Common Takeover Tactics and Defenses

advertisement

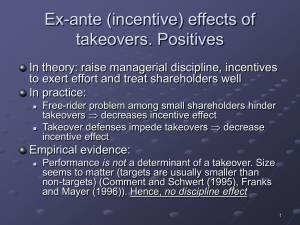

The Corporate Takeover Market Common Takeover Tactics, Takeover Defenses, and Corporate Governance Treat a person as he is, and he will remain as he is. Treat him as he could be, and he will become what he should be. —Jimmy Johnson Course Layout: M&A & Other Restructuring Activities Part I: M&A Environment Part II: M&A Process Part III: M&A Valuation & Modeling Part IV: Deal Structuring & Financing Part V: Alternative Strategies Motivations for M&A Business & Acquisition Plans Public Company Valuation Payment & Legal Considerations Business Alliances Regulatory Considerations Search through Closing Activities Private Company Valuation Accounting & Tax Considerations Divestitures, Spin-Offs & Carve-Outs Takeover Tactics and Defenses M&A Integration Financial Modeling Techniques Financing Strategies Bankruptcy & Liquidation Cross-Border Transactions Current Lecture Learning Objectives Providing students with an understanding of • Corporate governance and its role in protecting stakeholders in the firm; • Factors external and internal to the firm affecting corporate governance; • Common takeover tactics employed in the market for corporate control and when and why they are used; and • Common takeover defenses employed by target firms and when and why they are used. Alternative Models of Corporate Control • Market model applies when: – Capital markets are liquid – Equity ownership is widely dispersed – Board members are largely independent – Ownership & control are separate – Financial disclosure is high – Shareholder focus more on short-term gains • Prevalent In U.S. and U.K. • Control model applies when: – Capital markets are illiquid – Ownership is heavily concentrated – Board members are largely “insiders” – Ownership & control overlap – Financial disclosure limited – Shareholder focus more on long-term gains • Prevalent in Europe, Asia, & Latin America Factors Affecting Corporate Governance: Market Model Perspective External to Firm Legislation: 1933-34 Securities Acts Dodd-Frank Act of 2010 Sherman Anti-Trust Act External to Firm Regulators: SEC Justice Department FTC Internal to Firm •Board of Directors •Management •Internal Controls •Incentive Systems •Takeover Defenses External to Firm Institutional Activism: Pension Funds (Calpers) Mutual Funds Hedge Funds External to Firm Market for Corporate Control: Proxy Contests Hostile Takeovers Internal Factors: Board of Directors and Management • Board responsibilities include: --Review management proposals/advise CEO --Hire, fire, and set CEO compensation --Oversee management, corporate strategy, and financial reports to shareholders • Good governance practices include: --Separation of CEO and Chairman of the Board --Boards dominated by independent members --Independent members serving on the audit and compensation committees Internal Factors: Controls & Incentive Systems • Dodd-Frank Act (2010): -- Gives shareholders of public firms nonbinding right to vote on executive compensation packages --Public firms must have mechanism for recovering compensation 3-yrs prior to earnings restatement • Alternative ways to align management and shareholder objectives – Link stock option exercise prices to firm’s stock price performance relative to the overall market – Key managers should own a significant portion of the firm’s outstanding shares External Factors: Legislation • Federal and state securities laws – Securities Acts of 1933 and 1934 – Williams Act (1968) • Insider trading laws • Anti-trust laws – Sherman Act (1890) – Clayton Act (1914) – Hart-Scott-Rodino Act (1976) • Dodd-Frank Act (2010) Dodd-Frank Act of 2010: Governance & Executive Compensation • Say on Pay: In a nonbinding vote, shareholders may vote on executive pay every 3 yrs. • Say on Golden Parachutes (executive severance packages): Proxy statements seeking shareholder approval of M&As or sale of most of a firm’s assets must disclose pay agreements with target or acquirer executives • Clawbacks: Public firms must disclose mechanisms for recovering incentive pay paid during 3-yrs prior to earnings restatements. • Proxy Access: SEC has authority to require public firms to include nominees submitted by shareholders in proxy materials • Broker Discretionary Voting: Stock exchanges must prohibit brokers from voting shares without direction from owners in election of directors and executive compensation Dodd-Frank Act of 2010: Systemic Regulation and Emergency Powers • Financial Stability