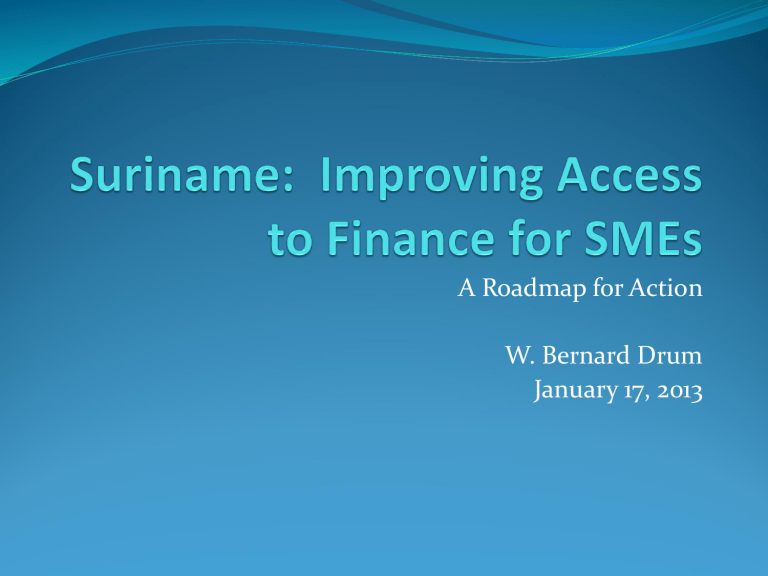

Suriname: Improving Access to Finance for SMEs

A Roadmap for Action

W. Bernard Drum

January 17, 2013

Purpose of Today’s Meeting

Briefly summarize the findings and recommendations from the recent study on access to finance for SMEs in

Suriname

Obtain feedback on the study report from a small group of important stakeholders. This will help in preparing a final version of the report for wider dissemination

Identify areas of consensus and establish priorities for action

Identify concrete next steps

The Study

Initiated in September 2012 by CUS in the Office of the

Vice President, with the support of IDB’s Compete

Caribbean Project

Work done by consultant W. Bernard Drum with support from CUS staff

Consisted of (i) desk research and (ii) ten days of field research in Suriname in October 2012

Analysis and recommendations draw on Suriname specific findings and on international best practices

Suriname Economic Background

Solid economic growth of 4.4 percent since 2000

Fiscal surplus of 1 percent of GDP in 2011

Debt at low level of 17.6 percent of GDP

But economy highly dependent on commodity exports

Economic diversification is a top priority

Large companies dominate in mining, banking, agroprocessing and trade

Private sector includes up to 20,000 SMEs, mainly in retail, trade, transportation and services

More than 25 percent of workforce employed by Govt.

Suriname Business Environment

Recent Reports

GEF Global Competitiveness Report 2012-2013

World Bank/IFC Doing Business Report 2013

World Bank Enterprise Survey 2010

Compete Caribbean Private Sector Assessment

Report 2012

Main Findings of these Recent reports

GCI ranks Suriname 114 out of 144 countries

Main constraints

government bureaucracy

corruption

access to finance

Doing Business ranks Suriname 164 out of 185 countries

Main areas of poor performance are

protecting investors, enforcing contracts, starting a business, registering property getting credit

resolving insolvency

Main Findings of these Recent

Reports (continued)

WB Enterprise Survey cites the top three constraints experienced by Suriname enterprises as

Inadequately educated workforce

Customs and trade regulations

Access to finance

Compete Caribbean PSAR cites the need to improve

Access to finance

Property rights

Transaction costs for trade

Labor markets

Priorities identified to improve the business environment

Identify and target priority sectors for development promote clusters, linkages, innovation and new technologies

Strengthen the institutional framework for competitiveness including improved interagency coordination, public private dialogue and investment promotion

Implement business regulatory reform

Target MSMEs for development, strengthen MSME skills and business associations

Improve the corporate tax structure

Improve corporate governance

Improve access to finance, especially for SMEs (identified as a key constraint in all the reports)

