edit title - to the Aon Energy Insurance Training Seminar Website

advertisement

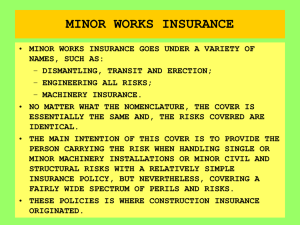

Aon’s 11th Energy Insurance Training Seminar Property Damage – Physical Damage and Business Interruption John Swann and Kevin Knight Why do companies insure their risks? Production Facility Explosion Hurricane Offshore Blowout Onshore Blowout Refinery Explosion Refinery Explosion Pipeline Explosion Insurance • The pooling of fortuitous losses by transfer of such risks to insurers, who agree to indemnify Insureds for such losses. • So it is the premiums of the many paying the losses of the few. Insurance Legal Principles When a company insures an individual entity, there are basic legal requirements. Several commonly cited legal principles of insurance include: •Indemnity •Insurable interest •Utmost good faith •Contribution •Subrogation •Proximate Cause Insurance Insurability Risk which can be insured by private companies typically share seven common characteristics. •Large number of similar exposure units •Definite Loss •Accidental Loss •Large Loss •Affordable Premium •Calculable Loss •Limited risk of catastrophically large losses Why Insure Operating risks? What drives companies to purchase insurance ? • Size of your company / its Financial Strength • Largest oil companies are bigger than any insurance Co. so often buy insurance as a purely financial transaction. • Medium / Smaller size oil companies benefit from access to capital for specified risks releasing funds for investment / access to finance. Why Insure Operating risks? Risk management philosophy / Impact of loss on the business • Focus on company’s expertise not random hazard loss • Could a single insured event reduce earnings in one year or damage the company’s viability ? • Interdependency vs alternate production / revenue sources What losses are we concerned about? • Aggregate value of all losses small or large? Larger losses only that could damage our revenue / share value? Why insure operating risks? Market opportunity • Is insurance cheaper than retained cost of transferable risks? • Is your insurance philosophy considered integral to business risk management or one of many tools? • A company may buy opportunistically or be a committed long term buyer and have a relationship with Insurers through hard and soft cycles Key Features of Insurance Contracts • Indemnification • Deductibles / Excess / Retention • Valuation of Insured Property – Replacement Cost – Actual Cash Value (ACV) – Agreed-upon Value Physical Damage - Valuation of property Traditional Method Full replacement value - ‘like for like’ / ‘new for old’ - early years a) Building risk completed value Historic incurred costs b) Agreed value for operating ‘Off the shelf’ value inflation adjusted ‘money of the day’ c) Increased costs of repair or Maximum envisaged replacement (ICRR all risks) repair cost d) Uplifted value (All Risks) Future inflation e) Total loss only interests (TLO) Additional incurred costs well abandonment / pipe re-routing Named Perils or All Risks Named Perils As the words imply underwriters will only pay claims in the event that the claim was caused by a named peril – it is the insured’s responsibility to prove that the claim was covered under a named peril. “All Risks” This is a misnomer as there is in insurance terms no way that underwriters will offer an all risks policy. These have a lot of exclusions and it is the underwriter’s responsibility to prove that a claim was caused by one of the many policy exclusions. Where does Offshore end and Onshore begin? In the Insurance world, Offshore and Onshore don’t mean what they say! • Offshore - Upstream Operations: E&P Production Facilities Drilling Contractor’s Equipment Well Control / Pollution / Redrill • Onshore - Downstream Operations: Refineries Petrochemical Plants LPG Plants Terminals Types of Offshore Structures Definitions of structures • Fixed Platform - Rigid structure fixed in the sea bed • Compliant Tower – Platform capable of “swaying” to absorb sea forces • Sea Star – Mini tension leg platform • Floating Production Systems – Floating tank system used to take oil/gas produced by nearby wells, process it and store it until it is unloaded • Tension Leg Platform – Semi-submersible platform moored vertically