Oversight Council (FSOC): Monitors U.S. financial markets to identify banks and nonbank banks exhibiting “systemic” risk. • New Fed Bank/Nonbank Supervisory Powers: Banks/nonbanks with total assets ≥ $50 billion must – Submit plans for their rapid dissolution in event of failure – Limit their credit exposure in any unaffiliated firm to 25% of its capital – Conduct semiannual stress tests to determine capital adequacy – Provide advance notice of intent to buy voting shares in financial firms • Leverage Limitations: Fed may require banks with assets ≥ $50 billion to maintain debt-to-equity ratio of no more than 15 to 1. • Size Limitations: No bank or nonbank can hold deposits > 10% of deposits nationwide; does not apply to mergers involving failing banks. • FDIC Guaranty Powers: May guaranty liabilities of solvent banks if FSOC and Fed determine appropriate to do so. • Orderly Liquidation Authority: FDIC may seize and liquidate banks threatening U.S. financial stability • New Bank Capital Requirements: At discretion of regulators. Dodd-Frank Act of 2010: Capital Markets • Office of Credit Ratings: Sets rules for transparency, conducts audits and makes it easier to sue rating agencies. • Securitization: Issuers of asset-backed securities must retain an interest of at least 5% of any security sold to third parties. • Hedge and Private Equity Fund Registration: Must register with SEC as investment advisors if assets ≥ $100 million; those with < $100 million subject to state regulation. • Clearing and Trading of OTC Derivatives: Must be traded on formal exchanges to provide real time data reporting to market participants (e.g., CDS-lender insurance). Dodd-Frank Act of 2010: Financial Institutions • Volcker Rule: Prohibits insured banks from buying and selling securities with their own money (i.e., proprietary trading) or sponsoring or investing in hedge funds or private equity funds; banks may do so if they have no control over funds. Does not apply to U.S. banks with foreign operations. • Consumer Financial Protection Bureau: Writes rules governing financial institutions offering consumer financial products • Federal Insurance Office: Monitors insurance industry and recommends which firms should be considered systemically important. External Factors: Regulators • • • • Securities and Exchange Commission Justice Department Federal Trade Commission Public Company Accounting Oversight Board • Financial Accounting Standards Board • Financial Stability Oversight Council External Factors: Institutional Activism • Pension funds, mutual funds, and insurance companies • Ability to discipline management often limited by amount of stock can legally own in a single firm • Investors with huge portfolios (e.g., TIAA-CREF, California Employee Pension Fund) can exert significant influence • Recent trend has been for institutional investors to simply withhold their votes External Factors: Market for Corporate Control • Changes in control can result from hostile takeovers or proxy contests • Management may resist takeover bids to – Increase the purchase price (Shareholders’ Interests Theory) or – Ensure their longevity with the firm (Management Entrenchment Theory) • Takeovers may – Minimize “agency costs” and – Transfer control to those who can more efficiently manage the acquired assets Discussion Questions 1.Do you believe corporate governance should be narrowly defined to encompass shareholders only or more broadly to incorporate all stakeholders? Explain your answer. 2.Of the external factors impacting corporate governance, which do you believe is likely to be the most important? Be specific. Market for Corporate Control: Alternative Takeover1 Tactics • Friendly (Target board and management supports bid) • Hostile (Target board and management contests bid) 1A corporate takeover refers to a transfer of control from one investor group to another. Market for Corporate Control: “Friendly” Takeover Tactics • Potential acquirer obtains support from the target’s board and management early in the takeover process before proceeding to a negotiated settlement – The acquirer and target firms often enter into a standstill agreement in which the bidder agrees not to make any further investments for a stipulated period in exchange for a break-up fee from the target firm. • Such takeovers are desirable as they avoid an auction environment • If the bidder is rebuffed, the loss of surprise gives the target firm time to mount additional takeover defenses • Rapid takeovers are less likely today due to FTC and SEC prenotification