Reed Elsevier Ventures Presentation Template

advertisement

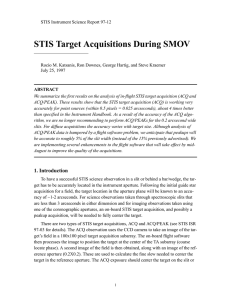

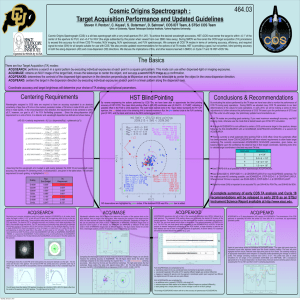

Reed Elsevier Ventures Overview Tony Askew General Partner Reed Elsevier Ventures BVCA Summit 17 October 2013 Reed Elsevier is one of the world’s leading provider of professional information solutions ~$26bn market cap $9.3bn annual revenues $6bn digital revenues 3 Reed Elsevier Ventures (REV) was founded in 2000 and has a dual focus: make money and be strategic 4 We have an LP/GP structure and have raised a total of $250m from Reed Elsevier over a number of funds • REV is structured as a VC Investment Partnership – Clear alignment of incentives with other investors and management • • • typical fund structure, 10 years duration for each fund management fee carried interest remuneration – Invests $1m to $10m for large minority stake • • • typically 10-30% equity ownership Series A/B, some later stage Lead and syndicate investor – Fast, transparent decision making • REV people are from the world of VC – VC skillset: diligence, investment discipline and mindset – Distinctive experience and network – Active investor, board seats and governance 5 We run a typical venture capital process with a focus on rigour and fast paced & clear decision making • Rigorous diligence, VC financial returns hurdle • Streamlined investment approval process (Investment Committee of CFO, CSO & REV Partners) • No BU champion/blackball • Sector focus and pro-active targeting of companies • Active post investment via board seats to exit • Active portfolio management • Aligned long term focus with management and other investors 6 We invest in high growth technology, information & media companies across the US, Europe and Israel Large scale data, analytics & enabling technologies Acq. By informatica Acq. By Business Obj. Acq. By Akamai Acq. By IBM Acq. By IBM Acq. By FAST Acq. By Vignette Internet, information, new media & mobile TASE: BBYL Acq. By IHS Acq. By RH Donnelly Acq. By D&B Healthcare information & software Acq. By Galapagos NV •Acq. By Optum Health. 7 Please feel free to contact us to learn more Tony Askew Kevin Brown General Partner General Partner tony.askew@reedelsevier.com kevin.brown@reedelsevier.com 8