Mr Thompson

advertisement

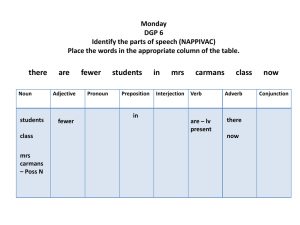

Financial Planning for Second Marriages Colin Jelley Private Client Director St. James’s Place Wealth Management Agenda Objectives: • Identify the issues • Examine the solutions • Case study: Mr & Mrs Thompson The Family Mr Thompson Aged 58 Widowed Andrew (24) Brenda (22) Mrs Thompson Aged 52 Divorced Catherine (12) Ross (27) Bradley (25) Asset Mr Thompson £k Mrs Thompson £k London home (jointly owned) 1,000 1,000 Holiday Cottage Cash/Investments 800 1,900 Personal Pension Employer’s Pension Life Cover (whole of life) 800 500 1,000 Total 6,000 Assets 500 250 250 2,000 Wills: Frequent issues • • • • Marriage revokes a Will No wills – “It’s just too difficult” Wills leaving assets outright to own children Wills leaving assets outright to survivor Mr Thompson: No Will Intestacy rules apply • Prescribed process • £250,000 (and personal belongings) to Mrs Thompson • Half of residue to Mrs Thompson in trust (£1,725,000) • Half of residue to Mr Thompson’s children (£1,725,000) No Will: IHT on Mr Thompson’s death Assets to children Less transferable nil rate band IHT at 40% IHT on Mrs Thompson’s death Assets Less Mrs Thompson’s nil rate band 1,725,000 (650,000) 1,075,000 £430,000 IHT at 40% 1,975,000 (325,000) 1,650,000 £660,000 TOTAL IHT £1,090,000 Mr Thompson: Outright gift on death to his children £3.7m Andrew (24) Brenda (22) Catherine (12) Mr Thompson: Outright gift on death to his children IHT on Mr Thompson’s death Assets to children Less transferable nil rate band IHT at 40% • • • Mrs Thompson is unhappy Possible claims against the estate – under IPFDA Conflict between Mrs Thompson, Andrew and Brenda 3,700,000 (650,000) 3,050,000 £1,220,000 Mr Thompson: Outright gift on death to Mrs Thompson Assets (£3.7m) Catherine (12) • • • Ross (27) Mr Thompson’s assets will pass in accordance with Mrs Thompson’s wishes on her death Andrew and Brenda could be “disinherited” Family conflict and unhappiness Bradley (25) Mr Thompson: Value of advice TRUST Assets (£3.7m) Andrew (24) Brenda (22) Catherine (12) Ross (27) Bradley (25) • The Trust “ring-fences” Mr Thompson’s assets • Mrs Thompson occupies trust property and receives income • Mrs Thompson has access to capital if necessary …. at the Trustees’ discretion • Choice of suitable trustees Further opportunity • • • • • The Trust (£3.7m) will form part of Mrs Thompson’s estate for IHT Does Mrs Thompson need to have access to all of Mr Thompson’s assets? Terminate Mrs Thompson’s interest in some of the assets in favour of Mr Thompson’s heirs? Professional Trustees – Mrs Thompson’s formal consent not required Significant IHT savings Further opportunity • • • • • • • Trustees decide to terminate Mrs Thompson’s interest in: Holiday cottage £800,000 Cash/investments (half) £950,000 Total £1,750,000 IHT saving after seven years of £700,000 Taper relief after three years CGT on the termination of Mrs Thompson’s interest? Sufficient assets left in the Trust to protect Mrs Thompson financially Andrew and Brenda no longer ‘waiting for step-mum to die’! But what if Mrs Thompson dies within seven years? What if Mrs Thompson dies within 7 years? • Mrs Thompson’s nil rate band will have been used up • Ross and Bradley pay more IHT on their inheritance • No more IHT payable as a result of the gifts to Andrew and Brenda but… • Trustees should have a plan of action to ‘compensate’ Ross and Bradley • Term insurance • Retain sufficient assets within the Trust How to turn two nil rate bands into three nil rate bands: the issue TRUST £650k TNRB Mrs Thompson (1) Mr Thompson Mrs Thompson (2) • Mrs Thompson (1)’s nil rate band (NRB) fully available on her death – transferred to Mr Thompson • • • On Mr Thompson’s death, he can only transfer his to Mrs Thompson (2) Mrs Thompson (1)’s NRB is wasted Only £650k available to pass tax-free on Mrs Thompson (2)’s death How to turn two nil rate bands into three nil rate bands: the solution TRUST £650k TNRB £325K IOU £975k tax-free Mrs Thompson (1) Mr Thompson NRB TRUST Mrs Thompson (2) IOU • • • Mr Thompson’s will leaves Mrs Thompson (1)’s NRB to a NRB Trust NRB Trust lends assets to Mrs Thompson (2) Debt (plus rolled up interest) deductible on Mrs Thompson (2)’s death for IHT Summary: no/poor planning • • • • Ticking time bomb Loss of control Family conflict/resentment/additional costs Tax on first death and wasted tax planning opportunities .…. Unhappy clients! Summary: sensible planning • • • • Assets properly managed by professional trustees following Mr Thompson’s death Assets pass as intended All members of the family properly provided for Lots of IHT saved Happy clients! Property ownership • • • • • • Does the ownership of the London home properly reflect their respective contributions and intentions? Has Mr Thompson contributed more than 50% to the purchase? Does he want to confirm this in a simple declaration of trust? Beware stamp duty land tax if there’s a mortgage Sever joint tenancies so that joint assets pass to the professional Trustees on the first death Joint property discount on the second death on the London home (to save a further £120k of IHT) – 15% discount Cash & Investments - £2.4m Bespoke investment strategy Bespoke tax strategy • Income Tax • Capital Gains Tax • Inheritance Tax Mr Thompson: Lifetime IHT Planning • • • • • • • Discounted Gift Plans Loan Trusts Gift Trusts Discretionary Trusts Bare Trusts Family Limited Partnerships Private Investment Funds Donor 100% Ltd Company General Partner 1% Child Ltd Partner 20% Child Ltd Partner 20% FLP Investments Donor Ltd Partner 19% Grandchild Ltd Partner 20% Grandchild Ltd Partner 20% Mr Thompson’s £1m life cover TRUST Mrs Thompson Loan Loan + 5 children • • • In Trust? Right beneficiaries Possible to alter? Pension planning Letter of nomination PP/EMPLOYER PENSION MASTER TRUSTS • • • Pension schemes in trust? Using pilot trusts Check letter of wishes PILOT TRUSTS Order of gifts • • • • Exempt gifts Loans to trusts Chargeable lifetime transfers Potentially exempt transfers The Inheritance (Provision for Family and Dependants) Act 1975 • • • Continuing financial obligations from first marriage? ‘Clash of the wives’ Mr Thompson’s Will: what he should have done Summary • • • • • A golden opportunity for you to encourage clients to review their financial affairs, including pension arrangements and life assurance Cement your role as their trusted adviser Don’t let them bury their heads in the sand – recipe for disaster There are solutions to meet clients’ needs and save significant amounts of tax along the way Advice is of paramount importance