What is a Maquiladora?

advertisement

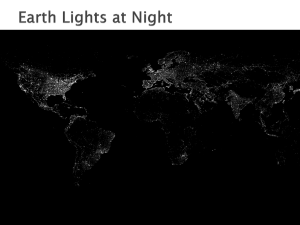

Julio A. Jimenez Gateway to Exporting Consultant juliojimenez@consultant.com The Maquiladora Industry The Rise of Production Sharing • The second half of the 20th century increased in world wide trade. • Between 1970 – 2000 trade increased in more than 370% due to production sharing. • An agreement to share the production costs between two or more firms. • this represents more than $800 billion in trade anually. • Maquiladora U.S. – Mexico trade is primarily intra industry trade (Production Sharing). • 80% of U.S. trade with Mexico is intra-industry. Introduction to Maquiladoras • End of the Bracero Program 1965 • Border industrialization program • The Maquiladora program was a measure to alleviate higher unemployment and growing poverty • By 1969 , 147 companies were in place, accounting for 17,000 jobs • The first two industrial parks were in Cd. Juarez, Chih. and Nogales, Sonora Mexico. (RCA, Convertors and Sylvania) • By 1985 had become Mexico’s second largest source of income from foreign exports, behind oil. What is a Maquiladora? • Maquiladoras are foreign-owned, these are controlled or subcontracted manufacturing plants that process or assemble imported components for export. • Maquiladora inputs are generally imported duty-free and countries like the U.S. only tax the value-added portion of maquiladora exports. Industry Evolution • First - generation: Highly labor-intensive with limited technology and dependent on decision from parent company i.e. textile. (U.S. located) • Second - generation: Oriented less toward assembly and more reliant on a manufacturing process. i.e. Automotive harnesses, TV sets and electrical appliances. • Third - generation: Research oriented, with emphasis on design and development. i.e. Delphi’s Mexico Technical Center. Delphi’s Mexico Technical Center Importance to the Mexican Economy • Maquiladora exports represent almost 50% of Mexico’s total exports. • The industry employs 10% of Mexico’s formal employment. Maquiladora Jobs Distribution in México Has the Maquiladora Impact change over time? • Over the years, the industry has switch from the manufacturing sector to the services sector. • This is good news because these type of jobs pay higher wages. • i.e. ACS which gives bilingual customer service to Boost mobile users in the U.S. Low-Wage Competition is over • Mexico’s Ministry of Economy estimates that the country pays and average wage with benefits of $2.96 per hour, compared to California's $16.60 per hour, and unfavorable when compared with China’s 0.72cents per hour. • The U.S. Bureau of Labor statistics puts Mexican wages at $2.08 per hour compared with 0.48 cents in Sri Lanka. • The international labor organizations estimates Chinese manufacturing wages at 0.25 cents per hr. How does Mexico compete today? 1. Proximity with the U.S. Market: Works for Large items, Big-screen TV’s, freezers, water heaters and blades for wind turbine’s. All produced in Juarez. 2. Quick turnarounds: Frequent changes to products or an ASAP shipment to the U.S. i.e. Auto parts. 3. Goods with high value added: Such as medical instruments, are often made in Mexico. This is to its skilled and experienced labor force. 4. Intellectual property: Used in the production process can be at risk overseas, Mexico offers better protection than other countries. 20 Largest Foreign Investors in Maquiladora Industry NUM. • • • • • • • • • • • • • • • • • • • • COMP. 1 DELPHI AUTOMOTIVE SYSTEMS 2 LEAR CORPORATION 3 YAZAKI NORTH AMERICA 4 ALCOA FUJIKURA LTD 5 GENERAL ELECTRIC COMPANY 6 THE OFFSHORE GROUP 7 TAKATA 8 SANMINA-SCI 9 THOMSON, INC 10 PHILIPS ELECTRONICS 11 SIEMENS AG 12 JABIL CIRCUIT 13 VISTEON CORPORATION 14 MAGNA INTERNATIONAL INC 15 SONY CORPORATION 16 KEMET CORPORATION 17 CARDINAL HEALTH 18 MALLINCKRODT, INC. 19 SUMITOMO 20 WHIRLPOOL EMPLOYES PLANTS ORIGEN 66,000 34,000 33,400 23,000 20,700 16,590 15,800 12,110 10,874 10,575 10,200 10,000 10,000 9,800 9,679 8,000 7,566 7,521 7,500 7,500 51 8 41 26 30 3 10 7 6 11 15 3 16 12 3 8 6 8 14 5 EUA EUA JAPON JAPON EUA EUA JAPON EUA EUA HOLANDA ALEMANIA EUA EUA CANADA JAPON EUA EUA EUA JAPON EUA INDUSTRIAL SEC. AUTOMOTRIZ AUTOMOTRIZ AUTOMOTRIZ INDUSTRIAL INDUSTRIAL SHELTER AUTOMOTRIZ ELECTRONICA ELECTRONICA ELECTRONICA ELECTRONICA ELECTRONICA AUTOMOTRIZ AUTOMOTRIZ ELECTRONICA ELECTRONICA MEDICA MEDICA ELECTRICA ELECTRONICA Examples of Maquilas Automotive Industry Electronic Industry Most common production inputs purchased by maquilas: • • • • • • • • Metal components Tool and die products Plastic injection Packaging materials Resins Chemicals Industrial wire Logistical services Maquila Considerations • Most maquilas are Fortune 500 companies or are global in nature. • Quality control is a given for maquila suppliers (ISO, Six-sigma, etc.) • Supply chain management usually entails putting pressure on suppliers to supply production inputs when needed. • If you are not located directly on the border, can you quickly and economically supply your Mexican buyer? • Becoming a supplier to a maquila means that you have to be prepared to become a part of its supply chain. • Volume can sometimes be a major consideration. • In addition to direct inputs, maquilas purchase MRO (maintenance, repair and operations) supplies. • Getting in front of a maquila purchasing manager can be a challenge. Thanks! Julio A. Jimenez Gateway to Exporting Consultant juliojimenez@consultant.com