Presentación de PowerPoint

advertisement

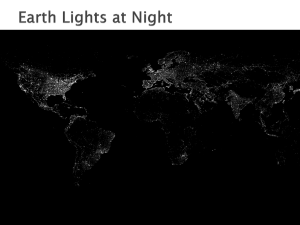

The Future of the Mexican Automotive Industry INDEX • Current Position of the Auto Industry • New Investments Increase Capacity • World Automotive Market • Challenges and Future Vision Current Position of the Auto Industry The automotive industry has had a very good performance • From 2006 to 2013, vehicle´s production and exports grew 5.8% and 6.7% annually in average, respectively. • During this period, the value of autoparts production showed an annual growth average rate of 12.9%. AUTOPARTS PRODUCTION VEHICLE EXPORTS VEHICLE PRODUCTION (THOUSANDS OF MILLION DOLLAR) (MILLION OF UNITS) (MILLION OF UNITS) 2.4 48.2 2.9 1.5 2.0 20.6 2006 Source: AMIA and INEGI 2013 2006 2013 2006 2013 There is still a positive trend in 2014 • From january to june 2014, vehicle production and exports grew 7.5% and 11.2%, respectively. • Value of auto parts production increased 7.8% in the same period. VEHICLE PRODUCTION VEHICLE EXPORTS (MILLION OF UNITS) (MILLION OF UNITS) AUTOPARTS PRODUCCION (THOUSANDS OF MILLION DOLLAR) 30.0 1.9 Source: AMIA and INEGI 27.8 1.4 1.7 Ene - Jul 2013 1.5 Ene - Jul 2014 Ene-Jul 2013 Ene-Jul 2014 Ene-jul 2013 Ene-jul 2014 Mexico's automotive industry improves ranking in the world • Up to july 2014, Mexico is the 7th most important vehicles producer in the world, which means a higher level compared to 2013. As well, we are the 4th most important export. MAIN COUNTRIES VEHICLES PRODUCERS (Million of Units) Rank Country MAIN COUNTRIES VEHICLES EXPORTERS (Million of Units) Jan-July 2014 Rank 1 Japan 4.87 2 Germany 4.75 3 South Korea 2.14 4 5 Mexico Spain 2.42 2.10 6 Canada 2.06 USA France 2.05 1.39 Country 2013 1 China 13.5 2 USA 6.6 3 Japan 5.1 4 Germany 3.6 5 South Korea 2.8 6 India 2.1 7 Mexico 1.9 7 8 8 Brazil 1.7 9 UK 1.22 9 Canada 1.3 10 Czech Republic 1.01 10 Thailand 1.1 Source: OICA, AMIA, Ward´s Auto Mexico diversifies its auto exports destination • Although United States is still the main destination of Mexican exports, during latest years, a diversification has been evident. 3,000,000 Vehicle Exports by Destination 2,500,000 2,000,000 1,500,000 1,000,000 500,000 0 2003 2004 2005 Resto del Mundo Source: AMIA. 2006 2007 Brasil 2008 Europa 2009 Canadá 2010 2011 Estados Unidos 2012 2013 In Mexico, there are some auto facilities ranked among the most efficient of the world • There are some facilities in our country, that are ranked among the top ten in engines production, as well as in stamping processes. More Efficient facilities for the Production of Engines More Efficient facilities for Autoparts Satamping (Hours/Engines) (Parts/Hour) 3.32 3.45 3.46 3.19 3.07 3.09 3.32 3.45 3.46 3.19 3.07 3.09 2.53 2.60 2.66 2.53 2.60 2.66 Hyundai Mongtgomery (USA) GM Parma, Ohio (USA) Toyota Princenton West (USA) Nummi (USA) Chrysler Toluca (México) GM Silao (México) Ford Dearborn (USA) Chrysler Belvidere (USA) Toyota Cambridge (Canadá) GM Romulus (USA) Chrysler Saltillo (México) Chrysler Mark Av. II (USA) GM Tonawanda (USA) GM Flit North (USA) GM Flint South (USA) Toyota West Virginia (USA) Toyota Georgetown (USA) GM Spring Hill (USA) Chrysler Dundee GEMA (USA) Source: The Habur Reporrt Toyota Georgetown (USA) 1.84 1.84 Mexico offers significant competitive advantages in the automotive industry. • Some cities in our country, where automotive clusters have been established, are identified as those highly competitive in parts assembly costs. Puebla, Aguascalientes and Monterrey are good examples. • At the same time, Mexico offers low assembly costs compared to other 9 important vehicles producers. Difference between México and USA, shows that in our country average costs are around 20% lower than in that country. Position in automotive parts assembly by city Advantage in automotive assembly costs (Position of 102 considered cities) 140 101 83 90 (Index 100 = USA) 120 100 63 80 60 0 Mexico Australia USA Canada France United Kingdom Netherlands Italy Germany Japan Hamamatsu, Japan Manchester, UK Detroit, USA 20 Paris, France 40 Melbourne, Australia 8 Adelaide, Australia 7 Greenville-Spartanburg, USA 6 Shreveport, USA 4 Monterrey, Mexico 3 Puebla, Mexico 2 Aguascalientes, Mexico Reynosa, Mexico 1 19 Montgomery, USA 18 Improvement in mexican automotive industry is evident • Mexico increased its contribution in automotive imports of USA. In 2014* reached 29.6% 35.0 29.6% 30.0 25.0 20.0 15.0 10.0 5.0 Alemania México Japón Canadá 0.0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Source: Census Bureau * Data to July New Investments in Mexico will Increase Production Capacity OEM´s investments announcements have been a constant in Mexico • From 2009 to 2014, new investments for 17,571 million dollars have been announced in the automotive sector; more than 40% (7,088) correspond to current federal administration. • With these new investments, automotive industry production capacity will grow in 1.8 million vehicles annually, when all facilities operate fully. • Additionally, more than 30 thousand employees will be generated in assembly plants with all mentioned investments. As a consequence, well trained people will be required by the industry. Inversiones anunciadas, 2009-2014. (millones de dólares) Foreign Direct Investment in autoparts industry has shown a good performance • The investments of the OEM´s boosted FDI in the auto parts sector. • From 2009 to June 2014 FDI in auto parts sector accumulated more than 10 thousand million dollar. Auto parts FDI, (Thousand Million Dollar) 1.8 1.4 1.3 1.6 1.2 1.2 0.9 2007 2008 2009 Source: Secretaría de Economía 0.8 