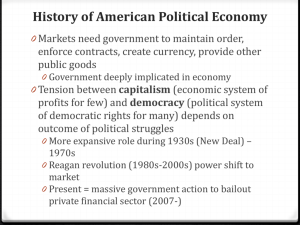

History of American Political Economy

History of American Political Economy

0

0

0

0

Markets need government to maintain order, enforce contracts, create currency, provide other public goods

0

0

Require protective, facilitating political order

“Invisible hand” of market requires “visible hand” of state

While less extensive, government deeply implicated in U.S. economy from start (e.g., commercial code, legal framework, common currency, military and police, roads and bridges, social services, etc.)

In U.S. (and elsewhere), tension between capitalism (economic system of profits for few) and democracy (political system of democratic rights for many) depends on outcome of political struggles

0 In U.S., business successful in limiting government’s ability to influence

0 behavior of private firms, shaping institutions involved in intervention, and influencing policies

Under popular pressure, state policy has sometimes diverged from business interests

Pendulum swings over time

0 More expansive role for government during 1930s (New Deal) – 1970s

0 Reagan revolution (1980s-2000s) power shifted to market forces

0 Present = massive government action to bailout private financial sector

(2007-)

Competitive Capitalism

0

0

0

0

First expansionary phase (starting in 1840s) driven by revolution in transportation (roadways, canals, railroads)

Classic era of competitive capitalism = small firms competed in local markets

0

0

Federal government’s role limited (tariff policy, banking and monetary policy, public land management, collecting taxes, maintaining order)

State governments actively involved in shaping pre-Civil War political economy

0

0

Some built and operated railroads; others invested heavily in private railroads

Regulated railroads through charters, commissions, rates

Downturn (1873) initiated wave of business consolidations and emergence of large corporations seeking to dominate markets

0 Working people forced to accept wages and prices = prompted emergence of organized political movements

0

0

Farmers Alliance and the Grange wanted fairer rates from railroads; joined Populist

Party

Railway workers struck to protest wage cuts, mobilized Great Uprising (1877)

Disparate movements opposed growth or large corporations and dominance of markets at expense of farmers, workers, and consumers

0

0

United with belief in equality, sense that labor created wealth, big business had captured political power, and majority could tame corrupting influence of capital

Left local heritage of radicalism; political program basis of later Progressive reforms; created alternative to dominant culture of competitive individualism

(based on dignity of labor, benefits of rough equality, value of solidarity, virtues of self-sufficiency)

Rise of Corporate Capitalism

0

0

0

Progressive era (1900-1916) marked profound change in American political economy

0

0

Rise of large corporations with power to dominate markets and exploit consumers, farmers, and workers generated demands for government action

Under popular pressure, federal government assumed increasing responsibility for regulating business activity (although limited to preventing unfair business practices)

World War I (1917-1919) government intervention increased substantially

0 Formed tripartite committees (business, labor, and government) to develop policy to coordinate production for war

0 Quickly disbanded at business insistence with end of war

1920s witnessed a boom marked by increasing inequality in income and wealth

0

0

0

0

0

“Roaring Twenties” ended with market crash (1929)

Great Depression produced increasing unemployment, wage cuts, increasing strain on government relief

Depth and persistence of Depression undermined faith in capitalism, business, and government

Demand for large-scale change increased

Farmers struck, workers organized unions and conducted strikes

A New Deal

0

0

0

0

FDR (elected in 1932) promised New Deal = government end depression, provide relief, and manage economy to restore growth

0 With WWII, FDR administration shifted from promoting growth through greater state intervention to increased consumption

New economic paradigm based on Keynesianism = depression caused by inadequate consumer demand

0

0

“Vicious cycle” -- mass unemployment reduced demand for goods

Government could run budget deficit to increase money in circulation and increase demand

0 Government spending in times of slack demand promotes “virtuous cycle” of growth

Business preferred this to more radical proposals (e.g., redistributing power between government and business, structural reforms and government planning)

Welfare state offered citizens protection from swings of business cycle

0

0

0

0

Unemployment insurance, social security created safety net

Labor market regulated to outlaw child labor and impose minimum wage

Labor unions grew increasing worker power relative to management

Federal expenditures increased as did number of federal employees

Conservative New Deal

0

0

0

0

0

0

No push to nationalize basic industries (as occurred throughout

Europe)

Keynes argued full employment necessary to increase aggregate demand

0 Conservatives opposed Truman’s Full Employment Act (1945)

Keynes believed redistribution of income necessary

Welfare spending lower and less redistributive than in Europe

Deficits in U.S. (under Democrats and Republicans) driven by cutting taxes rather than increasing government spending

0

0

Demand stimulated through private consumption rather than promoting public goods

Government spending increases geared toward military rather than welfare state spending

Conservative form of Keynesianism (new economic orthodoxy after war accepted by Democrats and Republicans)

0

0

0

Symbolic commitment to full employment

Economic stimulation through military spending (not redistribution)

Deficit spending through tax cuts not public investment

Rise and Fall of Golden Age

0

0

0

0

Golden age of capitalism (1950s-1970s)

