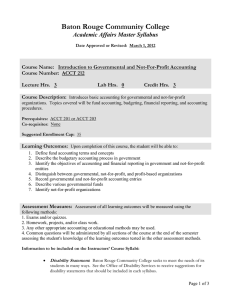

Government and Not-for-Profit Accounting

advertisement

Government and Not-for-Profit Accounting: Concepts and Practices, 5e Michael H. Granof Saleha B. Khumawala Granof-5e 1 Chapter 1 The Government and Not-for-Profit Environment Chapter 1 Granof-5e 2 Thoughts to Ponder: Chapter 1 "A democratic society depends upon an informed and educated citizenry." Thomas Jefferson “Service to others is the rent you pay for your room here on earth.” Mohammed Ali Chapter 1 Granof-5e 3 Learning Objectives After studying Chapter 1, you should be able to: Understand the characteristics that distinguish governments and not-for-profit organizations from businesses (for-profit entities). Identify the features that distinguish governments from not-for-profits Identify authoritative bodies responsible for setting GAAP and financial reporting standards for different governmental and not-for-profit entities. Chapter 1 Granof-5e 4 Learning Objectives (cont’d) Contrast and compare the objectives of financial reporting for (1) state and local governments (2) the federal government and (3) not-for-profit organizations. Distinguish Management Discussion & Analysis (MD&A), basic financial statements, and Required Supplementary Information (RSI) of state and local governments in their comprehensive annual financial reports (CAFR). Chapter 1 Granof-5e 5 How Do Governmental and Not-For-Profit Organizations differ from Business Organizations? No direct and proportional relationship between resources provided and the benefits received Absence or Lack of a profit motive Absence of transferable ownership rights Collective ownership by constituents Policy-setting process Chapter 1 Granof-5e 6 How Do Governmental and Not-For-Profit Organizations differ from Business Organizations? For businesses, annual report versus for GNP entities budget is very important. --budget is the culmination of the political process. --the budget is the key fiscal document. Ensure inter-period equity for most GNPs. Revenues may not be linked to constituent demand or satisfaction. No direct link between revenues and expenses. The matching concept has different meaning for governments and non-profits; Chapter 1 Granof-5e 7 How Do Governmental and Not-For-Profit Organizations differ from Business Organizations? Restriction on assets for particular activities and purposes. --ex. Federal government grants for low-income housing; a state’s gasoline tax may be targeted by law at highway construction and maintenance… No distinguished ownership interests. Less distinction between internal and external accounting and reporting. Chapter 1 Granof-5e 8 How Do Governmental and Not-For-Profit Organizations differ from Business Organizations? Power ultimately rests in the hands of the people People vote and delegate that power to public officials Created by and accountable to a higher level government – Power to tax citizens for revenue Chapter 1 Granof-5e 9 Governments Vs. Non-profits GASB: sets standards for all state and local governments and governmental nonprofits. Established in 1984, it has 56 stds and 4 concepts stmts as of Dec. 2009. FASB: sets standards for non governmental non-profits except federal government. FASAB: sets standards for the federal government 10 Objectives of Financial Reporting—State and Local Governments (SLG) Financial reports are used primarily to: Compare actual results with the budget Assess financial condition and results of operations Assist in determining compliance Assist in evaluating efficiency Chapter 1 Granof-5e 11 Objectives of Financial Reporting “ACCOUNTABILITY is the cornerstone of all financial reporting in government,” (GASB Concepts Statement No. 1, par. 56). Please see the summary of concepts Statement 1. What do we mean by accountability? How does “interperiod equity” relate to accountability? These questions are very important! Chapter 1 Granof-5e 12 Objectives of Financial Reporting (cont’d) What do we mean by accountability? Accountability arises from the citizens’ “right to know.” It imposes a duty on public officials to be accountable to citizens for raising public monies and how they are spent. Chapter 1 Granof-5e 13 Objectives of Financial Reporting: (cont’d) How does “interperiod equity” relate to accountability? Interperiod equity is a government’s obligation to disclose whether current-year revenues were sufficient to pay for current-year benefits—or did current citizens defer payments to future taxpayers? It is important to understand this concept of “interperiod equity”! Chapter 1 Granof-5e 14 Objectives of Financial Reporting— Federal Government Accountability is also the foundation of Federal government financial reporting Federal Accounting Standards Advisory Board (FASAB)’s standards are targeted at both: --internal users (management), and --external users Chapter 1 Granof-5e 15 Importance of Accounting for SLGs • There are over 89,500 state and local governments in the United States • State and local governments are responsible for approximately 14 percent of total employment in the United States • State and local governments collected approximately $1.3 trillion in tax receipts in 2007. Chapter 1 Granof-5e 16 