BMGF Fruit Market Opportunity

advertisement

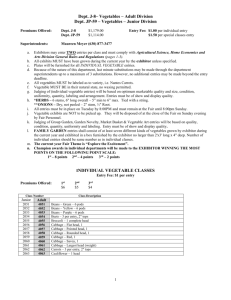

BMGF Sub-Saharan Africa Vegetable Market Opportunity Macro Opportunity Assessment 12 January 2009 6 of 80 Slides Certain vegetable commodities are prominent across Africa – in particular tomatoes and onions constitute ~20-35% of vegetable consumption in SSA Tomatoes and onions are the two most consumed vegetables in SSA constituting between ~20-35% of vegetable consumption within each region Exotic: • Primary • Tomatoes • Onions • Secondary • Peppers • Cabbage 2003 Consumption of vegetables in SSA (in M’s of tonnes) 100% 12.2 4.8 2.3 2.1 90% 80% 70% 60% 76% 79% 66% Other Vegetables 6% 14% Onions 22% 20% Tomatoes 72% 50% 40% 30% 20% 10% 9% 9% 15% 12% West Africa East Africa 0% Central South Africa Africa Main vegetable commodities in both West and East Africa Indigenous: • Primary • Amaranth • African eggplant • Okra • Secondary 1 • Spider plant • Night shade As incomes rise people tend to shift from consumption of indigenous to exotic vegetables Growing demand for exotic vegetables in urban areas particularly tomatoes and onions 1) Demand varies by country and regionally within a country Note: Consumption includes both fresh and processed vegetables, including watermelons and other melons Source: FAO; expert interviews 1 Tomatoes have relatively high nutrition balance scores and are the most locally produced vegetable in SSA 2007 SSA vegetable nutrition and availability analysis 95 Asparagus Spinach Lettuce and chicory 90 Vegetable nutrition balance score (NBS)1 85 Okra Pumpkins, squash and gourds Cabbages and other brassicas 80 Peas, green Artichokes Tomatoes 75 Eggplants (aubergines) Carrots and turnips Cucumbers and gherkins 70 65 60 Garlic Production statistics on African indigenous vegetables are not widely reported, but nutrition balance scores for certain indigenous vegetables are: reported. NBS: Amaranth: 79 Kale: 85 55 Onions, dry 50 0 1Source: www.nutritiondata.com 2Source: FAO Production statistics 3Note: 500 1,000 1,500 2,000 2,500 3,000 3,500 2007 Sub-Saharan Africa Vegetable production (in Ks of tonnes)2 Used “lettuce, green leaf” balance score for ‘lettuce and chicory” balance score; used “carrots” balance score for “carrots and turnips balance score, used “cucumbers” balance score for “cucumbers and gherkins” balance score; used “cabbages” balance score for “cabbages and 2 other brassicas” balance score Many indigenous vegetables have high nutritional content, they are relatively very high in calcium, vitamin C and iron as compared to onions and tomatoes Indigenous Vegetables 5.8 2.7 0.4 4.4 2.2 0.5 3.2 1.7 1.7 1.1 0.9 0.6 135 157 157 9 10 3 0.2 44 120 1.3 3.5 186 113 37 1 1.1 194 75 0.9 3.3 0.9 0.2 3 1.8 4.6 0 4.4 270 42 23 7 30 9 Note: assume headed cabbage is exotic; need to confirm if leaf cabbage is considered indigenous or exotic Source: "Advancing urban agriculture through use of indigenous vegetables: African experiences; Chapter 3”, by Ray-Yu Yang and Gudrun B. Keding 3 Across all vegetable commodities significant challenges exist along the value chain for vegetable production by smallholder farmers Challenges Inputs • Input scarcity (i.e. water, quality seed) • Inability to afford quality inputs • Cost/ availability of irrigation • • • • Production Wholesale / Processing Market Access / Retail Low productivity – low yield High waste Quality levels not met No planning, plant what neighbor plants Finance PRELIMINARY • High cost/ limited access and/or information of highquality inputs • Little-to-no use of irrigation • Cannot afford to finance inputs upfront • Poor farming techniques – limited training available • Limited use of pest/ disease management, and poor storage facilities • Limited market information – limited commercial mindset • Farmer is a price taker due to limited market access and product perishability • Consolidation of produce • Poor quality and inconsistent supply • Limited local processing to meet demand • • • • • Difficult for smallholders to access market directly • Farmers receive low price for produce • Fragmented retail market for fresh vegetables – primarily sold in wet markets and kiosks (though “super-marketization” underway) • Poor wet market infrastructure (crowded, unsanitary, poor storage facilities, etc. • Lack of cold-storage capacity – many vegetables are highly perishable • High transport cost • Poor post-harvest infrastructure/cold-chain • Poor/undeveloped roads, ports, transport links • Difficult to access financing across value chain (farmers, processors, etc.) • Lack of available affordable financing • Farmers cannot afford to finance inputs Retail / Trade Logistics Why? Source: Dalberg analysis; expert interviews Many steps in distribution channel – value captured across chain Farmers are widely disbursed and have low production volumes Poor post-harvest infrastructure, cold-chain Poor quality 4 Executive Summary • With regard to vegetable markets in Sub-Saharan Africa, West Africa is the largest and most attractive region for investment to increase smallholder farmer income – West Africa consumes two and a half times more vegetables than East Africa, and comprises 60% of the total vegetable consumption in Sub-Saharan Africa (SSA) – Even on a per capita basis, West Africa consumes over twice the amount of kg per year (48kg) than any other region in SSA, although none come close to the WHO recommended minimum (73 kg/year) – Nigeria alone makes up 35% of total vegetable consumption in SSA, and 62% of the consumption in West Africa – While most of the vegetables consumed are produced locally, West Africa imports at least 4% of their consumption from outside of the region, most of which is from Europe, indicating they cannot meet demand locally • Three opportunities stand out to increase smallholder farmers income in the vegetable value chain – Tomato Paste: Many West Africa countries are importing tomato paste from Europe and Asia. In 2003, Nigeria and Ghana imported 46K tonnes ($51M) and 31K tonnes ($30M) of tomato paste, respectively. Though the local processing sector requires further development, there is an opportunity to source fresh tomatoes locally or regionally , reaching 32-94K smallholder farmers, increasing their revenue by up to 700% if the necessary interventions occur (irrigation, training , etc.) – Onions: There is also a large market for onions in West Africa; in 2005 187K tonnes ($26M+) were imported a year from Europe into four countries (Senegal 95K, Cote d’Ivoire 44K, Guinea 24K and Mauritania 24K). There is an opportunity to either source this locally or through regional trade, reaching 12-37K smallholder famers and increasing their revenue by up to 300% – Processed vegetables: There is a large and growing global market for processed vegetables. There are opportunities to link smallholder farmers to vegetable processors focused on out-of-region export. Frigoken in Kenya works with up to 65,000 smallholder farmers increasing their income by up to 400% ; this model could be expanded and/or replicated • To capture these three opportunities, interventions with different partners are required – Though the challenges and risks vary across the three opportunities, there are some common themes: – Support smallholder farmers through enhanced production and post-harvest handling techniques, including improved seed; irrigation; etc. – Organize farmers for ease of implementation – Link farmers to a guaranteed, transparent market that they can rely on to sell their goods – Support local processors, where relevant, through soft-financing, managerial training and business model advice 5