2010 2011 2012 2013 Ene-Jun 2014 World Automotive Market Trends Global demand for vehicles by 2017 is estimated in more than 104 million of units • Demand in North America is expected to grow by 30%. • The increase in the productive capacity of Mexico could increase the participation of our exports to the United States by 3%. New Vehicle Demand by Region 2011 2017 52.2 30.3 23.8 20.4 19.0 15.6 5.3 Europa Source: KPMG. Note: includes heavy trucks Asia Pacífico Norte América 8.6 América del Sur Changes is Location of automotive manufacturing • From 2000 to 2011, vehicles production in developed countries reduce 24%, while in developing countries production grew by 200%. • Mexico has remained among the top 10 producers of vehicles worldwide. In 2013, our country was ranked in the number 8. As mentioned, currently our country is the 7th most important producer. • Due to the changes in the global automotive manufacturing, Mexico has the opportunity for structural transformation, considering the following elements: Innovation Human capital New technologies New environmental, security, connectivity and comfort Global environment: o Countries regulations aimed at protecting the environment. o New requirements of consumers related to safety vehicle, sustainability (efficiency in the performance of fuels and reduced emission of pollutants), connectivity (interconnection between different mobile devices and internet) and comfort. Considering this environment, to play a good roll in long term, it is important for Mexico to be among the main destinations of investment in research, development and automotive design. “Inventario de capacidades nacionales para el desarrollo tecnológico automotriz” Main findings There are technology development capabilities along all vehicle systems. The level of technological development in Mexico offers opportunities to improve; only a third part focuses on innovation development. more than 5,000 employees focused on R & D, those which have a high number of years of experience. Automotive industry spends a higher percentage of time in training, even though there are more than 700 relevant programs for the automotive sector offered by the Academy. The Academia and Research Centers have more staff prepared the industry and devote significant time to research, but productivity has opportunity to be improved. “Inventario de capacidades nacionales para el desarrollo tecnológico automotriz” In Infrastructure, 360 facilities and more than 2,000 relevant teams in the country covering all vehicle systems were identified. The equipment utilization levels are low and 95% of the organizations surveyed are willing to providing his team to other companies. There are opportunities to expand the inventory of specialized equipment In projects, there is an important link between Industry-Academy-Government, but a significant percentage of them are not focused on product innovation. Challenges and Future Vision Challenges and Future Vision for Automotive Industry in Mexico The U.S. International Trade Commission estimated that the added value of Mexican exports is 26.9%, which represents a high potential for the Mexican automotive industry. This means that Mexico has an opportunity area in increasing the national content of the automotive goods, that is why it is necessary to reinforce the automotive value chain and incorporating Tier 2 and Tier 3 producers. New trends like those focusing new and stricter standards on energetic efficiency and emissions, represent an opportunity for the development of new technologies and structural changes in the automotive sector at a global level. As most of Mexico´s production goes to foreign markets; and being part of the global chain of many of the biggest OEM’s, Mexico could take advantage of these new global trends in the future and be able to insert in the development of the new products that fulfill these new standards. Moreover, a positive relation is observed between trade and the development of industries with high added value. • As shown in the chart, higher levels added value sectors are related to higher trade. Transport equipment manufacturing is ranked at the top, however there is still opportunity to improve if innovation and design investment increases. Imports vs added value (Average annual growth 99 – 09) Exports vs added value (Average annual growth 99 – 09) Ttransport equipment Source: INEGI Economic Census and UN COMTRADE (NAICS code) Note: in red those industries classified as "high technology" according to The World Bank Ttransport equipment 23 Strategies for Automotive Industry Development • Main aspects that are being considered by Secretaría de Economía to improve automotive industry's competitiveness are: Human Capital Training Investment Attraction Support to Innovation Supplier development Federal Government has some supporting programs to help automotive industry to improve its global position, among which there are the followings: Federal Supporting Programs Program SE/PRODIAT SE/PROSOFT INADEM PROMEXICO CONACYT BANCOMEXT NAFIN MEXICO FIRST Features Training, Certifications and technological innovation Software "Startup" NAFIN full projects Internacional promotion Seed capital Training and technical asisitencia Seed capital Innovation support FINNOVA Suppliers Financing Financiamiento a Proveedores Certifications in TI Automotive Industry Vision PRODUCCIÓN* (MILLONES DE UNIDADES) EXPORTACIÓN* VALOR AGREGADO** (MILLONES DE UNIDADES) (PORCENTAJE DEL PIB) 3.5 4.0 4.5 3.2 2.6 2.1 2011 2017 */ Light vehicles **/Participation of Automotive Industry in GDP. 2011 2017 2011 2017