and disclosure requirements1 1The permitted reporting delay between first exceeding the 5% ownership stake threshold and the filing of a 13D allowed Vornado Realty Trust to accumulate 27% of J. C. Penny’s outstanding shares before making their holdings public. Market for Corporate Control: Hostile Takeover Tactics • Limiting the target’s actions through a “bear hug” • Proxy contests in support of a takeover • Purchasing target stock in the open market • Circumventing the target’s board through a tender offer • Litigation • Using multiple tactics concurrently Market for Corporate Control: Pre-Offer Takeover Defenses • Poison pills to raise the cost of takeover1 • Shark repellants to strengthen the target board’s defenses – Staggered or classified board elections – Limiting when can remove directors • Shark repellants to limit shareholder actions – Limitations on calling special meetings – Limiting consent solicitations – Advance notice and super-majority provisions • Other shark repellants – Anti-greenmail and fair price provisions – Super-voting stock, re-incorporation, and golden parachutes 1Note that poison pills could also be classified as post-bid defenses as they may be issued by the board as dividends without shareholder approval. Poison Pill: Cash for Share Purchase Target Price Share D S1 S2 P3 A B Target shareholder Profit/Share on Poison Pill Conversion P1 P2 DD reflects relationship between shares outstanding and price/share for given level of expected earnings & interest rates. D C Q1 D Q2 Target Shares Outstanding P1 = Pre-offer equilibrium price/target share P2 = Poison pill conversion price/target share P3 = Offer price/target share Q1 = Pre-offer target shares outstanding Q2 = Target shares outstanding following poison pill conversion ABCD = Incremental acquirer cash outlay due to poison pill conversion Poison Pills: Share for Share Exchange Acquirer Shareholder Ownership Dilution Due to Poison Pill New Company Shares Outstanding1 Without Pill With Pill Target Firm Shareholders Shares Outstanding Total Shares Outstanding 1,000,000 1,000,000 2,000,000 2,000,000 Acquiring Firm Shareholders Shares Outstanding New Shares Issued Total Shares Outstanding4 1,000,000 1,000,000 2,000,000 1,000,000 2,000,0002 3,000,000 1Acquirer Ownership Distribution in New Company (%) Without Pill With Pill 50 673 50 33 agrees to exchange one share of acquirer for each share of target stock. 2Poison pill provisions enable each target shareholder to buy one share of target stock at a nominal price for each share they own. Assume all target shareholders exercise their rights to do so. 32,000,000/3,000,000 4Target shares are cancelled upon completion of transaction. Market for Corporate Control: Post-Offer Takeover Defenses • • • • • • • • • • Greenmail Standstill agreement Pac-man defense White knights Employee stock ownership plans Recapitalization Share buy-back plans Corporate restructuring Litigation “Just say no” Discussion Questions 1. Discuss the advantages and disadvantages of the friendly versus hostile approaches to corporate takeovers. Be specific. 2. Do you believe that corporate takeover defenses are more motivated by the target’s managers attempting to entrench themselves or to negotiate a higher price for their shareholders? Be specific. Impact on Shareholder Value • Friendly transactions result in average abnormal returns to target shareholders of 20% • Hostile transactions result in average abnormal returns to target shareholders of 30-35% • Bidders’ shareholders earn average abnormal returns that are zero or slightly negative; however, often positive in certain situations • Recent studies suggest – Takeover defenses have small negative impact on abnormal target shareholder returns – Defenses put in place prior to an IPO may benefit target shareholders – Bondholders in firms with ineffective defenses (i.e., vulnerable to takeover) may lose value Things to remember... • Hostile takeover attempts and proxy contests affect governance through the market for corporate control • Hostile takeover attempts tend to benefit target shareholders substantially more than the acquirer’s shareholders by putting the target into “play.” Consequently, acquirers generally consider friendly takeovers preferable. • Anti-takeover measures share two things in common. They are designed to – Raise the overall cost of the takeover to the acquirer’s shareholders and – Increase the time required for the acquirer to complete the transaction to give the target additional time to develop an anti-takeover strategy.