to anchor points on the sea bed • Sub Sea System – Well(s) with wellhead(s) set on sea bed • Spar Platform – A very large manned single buoy mooring incorporating oil storage Definitions of structures Jack up Rig Floated to location and raises itself clear of the water by “jacking” itself up its legs. Their stability / load capacity depends on strength / stability of the sea bed. Definitions of structures Process/Receiving Plant -Onshore or Offshore (Semi, FPSO, Spar, TLP etc) Well -valves and well control at Christmas Tree Wellhead (single well or multi slot template) Flowline Oil/gas/condensate, water or gas injection Riser -vertical section of flowline between seabed and offshore platform Umbilical -well control and monitoring, power supply, hydraulic fluid, electric power Manifold (subsea hubs) Export Facility (Export Pipeline, Loading Buoy, etc) Offshore Hazards Environmental • Storm - hurricane / sub-hurricane storm / typhoon Earthquake Tsunami Ice - Beaufort Sea Seabed Subsidence - Ekofisk Field, Norway Deliberate • War and Political Risks - Persian Gulf Terrorism / environmental activists Deliberate Damage - Torrey Canyon spill Offshore Hazards Accidental • Fire / explosion - during maintenance “hot work” / gas leaks / work procedure – Piper Alpha 1988 $1.4bn – Petrobras ‘36’ 2001 $500m • Blowout – Macondo 2010 $20bn – Montara 2009 $350m • Impact - supply boats / drill rigs / helicopters – Ekofisk 2/4 W 2009 $750m • Anchor damage to sub-sea facilities • Load / discharge accidents - crane drops Offshore Hazards Construction Defects • Physical damage following faulty design • Fatigue / corrosion • Mechanical breakdown • Faulty work / materials NOT covered during operating phase Key Exclusions. • Windstorm (can be bought back) • Earthquake (can be bought back) • Loss, expense resulting from delay, detention or loss of use. • Wear and tear, gradual deterioration, metal fatigue, machinery breakdown, corrosion, rusting, error in design. • Liabilities to third parties. • Well(s) and / or hole(s) whilst being drilled or otherwise. • Drilling mud, cement, chemicals and fuel actually in use, and casing and tubing in the well. • Unrefined oil, gas or other crude product, except whilst in storage or in transit in pipeline. • In respect of pipelines only: subsidence, scouring, abrasive action of sea and shingle. Typical Offshore gathering operation Standard Offshore Forms • Offshore Rigs: London Standard Drilling Barge Form • Supply Vessels/Tankers: FPSO’s Institute Time Clauses Hulls or FSO’s, American Time Clauses • Production Units: London Standard Platform Form • Pipelines London Standard Pipeline Form Onshore hazards • Fire • Explosion • Lightning • Aircraft • Storm • Flood • Earthquake • Machinery Breakdown • Sabotage, riots, strikes, civil commotion, malicious damage… • War, terrorism Insurance Considerations for Onshore Energy • High values / loss potential – No single insurer will underwrite whole risk • Brokers act for many using their leverage / expertise to help insured obtain best deal. • Complex subject matter / insuring conditions / tailored policy. Physical Damage • Covers: – All Physical onshore assets, including: • Plant (Refinery, Petrochemical, LPG etc) • Pipelines • Jetty • Storage tanks • Vehicles • Unprocessed Oil and its products • Premium setting: – Insurers will apply a rate to the Total Values to reach the premium and not the Loss Limit Processing and storage facility Downstream - Refining, Petrochemical etc • Operating: – Physical Damage – Machinery Breakdown – Business Interruption – Third Party Liabilities – Terrorist & Political Risks Extent of Cover Core non-marine cover • Physical Damage following – All Risks – Machinery Breakdown • Business Interruption following PD Can be arranged “stand alone” or as part of a wider package depending on • Risk profile • Client’s needs Extent of Cover Loss destruction of damage must be: • Sudden and unforeseen /accidental • Physical • Resulting from insured cause/not resulting from an excluded cause Physical Damage Cover • Fire, lightning, Explosion, Aircraft (Flexa) • Added Perils – Natural e.g. • Earthquake, Seismic Risks • Storm/Windstorm • Flood – Manmade e.g. • Riot/Strike/Civil Commotion • Impact • Malicious Damage – Accidental Damage • This Coverage is provided either