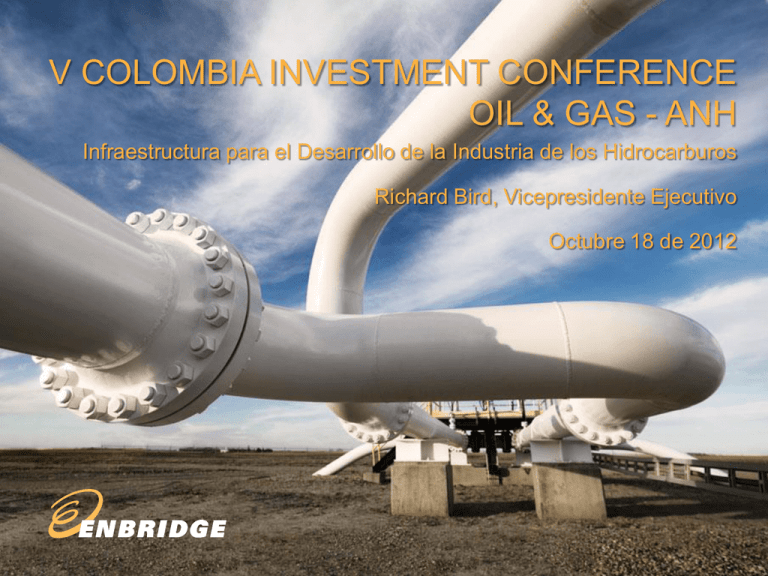

Enbridge - Inicio - VI Colombia Oil and Gas Investment Conference

advertisement

V COLOMBIA INVESTMENT CONFERENCE OIL & GAS - ANH Infraestructura para el Desarrollo de la Industria de los Hidrocarburos Richard Bird, Vicepresidente Ejecutivo Octubre 18 de 2012 Enbridge Assets: $43 billion Net Income: $1.3 billion Employees: 10,100 Core Business Segments Norman Wells Zama Fort McMurray Edmonton Hardisty Quebec City Clearbrook Montreal Superior Portland Toronto Casper Chicago Salt Lake City Patoka 2011 Adjusted Earnings Toronto Cushing 2011 Adjusted Earnings 15% 16% 63% 65% Houston Liquids Pipelines Gas Distribution Edmonton Fort St. John Wind Power Generation Solar Power Generation Waste Heat Recovery Geothermal Power Generation Power Transmission Edmonton Toronto Sarnia Chicago 2011 Adjusted Earnings 3% 2011 Adjusted Earnings 19% Houston Gas Pipelines 17% Renewable Energy 3 Priority One – Operational Excellence Pipeline Integrity – 4th-Generation medical imaging crack detection technology Pipeline Control – State-of-the-art automated proprietary systems GE UltraScanTM Duo with Phased Array Ultrasound Priority One – Operational Excellence Leak Detection – Advanced technology – Negative Wave – Acoustic – Temperature Sensing – Vapour Detection Hydraulic Optimization – Operating pressure – Drag reducing agent – Diluent – Pump design Multipath Ultrasonic Flow Meter Priority Two – Project Execution Capability Cost/Schedule Management – State-of-the-art estimating, monitoring and remediation processes Materials/Services Procurement – Global sourcing capability supporting $35 billion, five-year construction program Deep Technical/Executive Leadership Experience – Major Projects Management department of 1,150 executed $11 billion 2009 – 2011 program Project Status 15 8 1 1 Better than Budget & On-Time 2 On Budget & On-Time 3 Over Budget & Delayed 6 Priority Three – Environmental Sustainability Neutral Footprint Policy – Acquisition and set aside of natural habitat acreage equivalent to area of right of way disturbance Renewable Energy Development – 1,000 megawatts of wind and solar power; technology development investment Greenhouse Gases – 21% reduction from 1990 to 2010 Energy 4 Everyone Foundation – Ghana, Africa Enbridge International Focus Energy Infrastructure – Crude Oil Focus Regions/Countries – Refined Products Latin America Asia Pacific – Natural Gas Pipeline and Storage Facilities • Colombia • Australia • Peru Country Criteria – Stable sociopolitical environment – Favourable fiscal, legal and regulatory climate – Strong energy supply fundamentals 9 Colombia Investment Climate Colombia Crude Oil Market Balance (kb/d) 1,600 Supportive economic/regulatory and royalty structure 1,400 1,200 1,000 800 600 400 200 2010 2011e 2012f 2013f 2014f 2015f 2016f 2017f 2018f Production Consumption Exports Source: Business Monitor International Asian Demand Growth (Quadrillion BTU) 350 300 250 200 150 100 50 OECD Asia China India 2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 0 2013 Asian demand growth 2009 2012 Transportation constraints 0 2011 Crude production growth; increasing heavy slate Other Non-OECD Asia Source: EIA 10 Oleoducto al Pacífico (OAP) Buenaventura CPO 9 CPE 6 Tumaco OMBU 11 OAP Attributes An independently-operated Colombian solution to crude transport constraints Flexibility to serve large and small producers Improved netbacks for producers facing high costs and limited transport options Separation of capital investment requirements from shipping contracts Benefits to the national interest, stimulating the upstream sector and economy as a whole US$ millions Direct access to alternative / high growth Pacific markets Significant Potential Savings US$500 mm per year Lower cost 600 to transport diluent, if a 500 91 return diluent line 400 300 282 Lower costs related to lower diluent requirements 200 100 0 165 Lower estimated transportatio n cost 12 Main Benefits for Colombia Reduce reliance on one port Diversify markets Higher netbacks on its royalty oil Increased income for municipalities Supporting infrastructure development for undeveloped regions Opportunity for the government to consolidate governability in difficult access areas. 13 Key Conclusions • Changing crude oil fundamentals • Unique opportunity for Colombia • OAP is a viable project with many benefits to the country and to producers • Government support is key 14