1 - Aktif Bank

advertisement

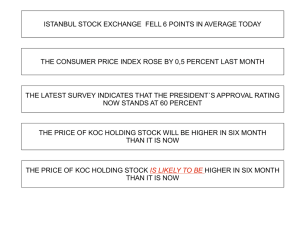

“New Generation Banking” 2011 First Quarter B RIEFLY AKTIF BANK Founder CEO Year of Establishment Shareholding Structure Date of Re-structuring Total Assets* (mio TRY) Equity* (mio TRY) Revenue* (mio TRY) Net Profit* (mio TRY) Dr. Önder HALİSDEMİR 1999 100% affiliate of Çalık Holding Started in 2007 2.047 236 (137% Increase in 2 years time) 62,6 29 ROA* 5.7% ROE* 49.6% Number of Employees* Number of Branches* Number of Sales Points* Network of Correspondent Banks* Ratings* SWIFT Web Adress * As of March 31, 2011 2 Ahmet ÇALIK 370 6 4 thousand 365 banks in 85 countries A- National / BB International (JCR) CAYTTRIS www.aktifbank.com.tr F IGURES GROWING ON A STRONG & PRUDENT BASIS As being the fastest growing bank in Turkey for the past 3 years, Aktif Bank is proud to have one of the lowest NPL ratio in the banking industry. We are taking very determined steps to carry our bank to be the most profitable bank in Turkey by the end of 2011. 3 F -Summary Financials IGURES RAPID AND HIGH QUALITY GROWTH Asset Size Growth Thousand TL 2,046,215 1,479,392 578,047 251,680 111,679 2007 4 2008 2009 2010 2011Q1 F -Summary Financials IGURES RAPID AND HIGH QUALITY GROWTH WITH ONE OF THE LOWEST NPL IN THE BANKING SECTOR Loan Growth & NPL Ratio Revenues TL thousands TL thousands 959,441 107,484 727,112 297,443 62,680 74,735 117,661 2007 2008 NPL : 0% NPL : 0,4% 2009 NPL : 0,57% 2010 2011Q1 NPL : 0,76% NPL : 0,58% Shareholders’ Equity 47,048 TL thousands 22,827 214,081 164,707 170,688 2008 2009 235.815 13,407 65,346 2007 5 2008 2009 2010 2011Q1 2007 2010 2001Q1 F - Summary Financials IGURES BECOMING A REPUTABLE GLOBAL ACTOR Number of Correspondents Funds Borrowed Million USD 365 441,8 320 220 169 100 2007 220.6 2008 2009 2010 2011Q1 Foreign Trade Volume Million USD 892 697 65.5 29.9 48.3 128 2007 2008 2009 2010 2011Q1 56 Dec.07 6 200 Dec.08 Dec.09 Dec.10 March 11 NEW GENERATION BANKING MODEL DIRECT REGIONAL CITY ANKING Retail 7 Corporate Investment International B DIRECT REGIONAL CITY ANKING DIRECT BANKING CITY BANKING REGIONAL BANKING Instead of investing in branch network, we provide technology-based products regardless of time and location constraints with convenient and attractive prices. To provide customized financial & non-financial products and services for the different needs of the cities To expand trade relations as a financial actor in Balkans, the CIS and the Middle East Branchless banking model Proper alternative Online integration with the Post Offices Concentration centers in the cities distribution channels for operational and financial infrastructure of the city “Shop in Shop” concept Corporate and investment products for the municipalities and local businesses 8 Synergies with our foreign based subsidiaries Growing with new subsidiaries in the region To be role model for other countries B Electronic Channels Aktif Bank Web Page and City Portals in Turkey Internet Banking in Turkey and Albania Dealer Portals in Turkey Call Center in Turkey and Albania Mobile Banking and Mobile City Applications ANKING CHANNELS Physical Channels Merchant Channel Network PTT 3,800 points in Turkey Aktif Points 760 points in 8 cities Aktif Kiosks 32 locations in 4 cities Branches 6 in 6 cities in Turkey and Albania THE WIDEST DISTRIBUTION CHANNEL IN TURKEY 9 Aktif Bank’s Retail Banking Innovations A KTIF ONLINE Cash Deposit Loan Collection Deposits Billing Collection Card Collection Cash Withdrawal Account Opening Application Mutual Funds Regular Transfer Instructions Regular EFT Instructions Other Company Products Stocks between bank networks and the PTT. points, including 1,178 locations where there are no bank branches. Enables quick product and service deployment. Credit and Card Application Insurance The first and the only online-realtime platform physical distribution channel via around 4,000 Financial Products 11 FULL ONLINE INTEGRATION WITH PTT Aktif Online provides Aktif Bank the widest Cash Withdrawal Loan Payment 1 P Securities -Cash Management- “UPT” Cheap Money Transfer “UPT” which means “Cheap Money Transfer” UPT Is Competitive And Profitable Without any branch overhead, it is possible to price the product well below the market UPT Is Easy Anyone can use UPT even when they are not a bank customer UPT Is Widespread 4.000 PTT branches, over 8.800 bank branches, telephone and internet banking as well as withdrawing cash from all 22.800 ATMs in Turkey UPT system was activated on January 04, 2010 and as of the year end around 227.470 transactions were performed of an amount totaling TL178.4 million. Number of channels Number of existing customers 12 4.000 119.478 -Cash Management- “Global Money