0 Pent-up consumer demand fueled postwar economy

0 Businesses expanded capacity and invested in new plants and equipment

Labor relations improved following 1946 strike wave 0

0

0

Government spending climbed steadily

0 Emergence of U.S. global dominance

Informal national bargain between business and government

Strategic decisions governing American economy would be made by corporate capital

0

0

Government would not intrude on corporate decision making or engage in economic planning

Government would create environment to encourage corporate investment and job creation (by smoothing out business cycle, educating workers, stimulating consumption, funding research, protecting corporate markets and investments abroad)

By 1970s, economy began to experience stagflation (unemployment and inflation simultaneously)

0 Slower productivity growth squeezed profits

0 Workers asked to work more for less

0 Businesses threatened plant closures unless collective bargaining was weakened and engaged in union busting

Conservative Keynesianism collapsed in 1970s

0 Unemployment, inflation, lower productivity growth, rising trade deficits

0

0

0

0

Rise of Extreme Market Capitalism

Extreme market capitalism = markets are rational, self-correcting, and beneficial

0 Prices set by markets reflect actual value of goods and assets (rational)

0 Business cycle tamed, government regulation unnecessary (self-correcting)

0 Leaving markets alone to work their magic good for society (beneficial)

Election of Reagan (1980) = shift from conservative Keynesianism to

Extreme Market Capitalism

0 Prosperity no longer dependent on welfare of workers whose wages propelled aggregate demand

Supply side economics = prosperity depends on welfare of affluent whose savings supplied capital for investment

0

0

0

Economy suffered from insufficient investment capital (not insufficient demand)

Boost investment capital through tax cuts, especially for the rich who are more likely to save and invest (Reagan introduced massive tax cuts; as did Bush)

Tax cuts rewarded the wealthy (Republican base) and bound them to the party; imposed fiscal restraints on government (reduced government revenues and spending)

Republicans adopted policy of deregulation

0 Environmental standards, consumer protections need to be rolled back if business is to be competitive in global marketplace

0 Cut regulatory agencies’ budgets, reduced their effectiveness

Effects of Extreme Market Capitalism

0

0

0

Large budget deficits due not to increased federal spending but tax cuts (declining revenues)

Growing inequality (see Table 3.1)

0 The biggest losers under the democratic party program of conservative Keynesianism had become the biggest winners under the Republican program of extreme market capitalism

0

0

0

Tax cuts for the rich, spending cuts for the poor

Unions were in decline, and wages and living standards for working class people stagnated

Wealth created by increasing productivity captured by corporations in form of increasing profits, not rising wages

Shift in basis of economy from industrial capitalism to finance capitalism

0

0

0

Banks “too big to fail” and politicians reluctant to challenge policy preferences of financial industry

Financial sector has extraordinary influence over policy that creates new profits for banks but increases risk, debt, and instability for economy

Debt-fueled consumption has contributed to rising balance of trade deficits

Crisis of Extreme Market Capitalism

0

0

0

0

The Great Recession (2007-present)

0 Collapse of housing market in 2007, stock market tumble

0 $12 trillion of wealth evaporated

Driven by housing bubble

0

0

Low interest rates set by Federal Reserve Board

Banks gave out loans to generate fees and interest

0

0

0

Lowered lending standards; subprime lending increased dramatically

Banks bundled loans and sold them as securities

Securities bought and sold with AAA ratings

Then the housing bubble burst

0

0

Investors became skeptical of housing values

Prices began to fall, more houses put up for sale, many foreclosed, continue to fall

0

0

Highly leveraged banks had debts far exceeding their assets

Banks were collapsing, and commerce ground to halt

0 Crisis in housing threatened entire economy

Government stepped in to bail out the banks, passed stimulus bill to ward off recession, guarantee loans, reorganize auto industry

A New Foundation (?)

0

0

0

0

0

Extreme market capitalism discredited

0

0

0

Markets do not behave rationally (subject to emotion and unwarranted outbreaks of confidence leading to speculative bubbles)

Markets are not self-correcting (government regulation necessary to prevent firms from acting badly and in ways safe for them and the public)

Leaving decisions to market does not always lead to best results for society

0 Contributes to instability and inequality

0

0

Volatility creates insecurity and demoralizes people’s ability to plan

Inequality undermines social cohesion and corrupts democracy

President Obama (2008- ), rescued failing banks but minimized government influence

0 Banks have increased checking account charges and credit card fees; continue to lavishly compensate executives; little difference between Fed’s efforts to stabilize financial system and interests of banks

Regulatory proposals weak

0

0

0

Have not broken up banks “too big to fail”; now bigger than before

Have not regulated derivatives market

Have not protected taxpayers from excessive risk taking

Aggressive fiscal policy

0

0

0

Using federal budget to stimulate economy; deficit spending

Federal spending increased toward economic recovery (stimulus, jobs bill), social welfare programs, and defense

Unclear whether government will be used to restore and stabilize economy or push beyond to include a “social democratic surplus” that redistributes power and rewards to those at the bottom

Depends on political struggle: politics of power will determine who benefits and where new frontier of public power of government and private power of capital is set