PowerPoint-Präsentation - Emerging Energy & Environment

advertisement

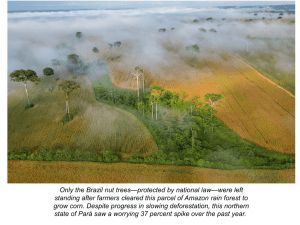

Investigating Energy Auctions December 5, 2012 By: John Paul Moscarella Emerging Energy & Environment, LLC 1 WHO WE ARE • Fund Management Company that manages two specialized and regional Private Equity Funds. • Region: Latin America mainly Mexico, Peru and Brazil, in the future, Chile, Colombia and Central America • Focused on Renewable Energy and Energy Efficiency infrastructure EMERGING ENERGY & ENVIRONMENT 2 WHO WE ARE: FUNDS UNDER MANAGEMENT • Emerging Energy Latin America Fund II, L.P. Primarily Renewable Energy and Energy Efficiency Infrastructure. Recent first closing • CleanTech Fund, L.P. Primarily energy efficiency, renewable energy, clean technologies, sustainable transportation Totally invested. Now divesting: - 3 Mini hydros - Efficient CNG - Efficient Corn processing - Hybrid Vehicles - Biogas EMERGING ENERGY & ENVIRONMENT 3 MARKET SUMMARY Market Growth Potential Hydropower Most countries in the region already use a good portion of their hydropower potential to generate electricity. Traditionally these projects have been developed with larger dam operations, seeking the economies of scale characteristic of large hydroelectric technologies. This practice has left a large portion of the small hydroelectric potential yet to be exploited. Given the high rainfall indices and the topography of many countries, small hydropower offers an attractive alternative to supply electricity, especially in remote sites. Solar Energy Solar energy is more evenly distributed, as good portions of the region lie within the Sun Belt Region of highest solar radiation. Thus solar energy is a predictable and reliable resource, capable of being transformed to heat and electricity by means of several commercially viable technologies in different stages of development. Wind Power The force of winds can be used to produce mechanical power and electricity by means of commercially available and costcompetitive technologies. Southeast Mexico, most Central American and Caribbean countries, as well as Northeast Brazil are attractive wind regimes due to the prevailing Trade Winds. Wind regimes can also be found in the southern hemisphere. When properly located and sized, wind has proven to be a reliable energy resource. The region’s governments are highly aware of this clean and efficient power source and will continue to stimulate its rapid expansion. EMERGING ENERGY LATIN AMERICA FUND II CONFIDENTIAL – FOR PROFESSIONAL INVESTORS ONLY 4 INVESTMENT STRATEGY AND SECTOR FOCUS PRIMARY COUNTRY/REGIONAL FOCUS INVESTMENT TYPE Infrastructure-orientation Asset-centric Expansion and growth Brazil Colombia Mexico Peru Chile Central America INVESTMENT SECTORS Renewable Energy Small Scale Hydro (up to 30 MW) Wind Solar EMERGING ENERGY LATIN AMERICA FUND II Energy Services Energy Services Companies Industrial Co-Generation Renewable Energy Distribution Renewable Energy Logistical Infrastructure CONFIDENTIAL – FOR PROFESSIONAL INVESTORS ONLY 5 INVESTMENT STRATEGY AND SECTOR FOCUS Portfolio Breakdown by Sector - Renewable Energy Infrastructure 80% - Energy Services Companies 20% Strategies: - Portfolio Companies with - Scalable and proven business and technology models Portfolio Diversification - Geography: <40% of the fund’s assets will be invested in one single country - Assets: <15% of the fund’s assets in a single investment EMERGING ENERGY LATIN AMERICA FUND II - Stable cash flow and resistance to macroeconomic fluctuations - Long term off take contracts with anchor end-users - Partnership with local management teams with proven development expertise and operational track records - Clustering companies into attractive portfolio acquisition targets - Lead investor role with extensive control over and influence on the operational management of portfolio companies CONFIDENTIAL – FOR PROFESSIONAL INVESTORS ONLY 6 INVESTMENT STRATEGY AND SECTOR FOCUS - TYPE OF ASSETS Fund II will principally invest in three types of assets: "Late stage" investments, with no early stage development risk, with construction risk, subject to completion of one or more of the following: Resource identification and measurement Basic engineering and design, construction budget reviewed and approved by third party Site control and access to transmission Key environmental permits and approvals, and execution contracts Anchor revenue contracts Project financing "highly likely" or in place Operating or brownfield assets: Assets with established operating profiles with potential for expansion ("low cost or free growth option") Early stage assets: Strong pre-feasibility