Bank of America`s Debit Card Fees

advertisement

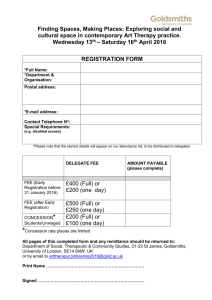

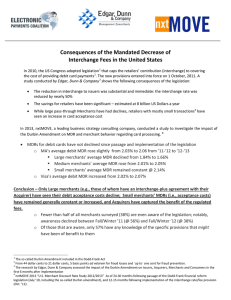

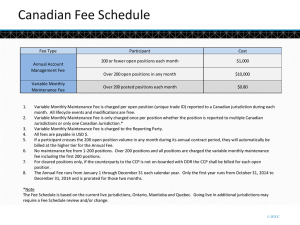

Bank of America’s Debit Card Fees: Consumer Perception vs. Corporate Strategy Overview Introduction & Problem Statement Background – Review of Financial Crisis – Impact of Dodd-Frank – Bank of America – Public Protests Decision Point & Discussion 2 B of A’s Decision Action Bank of America (BOA) decided to implement a $5 per month fee for its debit card users Environment The external environment sector remained turbulent 2007 Housing Collapse & Foreclosure Epidemic 2008 Financial Crisis Toxic Asset Relief Program (TARP) Occupy Wall Street Protests Reaction The public reacted with boycotts, protests, and online petitions (which went viral) What should BoA do? Proceed as planned and face a public relations nightmare or cancel the fee program, lose billions, and be forced to answer to shareholders? 3 History of Bank of America Started in 1904 as Bank of Italy before merging with Bank of America in 1928, adopting name Provides service across: – 50 states – 40 countries – 5,700 retail branches Maintains 57 million consumer and business relationships 4 Brian Moynihan, Bank of America CEO • CEO since January 2010 • Earned J.D. from the University of Notre Dame • Joined B of A in 2004, through the acquisition of Fleet Boston • Career banker Evolution of the Financial Industry Multi-decade era of deregulating the financial sector Changing legislation lead to rapid growth, but also increased exposure Banks became over-levered and vulnerable to the financial crisis of 2008 5 Notable Policy Decisions/Legislation 1980 Depository Institutions Deregulation and Monetary Control Act. 1982 Garn–St. Germain Depository Institutions Act of 1982 1999 Gramm-Leach-Bliley Financial Services Modernization Act 2000 No regulations on OTC Derivatives 2000s No regulations on Hedge Funds 2010 Dodd–Frank Wall Street Reform and Consumer Protection Act Consolidation of Financial Institutions 6 Volatility of Financial Institutions Symbol 1995 Price 2005 Price % Change Bank of America $11.97 $46.99 285.77% Citi $58.33 $481.80 746.09% JP Morgan $12.97 $39.01 208.19% Wells Fargo $5.87 $31.00 434.80% Symbol 2005 Price 2009 Price % Change Bank of America $46.99 $14.33 (67.96%) Citi $481.80 $71.40 (85.32%) JP Morgan $39.01 $31.35 (18.36%) Wells Fargo $31.00 $30.00 (3.49%) 7 Response from Legislators In response to the 2008 financial crisis, Congress passed new legislation to “re-regulate” Wall Street (Dodd-Frank) Included in this legislation was an amendment from Senator Dick Durbin, IL – Limited anti-competitive practices from commercial banks – Provided Federal Reserve the power to regulate debit card interchange fees 8 Senator Durbin Transaction Fee Background 9 Interchange Fee Market The introduction of the Durbin Amendment: – Reduced debit transaction fees banks could charge merchants by 50 percent ($0.44 $0.22) Volume of Debit Transactions per Year Pre-Durbin Fee per Transaction Debit Fee Revenue 38.5 billion $0.44 $16 billion Post-Durbin 38.5 billion $0.22 $8 billion – Eliminated $8b worth of revenue for banking industry (50% of total market) 10 Financial Impact to B of A In 2010, 53% of B of A’s revenue came from fee-based sources – Fee-based revenue: $58.7B – Interest-based revenue: $52.7B Enactment of the Durbin Amendment significantly reduced a reliable source of revenue; transaction fees $1.9B in fees 3.65% Noninterest income 11 1.67% of Total Revenue Shaken Consumer Confidence B of A’s decision to implement its new fee came during a time of financial distress and uncertainty – – – – – 3.9 million home foreclosures Recession; Effects of Financial Crisis Tax-payer funded bailouts Perception of executive greed Nationwide protests These variables created apprehension toward the financial industry 12 2011 Timeline of Events 9/17 9/27 10/1 10/3 13 10/5 10/8 10/15 10/28 10/29 10/29 Recap “Era of Deregulation” Banks seek opportunities to recover lost revenues Implementation of Dodd-Frank Act and Durbin Amendment 14 BoA proposal of $5 debit usage fee Case Questions What should BoA do? Proceed as planned and face a public relations nightmare or cancel the fee program, lose billions, and be forced to answer to shareholders? What was the most significant issue for Bank of America in this case? What was the root cause of public outcry? (Timing, Substance, Insensitivity) Did Bank of America conduct enough market research prior to proposing the new $5 debit card fee? 15