue 200 180 160 140 120 100 80 60 40 20 2008 2009 2010 2011 2012 2013 in millions CAD Revenue by Region 100 90 80 70 60 50 40 30 20 10 - 2011 2012 Alexander Fernandez, Founder & CEO Company Overview US UK EMEA Asia Pacific Investment Thesis Bryan Schmode, COO Name Background Alexander Fernandez Previous success with Qimaging Brad Bardua Previously CFO of Gateway Casinos Group, where the executive team grew revenue from $80 to $250 million in a short amount of time Bryan Schmode Over 15 yrs of experience in the industry; instrumental in success of companies such as Broadware 2013 Canada Brad Bardua, CFO Latin America Macro Outlook Catalysts & Risks Valuation Investment Thesis 1. Strong revenue growth driven by expansion into US & other geographic regions 2. Avigilon’s recent acquisitions of VideoIQ and RedCloud will drive growth in 2014 and beyond 3. As one of the few end-to-end solution providers, Avigilon will maintain an edge over competitors Company Overview Investment Thesis Macro Outlook Catalysts & Risks Valuation Macro Outlook The global market for video surveillance equipment is expected to grow by more than 12% in 2014, as per a study conducted by HIS, a global think tank There is push towards video data analytics; the ability to differentiate products will be important in 2014. The rising use of big data means that cloud computing would become more prevalent. Governments across the globe have been increasing their budgets for video surveillance, which will drive growth in this industry in 2014. 180/360 degree panoramic network cameras will be high demand with global unit shipment forecast to increase by more than 60% YoY Company Overview Investment Thesis Macro Outlook Catalysts & Risks Valuation Catalysts & Risks Catalysts Successful integration and synergy from acquisition of VideoIQ: VideoIQ provides analytics and active learning technology that detects intrusion from video surveillance without human involvement. This has the potential to become a selling factor for Avigilon. Major contract wins and global expansion: Avigilon has been focusing on expanding the reach of its products in the US and EMEA. End-to-end solution: Avigilon provides end-to-end solution to its customers, which is a significant advantage over competitors who only provide either the software or hardware for video surveillance. Risks Large competitors: Avigilon’s competitors have a much greater scale, which could impact its ability to compete at the global stage. Ability to innovate: Given that video surveillance can essentially be considered a commodity, Avigilon needs to continue to innovate in order to set the brand apart from its competitors. M&A Integration: There is a risk that the integration of VideoIQ and RedCloud (both acquired in 2013) might not go smoothly and it can impact Avigilon’s ability to leverage the synergies. Company Overview Investment Thesis Macro Outlook Catalysts & Risks Valuation Valuation - DCF Company Overview Investment Thesis Macro Outlook Catalysts & Risks Valuation Valuation - DCF Company Overview Investment Thesis Macro Outlook Catalysts & Risks Valuation Valuation – Trading Comparables Comparables Universe Company Overview Investment Thesis Macro Outlook Catalysts & Risks Valuation Recommendation Football Field Entry & Exit Strategy 52-week DCF 0 10 20 30 40 50 60 70 Entry Price: Market Price Target Price: $40.43 Price Upside: 27% Time Horizon: 12 months Stop Loss: $20 1. Strong revenue growth driven by expansion into US & other geographic regions 2. Avigilon’s recent acquisitions of VideoIQ and RedCloud will drive growth in 2014 and beyond 3. As one of the few end-to-end solution providers, Avigilon will maintain an edge over competitors Company Overview Investment Thesis Macro Outlook Catalysts & Risks Valuation