File - Aberdeen University Trading & Investment Society

advertisement

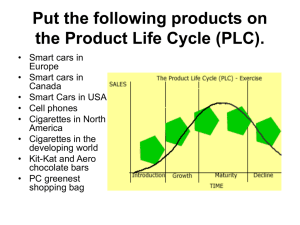

Aberdeen University Trading and Investment Society Energy Sector Overview 30/10/13 Structure • Energy Sector Overview • • • • Subsectors Growth Analysis Recommended Stocks (SWOT Analysis) • • • Cairn Energy PLC (CNE) - Andrew Douglas IGAS Energy PLC (IGAS) - Ally Dickson Circle Oil PLC (COP) - Alex Nargol Subsectors • The 6 constituents of the energy sector • Renewable Energy Equipment •Oil Equipment & Services •Alternative Fuels •Exploration & Production •Pipelines •Integrated Oil & Gas • The rise of renewables • Forward Thinking Industry 1 Year Change Market Cap (USD) Renewable Energy Equipment +131.39% 6.0bn Oil Equipment & Services +22.48% 711.0bn Alternative Fuels +39.01% 85.8bn Exploration & Production +29.46% 1.6tn Pipelines +4.68% 464.0bn Integrated Oil & Gas +2.25% 2.7tn Growth • Energy is fundamental global growth – • Emerging Markets • Which type of energy? Analysis Unique reasons for price movements: • Price of oil - OPEC • Government ‘responsibility’ - Green commitments • Political instability – Syria, Libya, Egypt etc.. •Geological risk - Antarctic drilling •Disappointing reserves - High start up costs Stock Recommendation (SWOT) Andrew Douglas Stock recommendation: Cairn Energy PLC (CNE) Cairn Energy PLC is one of Europe’s leading independent oil and gas companies. Their headquarters are located in Edinburgh and are a constituent of the FTSE 250 on the London Stock Exchange. •Operations •UK & Norway •Atlantic •Mediterranean • Strengths • • • • • • Weaknesses • • • Slowdown in economic growth Political and policy uncertainty Opportunities • • • 20 Year Track Record Strong Cash Flow – UK & Norway Asset Value vs. Market Cap – $4,018.0m (June 2013) vs. $1,690.9m (October 2013) Risk Adverse Exploration Profile - Different regions, more opportunity 18 month exploration period – Greenland, Morocco, Senegal, Ireland and Spain Rise of emerging markets – Push energy demand for years to come Threats • • Miss drilling expectations Europe instability Stock Recommendation (SWOT) Ally Dickson • Stock Recommendation – IGas Energy plc • IGas Energy is a leading British oil and gas explorer and developer, producing approximately 3,000 barrels of oil and gas a day from over 100 sites across the country, with significant potential yet to be delivered from our assets. • It is engaged in both unconventional and conventional hydrocarbons on-shore in Britain. In the North West and Staffordshire it has more than 500,000 acres under license. • Largest publicly owned onshore oil and gas company in the UK = SHALE GAS. • Strengths: • Licences for nearly all of UK onshore areas; • Drilling appraisal wells in Staffordshire Q4 2013 – with an expected result of between 20tcf – 170tcf of natural gas. The lowest estimate could power the UK for 6 years; and • Downside protection – 3000boe per day (revenues of £68.3m). • Weaknesses: • No ‘fracking’ licences yet – but applying after appraisal; and • Debt – up front costs of o+g exploration ca. £200m. • Opportunities: • Licencee for a large chunk of the UK’s shale gas (see USA); • UK Energy independence (see Grangemouth fiasco); and • Government cooperation and accommodation (tax rates <32% from 81%); • Threats: • Greenpeace and other environmental campaigns – amelioration; • Dry Wells; and • Natural Gas pricing.