Transfer Program" Foreign Currency Transfers Launched in November 2010 Foreign Currency Transfers Foreign currency transfers, domestic and international UPT Membership Program Using UPT Account for online shopping without sharing any financial data Money Transfer from UPT Account to anyone, anywhere We are candidate to be one of the leading money transfer programs in the next future Number of channels 13 4.000 K 2 P REAKTIF LOAN FACTORY INSTANT CREDIT DECISION Our dynamic and measurable loan factory includes flexible workflows and has high integration capability with different channels such as dealer, web, SMS and branch banking. Business Rule Management System integrated to loan factory produces loan decision in seconds. Other components of factory are: Verification Module Fraud Module User-friendly screens Smart Application Fields Dynamic Matrix Online Web Services Collateral, Document Management Reporting and Monitoring System 14 -Loan Products- “Consumer Loans” Loans through Dealers and ADCs “Aktif Bank’s Dealer Credit System - Kreaktif is used at more than 596 dealers and providers of education, furniture, major appliances and boilers” • Average loan amount TL 3,500 Average tenor 15 months Furniture loan program is available at 417 dealers including Doğtaş, İstikbal and Kelebek Mobilya which are two major furniture manufacturer chains in Turkey with sales points around the globe. Boiler and installation loan program is available at 128 dealers. Education loan program is available at 10 points of English Time (English language courses providing institute). Private bus assocations are offered: 15 SME Loans with and without collateral Refinancing Loans Vehicle Loans -Loan Products- “PTT Kredi” Launched in July 2010 Loans through Post Office Branches Aktif Bank collaborates with PTT and offers consumer loans to the PTT payroll customers. Given sufficient funding, accessing those 500,000 payroll customers with secured, colleteralized retail loans offers a sales potential of USD 1 billion. Credit operations was introduced to PTT for the first time by providing loan training to 1500 staff in 25 cities. 98.400 applications received and 59.000 credits were booked with TL 370 million by the end of April, 2011. TL 600 million outstanding balance and 76.000 customers are targeted by the end of 2011 16 A 3 P KTIF CARD SYSTEM PREPAID/DEBIT/CREDIT CARD MANAGEMENT SYSTEM AND CHIP TECHNOLOGY Aktif Card System (AKS) is a multilingual, multi We are the first Bank in Turkey to develop “a- currency, multi-institution loyalty card platform purse” (Aktif Purse) which is a dual interface AKS processes huge volume of transactions with high speed in a secure AKS is capable of setting payment standards between Turkey and the neighbouring countries 17 1 PrePaid card programs and offline transaction/balance management 2 Mifare, PayPass (MC) and PayWave (VISA) contactless card application, NFC 3 Standard credit card, debit card programs, Loyalty and point applications 4 Campus cards, FC fan cards, transportation cards, access control systems chip card application with transportation functionality. “a-purse” is a product of pure LOCAL engineering and it is fully compatable with GLOBAL standards Automatic Decision System Office Verification Module Fraud Module User-friendly screens Smart Application Fields Dynamic Matrix Online Outsource Interrogation AKS’s First Product Aktif38 Won First International Award AKS’s first product won two awards in international «Paybefore Awards 2011» with our Aktif38 city card 1-) The Best Non-U.S.-Based Prepaid Program Category Aktif38 2-) The Best Third-Party Prepaid Product Retailer Category Aktif38 KayseriPark This year’s Paybefore Awards were the most competitive yet, representing a record number of countries 18 Paybefore Awards,is one of the most prestigious award in international prepaid world. -Card Products- “City Card Product Family” Widespread, chip based, contactless, high security payment products Aktif 00 & Plus 00 Prepaid Purchase “Global Aktif Card System” Seferi is a card system that enables people visiting Turkey to shop and withdraw cash through all ATM and POS network without the need of Mastercard, Visa, etc. Transportation Loyalty Points Different uses of AKTIF 00 Installment Allowance, Campus, Gift,Corparate, Fan, Skipass, Food ... Seferi Card is accepted by over 28.500 ATMs and 1.850.500 POS machines in Turkey. 