analysis Attractive resource, favorable regulation, and strong economic outlook Key contracts or permits still need to be obtained EMERGING ENERGY LATIN AMERICA FUND II CONFIDENTIAL – FOR PROFESSIONAL INVESTORS ONLY 7 INVESTMENT STRATEGY AND SECTOR FOCUS - AGGREGATION EEE believes that there is an outstanding opportunity to aggregate smaller renewable energy projects, which benefit from portfolio efficiencies in financing, implementation and operation Improvements in technology and economics, combined with the existence of strong resource base (hydro, solar, wind) have made smaller projects economic and attractive The smaller projects, individually with enterprise value between $5-50 mm, is an overlooked and capital-constrained niche in the market EEE will pursue a country-specific or a regional approach in the implementation of its roll-up strategy EMERGING ENERGY LATIN AMERICA FUND II CONFIDENTIAL – FOR PROFESSIONAL INVESTORS ONLY 8 INVESTMENT STRATEGY AND SECTOR FOCUS - AGGREGATION Country-specific portfolios - key issues Lack of asset and geographic diversification Country risk concentration Resource risk diversity Asset financing - single asset vs. portfolio - lender appetite may vary Sector and electricity price outlook Regulatory and institutional issues Exit prospects Regional portfolios - key issues Portfolio diversification based on country, regulatory regime, hydrology variation, asset-type, assetstage Geographic composition of the portfolio - initial focus will be on countries with well-mitigated country and regulatory profiles favorable to small hydro, as well as investment grade sovereign ratings Regional approach to financing is new but lender feedback is encouraging Target focus - Peru, Mexico, Brazil, Chile, Central America, Colombia EMERGING ENERGY LATIN AMERICA FUND II CONFIDENTIAL – FOR PROFESSIONAL INVESTORS ONLY 9 PIPELINE - TARGETED SECTORS AND DRIVERS FOR FUND II DEALFLOW SMALL HYDRO POWER (SHP) KEY DRIVERS Untapped existing river flows with established hydrological patterns Modest capital cost due to lack of reservoirs Low environmental impacts compared to large hydros Relatively high capacity factors (>70% vs. 25% solar vs. 35% wind) Supportive regulation that subsidizes O&M cost and taxes KEY MARKETS Peru, Brazil, Chile, Mexico, Colombia and Central America are strong markets based on current EEE deal flow Total installed small and mini hydro capacity is still much lower compared to potential capacity based on untapped areas – current estimated resource is 2.8x total generating capacity, higher in some other markets SHP & SHP + Large Hydro: Peru – 3 GW (installed) vs. 58 GW (currently estimated feasible potential) Brazil – 3 GW vs. 15 GW Mexico – 210 MW vs. 3.3 GW Chile – 200 MW vs. 10 GW Central America - 4 GW vs. 11 GW (SHP + large hydro) Colombia –8.5 GW vs. x 48 (SHP + large hydro) EMERGING ENERGY LATIN AMERICA FUND II CONFIDENTIAL – FOR PROFESSIONAL INVESTORS ONLY 10 EELAF II, L.P. PIPELINE OVERVIEW Current Fund II active pipeline: Over 35 deals representing over US$2.7 billion of investment potential. Over US$2.2 billion of the pipeline represents wind, solar, and small hydro renewable energy infrastructure. BIOMASS, 8% RECYCLING, 3% CT INFRA, 8% SOLAR, 14% Central America, 13% SMALL HYDRO, 26% COGEN, 5% Uruguay, 4% Peru, 11% Brazil, 21% Chile, 9% WIND, 32% Mexico, 43% BIOGAS, 3% EMERGING ENERGY & ENVIRONMENT 11 Auctions: here to stay? Source: Energy contracting in Brazil and electricity prices, Hermes de Arauju (Dir. General, CEPEL) et al, Brazil, 2007 12 Brazil: Auctions as a policy response to 1990s privatization and energy reforms Brazil Auctions Structure After 1990s privatization and energy reforms, generation was mainly owned by public utilities (mostly government owned), while distribution was mostly owned by private utilities: Issue was how to encourage investment and signal pricing which would compensate sellers and not adversely affect consumers Original wholesale market (“MAE” in Portuguese) design showed significant flaws, including ownership thus new wholesale market operator (“CCEE” in Portuguese) was created as a non-profit owned by market players CCEE became the clearing house for all contracts, and auctions law was passed in 2004 TRANSPARENCY Auctions for “Existing” energy started in 2005, and for “New” energy in 2006 (typically large hydro, A-5 auctions, and thermal, A-3 auctions) gave the market pricing for new generation To stimulate renewable energy, government passed law in 2008 for Small Hydro (< 30 MW), wind, solar and biomas First auction in 2009 13 Brazil: (cont.) ACR and ACL markets created ACR is the regulated market for contracts wherein all the PPAs are