by – Fire and Perils Insurance – All Risks Insurance All Risk Coverage “All” Risks except those excluded in the Policy • Exclusion Types – Absolute • War/Nuclear • Wear and Tear • Gradual Cause • Deliberate Acts – Other Policies • Sabotage/Terrorism • Marine • Liability • Construction –Buy Backs • Natural Perils • Land Transits • Machinery Breakdown Coverage Issues Incidence of natural perils • Type of plant – Inherent risks • Risk retention – Limiting coverage – Deductibles • Market availability – Natural catastrophe Risk Considerations • Assumption that correct PD and BI values declared • PD values either reinstatement as new or indemnity. • Additional cost factors to be considered e.g. – Fire Fighting Expenses – Removal of Debris – Architects Fees – Expediting Expenses – Transport Costs – Testing Costs Risk Considerations • Current Technology – New plants cheaper BUT most losses are repairs • Age of plant – Is the same equipment available today? • Influence of external factors – Affecting delivery time and costs (material & labour) • Contractual advantage – Ongoing agreements with manufacturers Risk Considerations THE CLIENTS OPTION Risk retention strategies adopted for multiple location risks • Insuring the catastrophic loss only • Insuring first loss only. • Aggregate limits. Estimated Maximum Loss • Methodology – Broker or market assessment • Including Business Interruption scenarios • Assessing normal risk as well as catastrophe • Including Machinery Breakdown • Accuracy – Known scenarios or the unexpected Deductibles • The decision of the client or the will of the market depending on: – loss history – risk quality – financial advantage – ability to retain risk Property - Interests not Covered • Wells or holes whilst being drilled or otherwise (see OEE) • Drill mud, cement, consumables actually in use / tubing / casing • Unrefined oil / gas in the ground • Plans / specifications / records • Employees personal effects Property Exclusions • Consequential loss (see B.I.) • Inherent vice / wear & tear / gradual deterioration / Metal fatigue / machinery breakdown ( can buyback) / expansion or contraction due to temperature / corrosion / rusting & electrolytic action • Latent defect / faulty design • Electrical / mechanical derangement • Third Party Liability (see Liabilities) • War Risks / Terrorism - subject to possible terrorist buyback • Radio-active contamination Should an Insured buy their own policy? Operator arranged policy vs separate partner policies • Common valuation • Common loss adjusters / surveyors • Common wording • Ensuring philosophy freedom / control of own destiny & costs • ‘Fleet’ interests / bulk purchase • Retention / deductibles Coverage Issues: Property including Machinery Breakdown Cover can be provided on an indemnity or reinstatement basis:18 Indemnity: This means that the property at the time of loss is valued on the new value of the property, less deductions for wear and tear I.e. the actual cash value will be the basis of settlement under the policy Reinstatement: This means that following an accident, the property lost will be replaced by equipment in a condition equal to but no better than its condition when new. This is the most common form of property coverage Average: Whichever option of cover is chosen, the insured must pay particular attention to the sums insured under the policy and ensure that they keep pace with inflation and in respect of reinsurance policies, the increasing cost of new equipment. If the insured does not do this, he runs the risk of being under insured and, if there is an Average condition in the policy, then he will be penalised by underwriters for underinsurance and will be unable to recover the full amount of the loss. Basic underwriter considerations: It has now becoming essential for all but the smallest risks to have a survey prior to underwriters provide terms. This survey will include the following information: Hardware: details of the physical assets and process involved, their age and conditions, layout and spacing Software: Management, systems of work, safety procedures, housekeeping Fixed Protections: means of fire extinguishment permanently in place, fire prevention, fireproofing, fire/gas detection Fire Fighting Facilities dedicated fire brigades, support and