Bedford Borough Council - Bedfordshire Advice Forum

advertisement

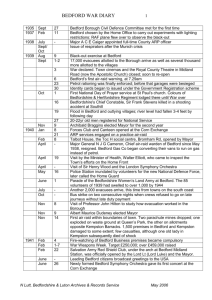

IMPACT IN BEDFORD BOROUGH • • Reduced real income for many Local Council Taxclaimants Reduction Scheme This will lead to extra pressure on Claimants Advice agencies Lee Phanco Support agencies / charities Assistant Director (Revenues, Housing associations Benefits and Customer Service) Bedford Borough Council Bedford Borough Council Council Tax Benefit Changes • Council Tax Benefit abolished 31 March 2013 • Councils required to put in place local Council Tax Reduction Schemes from 1 April 2013 • Statutory Scheme will protect pensioners • A Default Scheme will apply if no local Scheme in place • Bills will be reduced by a Council Tax Support discount not a benefit • Government funding reduced by 10% (£1.147 million for Bedford Borough) Council Tax Reduction Schemes • Council Tax Reduction Schemes must be agreed by 31 January 2013 following public consultation • Bedford Borough Council agreed a Local Scheme on 16 January 2013 • Final Scheme differs from the original draft scheme to secure new transitional grant from the Government and in response to public consultation • Government funding is fixed for the year • The Scheme will be reviewed before April 2014 Bedford Borough Council Tax Reduction Scheme • Applies to claims from working age applicants Working age claims 8,120 11.9% Pension age claims 5,170 7.6% Total claims 13,290 19.5% Total households 68,250 • Based on 9 Key Principles • Predominantly the national Default Scheme but with some adjustments • No one who would receive a 100% discount under the Default Scheme will pay more than 8.5% Bedford Borough Council - Key Principles • Support for those households most in need • Similar support for those in similar circumstances • Support must be affordable for the Council • All members of households with means should contribute • Households with the means to pay should do so • Those in larger properties should meet part of the cost • Additional support for the transition to paid employment • Evidence required to support all applications • Fraudsters should not get full support for six months Council Tax Reduction Scheme – Key Changes (1) • No Second Adult Rebate Scheme (currently up to 25% off the Council Tax bill) • Discount for households in Council Tax Bands F, G and H limited to 91.5% o Typical Band F Council Tax £2,254 per year o 8.5% = £192 or £3.70 per week Council Tax Reduction Scheme – Key Changes (2) • Deduction from weekly discount where a nondependant earns more than £401 per week will be £11.90 (£0.95 higher than the Default Scheme) • Where a sanction is imposed for Council Tax Support fraud or Benefit fraud the discount will be limited to 91.5% for 6 months Council Tax Reduction Scheme – No Change • Income from war pensions disregarded in full • Maximum amount of savings remains at £16,000 • Income disregards remain the same • Extended payments remain the same • Backdating – pensioners up to 3 months • Backdating – working age up to 6 months where there is good cause • No changes to other non-dependant deductions Council Tax Reduction Scheme – Practicalities • Application process broadly the same – applicants required to provide original documents to verify entitlement • Expected that all live claims will automatically transfer at 1 April 2013 • Eligibility assessed in a similar way • Option to review claims every 6 months • Right of appeal – but appeals to be heard by the Valuation Tribunal in the same way as appeals about other Council Tax discounts Council Tax Reduction Scheme • Thank you for listening • There will be an optional questions and answers session at the end of the presentations Welfare Reform – Changes to Housing Benefit James Hurd IRRV (Hons), Compliance and Quality Officer Revenues & Benefits Service Story so far… • Local Housing Allowance changes have reduced the amount of Housing Benefit (HB) that can be awarded to claimants renting in the private sector. • Non-dependant deductions have increased considerably. • Single persons aged under 35 entitled to the Shared Accommodation Rate of LHA (i.e. the rent for a room in a shared house), an increase from the age of 25. In the short term: There are some major changes planned for 2013: • A restriction on under occupation in social housing. • A overall Benefit Cap of £350 per week for a single person and £500 for couples/families. • LHA no longer reviewed on the anniversary of the claim. • LHA annual increases now linked to Consumer Price Index rather than actual rents Restriction on Under Occupation in Social Housing • New restriction on how much Housing Benefit can be paid when a Social Housing property is under occupied. • Applies only to working age tenants. • The current requirement is to apply a 14% reduction if there is one room under occupied and 25% if there are two or more rooms. • Occupancy criteria the same as for private sector tenants – one room for claimant and their partner, one for every occupant over 16, one for every two children under 10 (or under 16 if same gender) Restriction on Under Occupation in Social Housing • There are certain exemptions: Shared ownership Pensioners Temporary accommodation Supported “exempt” accommodation • No exemptions for disabled persons, unless due to their disability there is someone who occasionally stays over and cares for them. • No assistance for Foster Carers, as both the presence of the children and the income for the care are disregarded. Impact in Bedford Borough • There are currently have 7,762 Social Sector claims • Of these 5,297 are working age tenants • Current estimate is that 1,260 will be restricted. • The Council will be writing to all the tenants potentially affected to: – advise them of the change – ask them if they think they will fall into one of the exemption categories Options to Cope with the Restriction • Inform the Council if an exemption applies • Pay rent that is due – typically around £14 per week for one spare bedroom, £25+ for two or more • Move to a smaller property • Request a transfer or exchange • Take in a lodger or a non-dependant adult • Council can award Discretionary Housing Payment in exceptional circumstances (but funding is limited) Overall Benefit Cap • The maximum income from Benefits will be the capped at the national average of earnings – which is £500 per week for a family and £350 for a single person. • It will be calculated by adding together benefit income such as: – Any “out of work benefit” (JSA, IS or ESA) – Award of Housing Benefit – Child Tax Credit – Child Benefit • Where this is over £500 then Housing Benefit will be reduced pound for pound – some families may lose all their Housing Benefit. Benefit Cap • Exceptions apply where someone in the household is: – Working and entitled to WTC – In receipt of DLA, AA or the Support Component of ESA • The Government’s stated aim is to get people into work. • Job Centre Plus is writing to those likely to be affected offering support to find work. • Still not entirely clear which households will be affected – work in progress across the Council and other agencies to identify those affected. Impact of Benefit Cap in Bedford • Will mainly affect families with three or more children. • Any family with five or more children is likely to see their entire entitlement to HB removed (except for a statutory minimum of 50p per week). • Current estimates suggest up to 100 households may be affected – 10 likely to receive the minimum. • The Cap was due to commence in April 2013, but will now be piloted in four London Boroughs first. • To be rolled out nationally in ‘summer 2013’ – dates for Bedford yet to be confirmed. Direct Payments to Tenants • There are no plans to change how the Council pays Housing Benefit. • Currently, Housing Association tenants can ask for their HB to be paid direct to their landlord. • Private tenants have to justify direct payments to their landlord – either due to difficulties handling money or as a condition of the tenancy. • However, current indications are that where Universal Credit is paid (for new claims after October 2013) the Universal Credit will be paid direct to the claimant Universal Credit: • Universal Credit will replace a number of means tested benefits including Housing Benefit (but not Council Tax Support). • No new claims for Housing Benefit after April 2014, and then a phased migration to Universal Credit by 2017. • Universal Credit likely to be paid direct to the claimant. • Pensioners claiming Housing Benefit to be migrated to a new housing element of Pension Credit from October 2014 onwards. • Councils will continue to be responsible for Supported Accommodation costs – but no details available yet. Housing Benefit Changes • Thank you for listening • There will be an optional questions and answers session at the end of the presentations Local Welfare Provision Mrs S M Audin Head of Revenues & Benefits Introduction From April 2013 Local Authorities will put in place a scheme of Local Welfare Provision A proportion of the funding previously allocated to the Community Care Grant and Crisis Loan element of the Social Fund will be provided to enable them to assist persons in need The proposed policy for the delivery of Local Welfare Provision in Bedford is out for public consultation so that the final policy may be agreed to take effect from 1 April 2013 Proposed Council Policy The Council will not need to replicate the current provision however the current criteria for the awards is a good basis for the development for the local policy Full document out to consultation on the Council’s website Link: www.bedford.gov.uk/LWP So what does the Council’s Policy look like:- Proposed Policy Two forms of payment available to residents in need • Crisis Grants • Home In the Community Grants In general, grants will only be awarded where sufficient financial resources allocated for that purpose are available and Grants will only be awarded to persons habitually resident in Bedford Crisis Grants These grants will provide immediate assistance to qualifying residents experiencing an emergency that jeopardises their health or safety, for example: Food, fuel/energy costs Goods for infants/children Essential clothing It is anticipated that most awards will be for less than £50 and limited to two awards in a any one year Home in the Community Grant • To assist vulnerable persons to settle and form part of the community or to remain in their home • For example: – House fire/flood or other major emergency – Breakdown of a relationship/fleeing domestic violence – Leaving institutional/long term care It is anticipated that awards will limited to a maximum of £1,500 and only one in any twelve month period Restricted Items • It is proposed that assistance will not be provided for certain items • Generally the same items that are currently restricted under the Social Fund • Housing costs, including rent, will not be paid from Local Welfare Provision • Taxes, debt and insolvency costs, care provision, legal costs and medical prescription items are also excluded Application Process There will be no provision for applications for grants to be made in person Requests must be made by telephone to the number provided for that purpose by the Council Will normally make a decision on Crisis Grants immediately Will aim to make a decision on Home in the Community Grants within a few days Application Process …continued The Council may at its discretion consider an application received for a Crisis Grant as an application for Home in the Community Grant and vice versa • There is an intention to liaise with other supporting agencies such as: – Social workers – Probation workers – Medical staff Local Welfare Provision • Thank you for listening • There will be an optional questions and answers session at the end of the presentations