effectively signed with all the distribution companies via the CCEE, typically tend to be more competitive leading to lower prices but strong “offtaker” enhances creditworthiness and PPA is more “bankable” ACL are freely negotiated bilateral contracts between a generator and a free customer Since 2008 law, Energia Incentivada auctions have been held in 2009: 1.8 GW of Wind projects awarded 2010: over 2 GW of Wind projects awarded 2011: 1.9 GW of wind projects awarded Pricing has come down every year from R$140/MWh to just over R$100/MWh Reflects the fact that most sellers are either large public utilities or new renewable energy players looking to “get into” the market Reserve auctions are also employed to contract renewable only Since 2005, over 31 GW have been awarded, US$300 billion in contracts About 40% is large hydro, and 20% is renewables 14 Auction features Technical requirements Long list of requirements, i.e. Prior environmental license Financing capability Specific offers: In the case of wind for example, prices tend to converge to PROINFA (“feed-in tariff” like) Complex mechanisms to compensate for non-delivery Auction committee: Several government agencies Define the process Set caps (if any) Coordination with transmission planning 15 Brazil: Small hydro recent developments SHP: Installed Capacity 3,500 3,066 3,000 2,700 2,500 • • • 2,237 2,000 • 1,500 1,000 500 450 0 1998 2008 2009 2011E • Source: CCEE Annual reports • 2010: 7 projects awarded (131 MW) 2011: 41 projects registered (725 MW), but less than that awarded 2011: 4 projects totaling 318 MW received awards 2012: Few SHP projects are expected to be bid in the auctions going forward (Dec. 2012), some are same as 2011 projects Have the Brazil auctions have become “too competitive” for acceptable rates of return to SHP projects? Is there competition with wind that hampers SHP development? 16 Peru: A market that is growing 2009: Similar to Brazil, Peru enacted the “Ley de Recursos Energeticos Renovables” RER auctions SHP is defined as < 20 MW 2010 – First 2 auctions held yielding the following results: First round 17 Projects = 161 MW Price range US$55-74/MWh Second Round 1 project = 19 MW Price = US$64/MWh 2011 – Second auction 7 projects = 102 MW Price range = US$ 47- 55 MWh 2012 – No auction yet, RER expected in 2013 Likely pricing range ~ US$55/MWh 17 Comp: Brazil wind auctions Fuente: Impsa Source: IMPSA, Argentina, 2012 18 Comps: Wind price Latin America Fuente Impsa, Mendoza, Argentina 19 Other markets: Uruguay, Chile, Mexico Uruguay: Started with wind auctions in 2010 and has had three rounds so far, up 450 MW awarded in feb 2012, at US$63.50/Mwh Unclear whether SHP will be included in new rules Mexico Self-generation market has proven slow to deploy SHP (circa 200-300 MW) over last 10 years for SHP Widely expected Small Producer (< 30 MW) auctions to the federal utility to start in 2013, marginal cost pricing for utility Chile ERNC law since 2010 has led to few SHP projects, < 10 MW is dispatched first Ministry is reviewing auction models, expect to launch, but unclear about the timing Auctions are becoming increasingly used as a policy tool to encourage investment and keep prices for SHP and other renewables competitive. 20 PPAs: Peru RER Example Main Features of Peru RER Counterparty = Ministry of Mines and Energy Payment terms – via the COES, wholesale market operator, for wholesale market prices and OSINERGMIN pays the differences to the generator (“contract for differences”) Term = 20 years Indexation = US CPI index Bidders: Firm energy amount – calculated as a % of the installed capacity Correction factor – one time correction of firm energy factor, if 4 periods are < 85% of the firm energy Price = US$/MWh (blended cap + energy payment) Penalties for non delivery based on firm energy start to accrue unless force majeure applies Contract allows bidder to pledge revenues based on PPA to secure project financing, highly bankable Overage energy delivered paid premium based on “prima” 21 Some conclusions Not all auctions are created equal Overall, success of auctions in Brazil has led to billions of investment into new SHP projects Similarly, Peru has achieved circa 300 MW of new SHP investment in past few years But, prices are tending to become less and less attractive for investors Conditions for developers are increasingly onerous Overall, as a policy mechanism to encourage investment in renewables and SHP in particular it shows it can work but continual monitoring and different market conditions may hamper the future If a significant share of wind capacity awarded in recent auctions fails to be commissioned for example RETHINKING 22