19 Plus Aktif 00 is designed by taking into account the lifestyles and needs of people Aktif Bank’s Corporate Banking Innovations 20 I 4 P NTEGRATED RECEIVABLES MANAGEMENT “B.A.Y.” END TO END COLLECTION MANAGEMENT CLIENT ASSESTMENT End-to-end receivables management service No differentiation of receivables Invoices, cheques, notes and bills are FINANCING COLLECTION SERVICES REPORTING included in the collection scheme Obtain financing by pledging receivables Advisory Services Initial assesment of agency and dealer network of the client CALL CENTER Reporting and notification by follow-up through the call centre In case of default, legal follow-up of overdue payments 21 -ACT Office- Foreign investors have demonstrated more interest in Turkey, which has attracted greater attention from the global business with its consistent and rapid growth performance in recent years. Seeing this potential, Aktif Bank desingned the “Act Office” service concept in 2009 to provide the following services required by international financial institutions in Turkey and other countries in the region ACT Services Marketing and sale of products and services Research activities Loan supply, collateralization and legal consultancy Credit evaluation Operation and monitoring Management and logistics 22 Local and regional agent of ITFC and ICIEC 23 Aktif Bank became the only agent in Turkey and in the region to offer foreign trade, structured finance, export loan and advertisement insurance products and services which are only provided by ITFC and ICIEC to their member countries -Aktif Bank Bond- We initiated the formation of a commercial paper market in Turkey Under this program, we issued the first bank bond in Turkey All of our issuances have been fully subscribed 1st tranche: TL 35 million (September 2009) 2nd tranche: TL 65 million (September 2009) 3rd tranche: TL 100 million (February 2010) 4th tranche: TL 400 million (April 2010) 5th tranche: TL 700 million (September 2010) 6th tranhce: TL 1 billion (May 2011) TL 150 million is quoted in Istanbul Stock Exchange. With a maturity profile of 30 days to 360 days Tax advantage over time deposits Aktif Bond is quoted on Reuters and Bloomberg 24 First direct bank of Turkey We are the bank of innovations Only bank to have online realtime integration with Post Offices Founder of Money Transfer Programme which is commonly used in Turkey The first bank to issue a commercial paper program The first bank to introduce “Liaison Office” concept in Turkey (“ACT Office”) One of the few banks with dealer credit system Market leader in contactless cards in Turkey The first bank to develop “a-purse” which is a dual interface chip card application with transportation functionality The first to develop a transportation kiosk One of the few banks in Turkey with an instant decision making credit system “Credit Factory” One of the few banks with dealer credit system 25 APPENDIX Ç ALIK HOLDING We are an Affiliate of a Reputable Global Conglomerate 28 The leading investor in Turkey, Balkans and CIS One of Turkey’s most up and coming Groups with more than 20,000 employees in 14 countries 2010 Assets of USD 5.5 billion and Revenues of USD 2.2 billion Rated by Fitch & JCR 5th Turkish corporate issuing a Eurobond Reputable partnerships and cooperation with global brands ENI, EWE, Mitsubishi, General Electric, Turkish Telecom, Qatar Investment Authority, Anatolia Minerals, Initec Energia 29 TAPCO POWER SYSTEMS Completed turnkey delivery of 5 power stations with a total capacity Trans-Anatolian Pipeline (TAP) of 883 MW in Turkmenistan 254 MW 6th power plant under construction Long-term supply and maintenance contract with Turkmen state Hold 10 licenses to construct hydroelectric, wind and thermal power Awarded the license to build and operate strategically important Partnership with ENI Group of Italy Annual capacity of 50-70 million tons of oil Completion date of 2013 EXPLORATION AND DRILLING plants with a total capacity of 1500 MW in Turkey Joint construction of a gas power plant in Uzbekistan with Initec Explores and drills oil and gas in Turkmenistan Energia of Spain Partnership with Parker Drilling of USA Holds oil and exploration licenses in Eastern Turkey and Thrace region Project amount of USD 470 million Generation capacity of 472 MW Completion date of 2013 UTILITIES Yeşilırmak Electricity Distribution Company REFINERY Ceyhan Yeşilırmak License was acquired in December 2010 and the acquisition price has been USD 441.5 million ALBTELECOM 30 Bursagaz and Kayserigaz services 850,000 households Incumbent fixed line operator in Albania 290,000 subscribers with a potential of 1 million, 30% penetration In October 2008, Çalık Holding sold 39.9% of Bursagaz and Kayserigaz to EWE for a total price of USD 438 million (34x 2008E EBITDA) Owns 76% stake in Albania's Albtelecom Turkish Telecom is a strategic partner with 20% share Participates as an investor in Bursagaz and Kayserigaz. Annual capacity of processing 10 million tons of crude oil and 2 million tons of petrochemicals , Budget of USD 6 billion 1.5 million subscribers in the cities of Samsun, Amasya, Çorum, Ordu and Sinop Awarded the license to build a refinery and petrochemical complex in Third GSM operator after AMC and Vodafone 500,000 subscribers, 15% market share GAP İNŞAAT MEDIA One of only two nationwide print distribution network in Turkey 5 regional offices (2 representative offices) 5 printing facilities 25,794 sales outlets (810 chain stores) 221 distributors GAP İnşaat ranked 176th in the “Top International Contractors” list of ENR magazine in 2010 Active in the construction of turnkey industrial plants, infrastructure and environmental projects, hospitals, hotels, schools, roads and museums Cover Middle East, CIS and North Africa 20% market share in TV & newspaper advertising Value of completed projects amounts to approximately USD 2.5 billion Lusail International Media Co., media affiliate of Qatar Investment Value of housing projects in the pipeline with a start date of late 2009 in Authority, is 25% shareholder of Turkuvaz GAP GÜNEYDOĞU TEKSTİL GAP Güneydoğu is one of the world’s top ten suppliers of denim Active in the production of yarn, fabric, garment and home textiles Manufacturing operations in Turkey, Turkmenistan and in Egypt Majority of sales exported to North America, Europe, North Africa and East Asia Top 3 export destinations are the USA, Italy and Spain Customers include global names such as Diesel, Replay, LeeWrangler, Levi’s, Benetton, H&M, Calvin Klein, Tommy Hilfiger, Zara G-Star, Miss Sixty, M&S, Next, Esprit, Escada 31 Undertaking Turkey’s first urban transformation and renovation projects with private involvement in the heart of Istanbul Tarlabaşı, Fener Balat ÇALIK MADEN The only rated textile company in Turkey with a local currency rating of BBB+ from Fitch Istanbul is around USD 750 million An extensive partnership with Anatolia Minerals in Turkish mining industry Anatolia Minerals is based in the US and holds more than 100 licenses in Turkey Çalık Maden buys into Çukurdere, a subsidiary of Anatolia Minerals 175,000 ounces annual production started in 2010 Cukurdere owns a gold mine in Erzincan with 6m ounces reserves The alliance will allow for joint exploration and development of other mineral properties in Turkey on a 50/50 basis A Aktif Online; • Turkish The first and the only online-realtime platform between bank networks and the PTT Provides Aktif Bank with the widest physical distribution channel KTIF ONLINE Postal Service (PTT) is a public institution which has the largest distribution network in Turkey . • Domestic and international mail • Parcel post, telegraph, fax, • Bill payment and collection services • Domestic and international money transfer services Enables quick product and service deployment • PTT operates via approximately 4000 points, & including 1,178 locations where there are no bank branches. THE FIRST BANK WITH TURKISH CAPITAL TO HAVE INVESTED IN KOSOVO BEFORE THE INDEPENDENCE OF KOSOVO WAS DECLARED. Owned 100% by Çalık Financial Services Active in Corporate and Retail Banking with market share of 17% in deposits 12% in loans Second largest bank amongst 16 banks as of 2010 Total Assets USD 1.5 billion Deposits USD 1.3 billion 57 branches throughout Albania 15 branches in Kosovo Captures 80% of trade activity between Turkey and Albania In 2009, it was selected as the “Best Bank of the Year” and “Best Medium Sized Bank in CEE” by Finance Central Europe Magazine. In 2010, it was selected as the “Best Bank of the Year” by The Banker Magazine and awarded the “Quality Management Certificate” by Certiquality. Rated AAA Stable by Japanese Credit Rating Agency (JCR) 33 W ORKING TO ITS VISION OF BUILDING CITY TECHNOLOGIES E-KENT BECAME ACTIVE IN MORE CITIES AND ALSO GREW MORE EFFECTIVE IN THE SECTOR, WITH A WAVE OF NEW PRODUCTS AND SERVICES PUT INTO PRACTICE ONSITE. Established in 2002. It is Turkey's largest electronic fare collection operating company, and currently operates in 9 cities of Turkey E-Kent is a member of the International Provides modern and high-technology solutions for city life Operates contactless card payment systems in public Association of Public Transport (UITP). transportation Services citizens, municipalities and private bus E-Kent in figures; companies with advanced technology solutions and 10 Million Population 4 million pre-paid cards 3,000 buses 1,330 tollgates consulting Expert in widespread field operations Acquisition of E-kent by Aktif Bank Access to micro-payments market in transportation 950 top-up points and ticket boots Legitimization of cash receivables More than 1 billion transactions per month Introduction of “city card” solutions 2009 Revenues of TL 800 million 34