back up from local fire services, availability of fire extinguishing media Natural Hazards: Assessment of exposure to hazards of nature, eg. Earthquake, flood, windstorm, subsidence Maximum Loss Evaluation: Noting the above factors, assessment of the potentiall for loss and quantification for insurance purposes The Loss Record and deductible level. Machinery breakdown Insurers normally require the following information • A list of key machinery items within the plant • The new replacement values of these items • A description of each item, eg. Its function, its capacity, its operating parameters, mechanical details and the name of the manufacture • A list of spares kept • The time it is anticipated that it will take to replace the item • What the effect will be on the overall plant operation of a machinery breakdown incident on each of the items • Details of Manufacturers’ guarantees in force at the commencement of operation. M A I N R I S K A S S S M E N T F A C T O R S Benefits ofE aS Risk Survey Report • Main Risk Assessment Factors P R O C E S S ( I N H E R E N T R I S K ) E N G I N E E R I N G ( A S B U I L T R I S K ) M A N A G E M E N T ( C O N T R O L O F R I S K ) H I G H A N D L O W R I S K F A C T O R S Benefits of a Risk Survey Report • P R O C E S S F A C T O R High & Low Risk Factors Process Factor L O W E R R I S K H I G H E R R I S K I N V E N T O R I E S O F F L A M M A B L E S O X I D A T I O N R E A C T I O N S C O N T I N U O U S O R B A T C H P R O C E S S S I M P L E O R C O M P L E X P R O C E S S E X O T H E R M I C R E A C T I O N S P R E S E N C E O F H Y D R O G E N H I G H T E M P E R A T U R E S & P R E S S U R E S V O L A T I L E H E A V I E R T H A N A I R F L A M M A B L E S ( e g L P G ) H I G H E N E R G Y M A T E R I A L S ( e g O l e f i n s ) S R O T C A F K S I R W O L D N A H G I H Benefits of a Risk Survey Report R O T C A F G N I R E E N I G N E • High & Low Risk Factors Engineering Factor K S I R R E W O L K S I R R E H G I H E D O C N G I S E D D E G D E L W O N K C A R O T C A R T N O C E L B A T U P E R E R U S O P X E L A N R E T X E ) e g a k n a T , s p m u P , s e c a n r u F g e ( T U O Y A L ) e g a k n a T , s r o t c a e R , s e c a n r u F g e ( N O I T A T N E M U R T S N I N O I T A L O S I Y C N E G R E M E G N I F O O R P E R I F N O I T A C I F I S S A L C A E R A s v T N E M P I U Q E L A C I R T C E L E S E I T I L I C A F N O I T C E T O R P / N O I T C E T E D Major Onshore losses in modern history • Flixborough (1974) – 28 killed, 36 injured. – Poor engineering planning. – BIG loss at the time. • Phillips 66, Pasedena Chemical Complex (1989) – 23 killed, 130-300 injured. – Including BI, loss over US$1,000,000,000. • Toulouse Fertiliser Plant (2001) – 29 killed, 700 injured. – Including BI, loss over US$1,000,000,000 All VAPOUR CLOUD EXPLOSIONS Introducing Business Interruption • Losses from physical damage to our property are easy to identify • Consequential financial losses are harder to quantify. • Business Interruption (BI) insurance is one method of protecting the balance sheet from unexpected financial loss. – Phillips, Pasadena explosion • BI insurance is the most flexible of all insurances and is adjustable to suit individual needs • Providing the financial loss results from insured loss or damage to property, the Insured can select any sum of money to be insured under the policy A Rose By Any Other Name…… Like all the best things in life, it has various names: • Business Interruption • Loss of Profits • Loss of Revenue • Loss of Hire • Delay in Start-up • Loss of Production Income Origins of Business Interruption • Loss of Hire was bought by shipowners to maintain their income when their vessels were unable to trade. • Loss of Profits can be traced back to 1797, becoming more widespread in the nineteenth century during the industrial revolution. • In the insurance markets BI insurance has always had an aura of mystique • This is wrong because in fact the Insurers’ end of the contract is simple – it is the Insured’s who has to make all the tough decisions……the type of exposure to insure and what sums to insure Types of Financial Loss That Can Be Insured • Profit • Loan interest and principal repayments • Ongoing standing charges • Contract penalties • Contract fulfilment