Composition of the Local U.S. Government Units (16,519) (19,492) (13,051) (3,033) (37,381) Chapter 1 Granof-5e 17 Importance of the NFP Sector Size and Scope 2006-2007: • Number of not-for-profit organizations 1.9 million • Total nonprofit sector revenues (2006) $1.1 trillion • Annual contributions from private sources (2007) $306.39 billion • Percentage of wages and salaries paid in the US by NFP 8.3% • Percentage of NI attributed to the Indep. sector (2006) 5.3% Giving 2007: • • • • Individuals contribution (74.8%) Charitable bequests (7.6%) Foundations (12.6%) Corporate (5.1%) Chapter 1 229.03 billion 23.15 billion 38.52 billion 15.69 billion Granof-5e 18 Importance of the NFP Sector Size and Scope 2006-2007: • Number of not-for-profit organizations 1.9 million • Total nonprofit sector revenues (2006) $1.1 trillion • Annual contributions from private sources (2007) $306.39 billion • Percentage of wages and salaries paid in the US by NFP 8.3% • Percentage of NI attributed to the Indep. sector (2006) 5.3% Giving 2007: • • • • Individuals contribution (74.8%) Charitable bequests (7.6%) Foundations (12.6%) Corporate (5.1%) Chapter 1 229.03 billion 23.15 billion 38.52 billion 15.69 billion Granof-5e 19 Sources of GAAP and Financial Reporting Standards FASB – Financial Accounting Standards Board Business organizations: ex. Wal-Mart Nongovernmental not-for-profits: ex. Rice University, American Cancer Society, GASB – Governmental Accounting Standards Board Governmental entities: ex. New York City, Atlanta Governmental not-for-profits: ex. University of Houston FASAB – Federal Accounting Standards Advisory Board Federal Government and its agencies Ex. Department of Agriculture, Department of Transportation, Department of Energy, Department of Education, Department of Defense, HUD, HHS and others. Chapter 1 Granof-5e 20 Who are the users of financial reports? • Governing Boards: the prime recipients of the report because they approve budgets, major purchases, contracts and significant operating policies. • • • • • Investors and creditors Citizens and organizational members Donors and Grantors Regulatory Agencies Employees and other constituents Chapter 1 Granof-5e 21 Several forms of Financial Reporting • • • • Paper generated text financial statements PDF Internet- HTML or PDF XBRL (eXtensible Business Reporting Language) Chapter 1 Granof-5e 22 General Purpose External Financial Reports (SLGs) Source: GASB Statement 34 Management’s discussion and analysis Government-wide financial statements Fund financial statements Notes to the financial statements Required supplementary information (other than MD&A) Chapter 1 Granof-5e 23 Comprehensive Annual Financial Report (CAFR) CAFR -- recommended, but not mandatory Three Sections: Introductory section Financial section Statistical section Chapter 1 Granof-5e 24 CAFR - Introductory Section Title page Contents page Letter of transmittal Other (as desired by management) You can view online the City of Houston’s Annual Reports for the years 2009, 2008, and other years at the following link: http://www.houstontx.gov/controller/cafr.html Chapter 1 Granof-5e 25 CAFR—Financial Section (GASB Statement No. 34) Auditor’s report MD&A Basic Financial Statements Required Supplementary Information RSI (Other than MD&A) Combining the individual fund statements and schedules Remember GASB Statement No. 34 is the CURRENT Reporting Model that SLGs have to follow. Chapter 1 Granof-5e 26 Management’s Discussion and Analysis (MD&A) Brief objective narrative providing management’s analysis of the government’s financial performance This is basically “Tell it like it is.” Chapter 1 Granof-5e 27 Basic Financial Statements Government-wide Financial Statements Statement of Net Assets Statement of Activities Fund Financial Statements (see next slide) Notes to the Financial Statements The Government-wide Financial Statements are the TWO additional F/S required under GASB 34. Chapter 1 Granof-5e 28 Fund Financial Statements Governmental-type Funds Balance Sheet Statement of Revenues, Expenditures, and Changes in Fund Balances - Governmental Funds with reconciliation Proprietary-type Funds Statement of Net Assets Statement of Revenues, Expenses, and Changes in Fund Net Assets Statement of Cash Flows Fiduciary-type Funds Statement of Fiduciary Net Assets Statement of Changes in Fiduciary Net Assets Chapter 1 Granof-5e 29 CAFR - Statistical Section Tables and charts showing multiple-year trends in financial and socioeconomic information Chapter 1 Granof-5e 30 Fund Accounting Fund accounting reports financial information for separate self-balancing sets of accounts, segregated for separate purposes or to account for resources restricted as to use by donors or grantors Funds are separate accounting and fiscal entities Chapter 2 explains the concept of fund accounting. Chapter 1 Granof-5e 31 Summary In this course you will become familiar with current GASB, FASB, and FASAB standards relative to governmental and not-for-profit organizations. Accounting and reporting for governmental and not-for-profit entities differ from those of for-profit entities because each type of entity has different purposes and reporting objectives. Chapter 1 Granof-5e 32