Banking sector performance

Good performance on capital adequacy (12 per cent), return on assets (1.9 percent) and return on equity (27 percent)

Ongoing proactive measures by the Central Bank to improve supervision

Deposits are around 51 percent of GDP – near the regional average

Interest rate spreads around 5 percent for local currency – near or below the regional average

But credit to the private sector is only 23 percent of GDP, and Suriname ranks as one of the lowest in the region on this criterion

Banking sector structure and infrastructure

Sector is highly concentrated with 80 percent of assets in top three banks

State ownership predominates

No formal credit information sharing mechanism

No movable assets registry

Clearing and settlement and POS/ATM infrastructure relatively well developed

NBFS not significant as a source of finance for business with the exception of informal lending

State Sponsored Credit Lines

A number of internationally financed credit lines have been extended through the commercial banks over the last 30 years, in many cases with NOB as the apex institution

Anecdotal evidence is that the performance of these credit lines, particularly the earlier ones, was mixed

Recent announcements of trade guarantees for SMEs through DSB

Plans are on the table for setting up a partial credit guarantee scheme

Main Access to Finance

Impediments Identified in the

Study

Central Bank reserve requirements – 25 percent for domestic currency and 40 percent for forex

Loans secured mainly by real estate – no movable assets registry or developed secured transactions regime

Lack of a formal credit information sharing or reporting mechanism

Historical focus of the commercial bank lending on larger borrowers

Inadequate financial reporting regulations and practices in

Suriname continued

Main access to finance impediments identified in the study (continued)

Lack of skills in SMEs in the preparation of business plans and loan proposals

Weaknesses in the investor protection regime that impede the development of the capital markets

Little use of leasing or factoring and the absence of an enabling environment to encourage the use of these instruments

Little or no venture capital available

Recommendations

Create a private credit bureau

Independent ownership

Comprehensive sharing of all credit information

Wide coverage of credit sources

Use internationally available expertise

Consult fully with the public to ensure success

Continued:

Recommendations (continued)

Strengthen the secured transactions regime and create a movable assets registry

Review the legal framework governing property rights and collateral and make changes where necessary

Design and implement a collateral registry

to cover all movable pledged collateral in Suriname

Limit information to security interests

Online and accessible at all times

Secure

Subject to data entry by registrants

Recommendations (continued)

Strengthen accounting and auditing rules and standards

Draft an Accountancy Act to include institutional and accounting reforms

Strengthen capacity of SUVA and improve training of accountants

Establish a Securities and Exchange Commission and continue to improve Central Bank supervision

Phase in new reporting requirements at a rate compatible with development of accounting capacity

Recommendations (continued)

Support training of entrepreneurs in business planning and loan proposals

Engage all stakeholders and complete a study of supply and demand

Avoid generic training and focus on specific needs

Delivery it in a market friendly way through private providers

Ensure cost recovery through beneficiary contributions

Apply rigorous monitoring to ensure desired targeting

Recommendations (continued)

Support training of bankers in SME lending

Assess supply and demand for such training and determine its scope

Select an institution to deliver it

Likely focus will be on SME lending skills such as:

Risk appraisal and management

Loan products and pricing

Collections

Information systems

Compensation and incentives for loan officers

Recommendations (continued)

Develop additional sources of finance and financing instruments

To promote the stock market complete a review and update corporate governance laws, regulations and practices

Create a new code of good corporate governance

Improve financial disclosure

Enhance the roles and compositions of boards of directors

Increase CEO and director accountability

Enact a new capital markets law

Review and improve legislation impacting the creation of venture capital companies

Review the laws and tax rules governing leasing and factoring

Recommendations (continued)

Complete a detailed cost benefit analysis of current proposals for a credit guarantee facility. If a decision is taken to go ahead:

Establish monitoring and evaluation criteria in advance and apply them rigorously

Building of capacity, particularly risk management skills, within lending institutions should be a major objective

Maximize involvement of private institutions in implementation

Central Bank should supervise the operation

Beneficiaries should be SMEs who should be required to provide collateral or other security

Participating financial institutions should be required to cover a share of the risks