costs • Demurrage on chartered tankers • Increased Cost of working to reduce loss What To Insure • Indemnity Period • Waiting Period • Direct cause / contingent cause • Customers & Suppliers • Dependency Premises – the value chain Basic Information Requirements • Volume of production and value • Volume of sales and value • Cost to company of production and sales • Estimated period of shut-down • Continuing Costs during shut down • Dependency premises exposure Basic Information Requirements NET PROFIT FIXED COSTS Debt Service Wages Maintenance TURNOVER i.e. sales price VARIABLE COSTS Feedstock Utilities Transport Wages GROSS PROFIT i.e. the bit that could be insured Business Interruption Product For Sale Production Costs Sales Revenue Working Capital Loans for interest Finance Institutions Loan capital for dividends Shareholders Loss of Margin – Financial Consequences • Interruption to the money cycle • Unable to realise cash from the sale of products • Ongoing “standing charges” to be paid from reduced sales revenue • Reduction in working capital • Loss of investment income on capital reserves Long term consequences • Shareholder dissatisfaction • Lender dissatisfaction • Loss of continuity of market • Potential for sale & take-over of the business • Deferral of expansions Benefits of Business Interruption Insurance • • • Protection of the bottom-line budgeted profit • Provide working capital to pay on-going operational costs • Maintain the budgeted return (dividend) to the shareholders Enabling continuity of business planning • Maintenance of reserve for long-term plans/projects • Reduced requirement to obtain injection of loan capital Maintenance of market position • Retaining customer loyalty and market share Insurance Coverage Issues • • • • • • • • Loss and/or damage to assets by an insured event. Differed basis of protection – Revenue, Process fee, Standing charges, Debt servicing or extra expense Coverage to reflect business. Loss limit and sum insured to reflect future business risk. Extensions to third party facilities. Time limitation based on business recovery. Extra expenses based on business recovery. Uninsured waiting period. Coverage Designed to Protect • • • • • • Reduction in profit Revenue required to pay for standing charges and payroll expenses Revenue required to pay for debt servicing costs Business disruption costs – extra expense Cost of acceleration of the repair (expediting expenses) Penalties under contract Business Interruption • Commercial rationale – Damage to our asset or others may interrupt production hence income – Extra Expenses of operating may be incurred to maintain production – BI insurance can provide financial compensation for these costs • Basis of measurement – losses must be capable of quantification by the insured – If no P&L account then no BI cover – Offshore this is an agreed amount = projected production / revenue – “OPEX + Net profit” or in UK “Sales less variable costs” – “variable cost” = one which varies in direct proportion to production Business Interruption • Indemnity period – re-build or repair period 12, 18, 24, 36 months • Deductible (waiting period) – 60 days or more • Cause – Resulting from physical damage to property • Contingent B.I. Extension – suppliers / customers – Partial interruption – Modest take up due to cost, alternate revenue sources Business Interruption - Exclusions • Strikes / workforce • Where there is no damage - latent defect requires repair and field shut down - thus no PD or BI claim • Insolvency of any party • Withdrawl / non-issuance of licence excl PLOD • Under insurance for PLOD Loss of Production Income (LOPI) Coverage Basics • Measure of Recover = Loss of Production x Unit Price • • Follows losses covered by Property or OEE Section Fixed Indemnity – Fixed Declared Volumes – Fixed Unit prices Standard Indemnity Period 180 days Waiting Period 45 / 60 days “Contingent” LOPI sub-limited to $250k unless locations named • • • Loss of Production Income (LOPI) Exclusions • Strikes / Lockouts / Political disturbance / Riots • Following Abandonment of Insured’s Premises • Suspension / lapse of any licence or lease • Fines / Damages • Dishonesty / Fraud • Loss of Market • Drilling Wells unless Specifically agreed • Unnamed “Contingent” locations Questions?