Chapter 4

advertisement

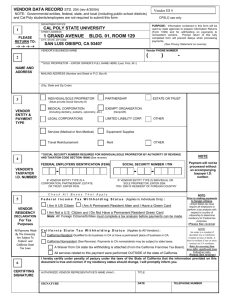

Global Real Estate: Transaction Tools Chapter 4: Tax Matters In This Chapter • • • • • • Taxpayer status—resident and nonresident Physical and substantial presence tests Income taxes for foreign property owners Capital gains tax Estate tax Foreign Investment Real Property Tax Act (FIRPTA) • Nontax reporting requirements Page 56 Taxpayer Status • U.S. citizens and resident aliens pay tax on worldwide income • Nonresident aliens pay tax only on U.S.sourced income • All real estate is U.S.-sourced • Tax treaties Page 57 Substantial Presence • Present 31 days in current year AND • Weighted average of 183 days over 3 years including current year, triggered in 3rd year • Qualifies as resident for income tax (not immigration) Page 58 Taxpayer Identification Number (TIN) • Taxpayer Identification Number • Employer Identification Number (EIN) for corporations • Required for real estate business • Allow 8–10 weeks for application Page 59 Income Tax for Foreign Real Estate Owners • 30 Percent Withholding OR • Effectively Connected Income (ECI) • Foreign owner may choose • IRS approval needed to switch • Best choice depends on overall tax liability Page 60 Withholding Agents • Property managers as withholding agents • FACTA – Requires foreign financial institutions (FFIs) and U.S. withholding agents to implement new procedures Page 61 Taxable Income Net Operating Income (NOI) – Cost Recovery – Interest – Amortized Points = Taxable Income Page 61-62 Cost Recovery • Annual deduction for a portion of the cost of an asset • Non-residential real estate—39 years • Residential rental property—27.5 years • Lowers basis • At sale, gain attributable to depreciation is recaptured and taxed at 25% Page 62 FIRPTA • Buyer must withhold 10% of sale price—not gain—and remit to the IRS within 20 days of closing • Exempt: personal residence under $300,000 (buyer or family member must occupy the residence for 50% of time for 2 years) • Commercial real estate • Investor (or agent) must withhold 30% of gross rental income • 10% of sales price • Changes pending Page 62-63 Adjusted Basis Purchase Price + Capital Improvements - Accumulated Cost Recovery =Adjusted Basis Basis for capital gains tax Page 65 1031 Tax-Deferred Exchanges 1. Property must be held for investment or productive use in trade or business; dealer property does not qualify. 2. Property must be exchanged for like-kind property. 3. Replacement properties must be identified within 45 days after the relinquished property is transferred. 4. The exchange must be completed (replacement property received) by the earlier of 180 days or the tax return due date. • Page 65-66 Both exchanged and relinquished properties must be located in the U.S. Estate Tax • Exemptions and credits for federal estate and gift tax depend on resident or nonresident status – Figured differently for estate tax • No marital deduction • Noncitizen surviving spouse—even if legal resident—pays tax on total estate including personal residence – Qualified Domestic Trust (QDT) can mitigate impact Page 66-67 Forms of Ownership • Direct ownership • Indirect ownership through a U.S. entity – – – – – – Sole proprietorship General partnership Limited partnership Limited Liability Corporation (LLC) C Corporation S Corporation • Indirect ownership through a foreign entity Page 67-69 Foreign Ownership: Required Reports • Business enterprises with 10% foreign ownership (BEA) • Subdivisions of 100+ lots (CFPB) • 10+ acres of farm, ranch, timber land, or under 10 acres with $1,000 revenue (USDA Farm Service Agency) • State requirements Page 69-71 Key Point Review Page 73-74