History of APE chapter 3 brief

advertisement

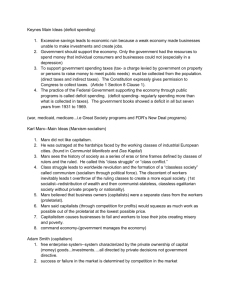

History of American Political Economy 0 Markets need government to maintain order, enforce contracts, create currency, provide other public goods 0 Government deeply implicated in economy 0 Tension between capitalism (economic system of profits for few) and democracy (political system of democratic rights for many) depends on outcome of political struggles 0 More expansive role during 1930s (New Deal) – 1970s 0 Reagan revolution (1980s-2000s) power shift to market 0 Present = massive government action to bailout private financial sector (2007-) Competitive Capitalism 0 Expansionary phase (1840s) revolution in transportation (roadways, canals, railroads) 0 Era of competitive capitalism = small firms competed in local markets 0 Federal government’s role limited; state governments more active 0 Downturn (1870s) initiated emergence of large corporations and organized political movements (e.g., farmers, workers) opposed to market dominance by corporations 0 Believed in equality; labor created wealth; big business captured political power; majority could tame corrupting influence of capital 0 Radicalism basis of later Progressive reforms Rise of Corporate Capitalism 0 Progressive era (1900-1916) marked profound change 0 Rise of large corporations demands for government action 0 Federal government assumed increasing responsibility for regulating business activity 0 World War I (1917-1919) government intervention 0 Tripartite committees (business, labor, and government) coordinated production; disbanded at business insistence 0 Boom (1920s) marked by increasing inequality 0 “Roaring Twenties” ended with market crash (1929) 0 Great Depression increasing unemployment, wage cuts, strain on government relief; undermined faith in capitalism, business, and government; demands for change A New Deal 0 FDR (1932) promised New Deal = end depression, provide relief, manage economy/restore growth 0 Keynesianism = depression caused by inadequate consumer demand 0 Government should run budget deficits to increase money in circulation and increase demand 0 Preferred by business to more radical proposals 0 Welfare state offers citizens protection from swings of business cycle 0 Unemployment insurance, social security creates safety net 0 Labor market regulated to outlaw child labor, impose minimum wage 0 Labor unions grew increasing worker power relative to management 0 Federal expenditures and number of federal employees increased Conservative New Deal 0 No push to nationalize industries 0 (Keynes) Full employment necessary to increase demand 0 Conservatives opposed Truman’s Full Employment Act (1945) 0 (Keynes) Redistribution of income necessary 0 Welfare spending lower, less redistributive 0 Deficits driven by cutting taxes rather than increasing government spending 0 Demand stimulated through private consumption rather than promoting public goods 0 Government spending increases geared toward military rather than welfare state spending 0 Conservative Keynesianism 0 Symbolic commitment to full employment 0 Economic stimulation through military spending (not redistribution) 0 Deficit spending through tax cuts not public investment Rise and Fall of Golden Age 0 Golden Age of Capitalism (1950s-1970s) 0 Consumer demand soared; businesses expanded; labor relations improved; government spending climbed; emergence of global dominance 0 Bargain between business and government strategic decisions left to corporate capital; government encourage corporate investment and job creation 0 (1970s) Stagflation (unemployment and inflation) 0 Slower productivity growth squeezed profits 0 Workers asked to work more for less 0 Businesses engaged in union busting 0 Conservative Keynesianism collapsed (1970s) 0 Unemployment, inflation, lower productivity growth, rising trade deficits Rise of Extreme Market Capitalism 0 Extreme market capitalism = markets rational, self- correcting, beneficial 0 Reagan (1980) = Conservative Keynesianism Extreme Market Capitalism 0 Prosperity no longer dependent on welfare of workers whose wages drove demand 0 Supply side economics = prosperity depends on welfare of affluent whose savings supply capital for investment 0 Insufficient investment capital (not insufficient demand) 0 Boost investment capital through tax cuts, especially for rich 0 Tax cuts reward wealthy, bind them to the party; impose fiscal restraint on government 0 Policy of Deregulation 0 Environmental standards, consumer protections rolled back in name of global competitiveness 0 Cut regulatory agencies’ budgets, reduce effectiveness Effects of Extreme Market Capitalism 0 Large budget deficits due to tax cuts 0 Growing inequality (see Table 3.1) 0 Biggest losers under Conservative Keynesianism biggest winners under Republican Extreme Market Capitalism 0 Tax cuts for rich, spending cuts for poor 0 Unions in decline, wages/living standards for working class stagnated 0 Wealth created by increasing productivity captured by corporations in form of increasing profits, not rising wages 0 Shift from industrial capitalism to finance capitalism 0 Banks “too big to fail,” politicians reluctant to challenge financial industry 0 Financial sector = influence over policy creating new profits for banks but increasing risk, debt, and instability 0 Debt-fueled consumption contributes to trade deficits Crisis of Extreme Market Capitalism 0 Great Recession (2007-present) 0 Driven by Housing Bubble 0 Low interest rates set by Federal Reserve Board 0 Banks gave out loans to generate fees and interest 0 Lowered lending standards; subprime lending increased 0 Banks bundled loans and sold them as securities 0 Securities bought and sold with AAA ratings 0 Housing bubble burst 0 Investors became skeptical of housing values 0 Prices began to fall, more houses put up for sale, many foreclosed 0 Highly leveraged banks with debts exceeding assets 0 Banks collapsing, commerce ground to halt 0 Crisis in housing threatened entire economy 0 Government stepped in to bail out banks; passed stimulus bill to ward off recession, guarantee loans, reorganize auto industry A New Foundation (?) 0 Extreme market capitalism discredited 0 Markets not rational, self-correcting, nor beneficial 0 President Obama (2008- ), rescued failing banks but minimized government influence 0 Regulatory proposals weak 0 Banks “too big to fail” not broken up; derivatives go unregulated; taxpayers not protected from excessive risk taking 0 Aggressive fiscal policy 0 Used federal budget to stimulate economy; deficit spending 0 Federal spending increased toward economic recovery (stimulus, jobs bill), social welfare programs, and defense 0 Unclear whether government will be used to restore and stabilize economy or push beyond to include “social democratic surplus” that redistributes power and rewards to those at the bottom 0 Depends on political struggle: politics of power will determine who benefits and where new frontier of public power of government and private power of capital is set