microfinance

advertisement

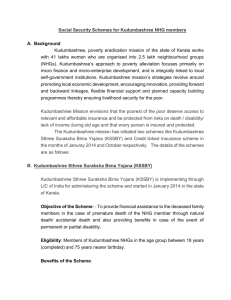

Empowerment of Women through Microcredit Concepts and Case Studies Aparna Krishnan Roadmap The microcredit concept Empowerment of women through microcredit Grameen Bank – A well-known example Origins How it works Kudumbasree – Focus on an effort closer to home How it works Analysis & suggestions for improvement Empowering Women through Microcredit - Concept The Microcredit Concept One form of microfinance, along with microinsurance, microsavings etc. Extension of microloans to poor people viewed as not bankable No collateral, steady employment, credit history or education Helps poor people engage in self-employment & generate income Allows poor people to help themselves through self-help groups Why care about microcredit? Originated in developing countries and shown to work • Repayment rate is often higher than with traditional banking Goals go beyond those of traditional banking • Helps raise living standards, enhance the status of women Better than handing out charity • Gives the poor a say in their own destinies, and returns self-confidence • Provides greater incentive to employ the money for generating income • Poor countries are no longer prisoners of foreign aid Advances socio-economic development, democracy and human rights UN declared 2005 as International Year of Microcredit Case Study-1: Grameen Bank Origins Founded by Dr. Mohammed Yunus in 1976 in Jobra village in Bangladesh Began with lending $27 to 42 families Were forced to borrow under oppressive terms (dadan system) Considered non-creditworthy by traditional banks $300 capital secured from Janata Bank with Dr. Yunus as guarantor Why Lend to Women? 97% of Grameen Bank’s borrowers are women Benefits reach the family more directly Women are often the worst affected by poverty – they are left totally insecure and have few opportunities Dr. Yunus: “When a destitute mother starts making some income, her dreams invariably center around her children ” Have more at stake, and given the smallest opportunity are willing to work extra hard Adapt quicker to self-help groups Boosts self-confidence of women Gender equality key to socio-economic development Higher repayment rates than loans to men Challenges with lending to women Hard to reach women overcoming societal barriers like purdah system Handle conflict within the family when the woman is designated to hold purse-strings Support system to help women How Grameen Bank Works - I 5 member groups Group fund for emergencies Grameen Bank •No offices •Trained women bank workers who live with the poor Repayment •One year loans •Equal weekly installments •Repayment starts 1 week after loan •Grameen is not just a lender – Sixteen Decisions make it a close partner in improving the living standards of the poor Centers made of upto 8 groups •Relationship built on trust - 99% repayment rate •90% owned by borrowers •Organizes workshops •Established Sixteen Decisions as guidelines to give meaning to lives of borrowers Analysis of Grameen Achievements 99% repayment rate Improved status of oppressed women in Bangladesh Helped in economic development of small villages Reached out idea of microcredit to other countries as well. E.g.: Kashf in Pakistan Issues / Continuing problems Changing the mind-set of people in villages High interest rates for microloans. Ineffective measures to tackle problems of interest rate. E.g.: rate ceiling Case Study-2: Kudumbashree KUDUMBASHREE- Quick Facts A multifaceted women based poverty reduction programme Jointly initiated by Government of Kerala and NABARD. Scaled up from two UNICEF assisted initiatives in Alappuzha Municipality (UBSP) and Malappuram district (CBNP) Implemented by Community Based Organizations(CBOs) of Poor women in cooperation with LSG Institutions How Kudumbashree Works- II Identification of beneficiaries Pooling like-minded individuals into selfhelp groups, thus giving it a community based organization (CBO) Neighborhood groups (NHG) - One woman each from 15 – 40 families at risk Area Development Society (ADS)- Federation of all NHGs in a ward Community Development Society (CDS)- The Apex body at the Local Body Level ADS NHG ADS NHG CDS How Kudumbashree Works (cont’d) Initially, groups collect money for use by needy member and maintain finances. This process assessed by bank. Bank account created for future loans and savings. (Microloans) Repayment within stipulated time Special vocational training administered. Microenterprise set up Development: Gender empowerment, improved standard of living Stairway to success Women Empowerment Group action to access services, resources and against social evils Micro-enterprises Resource assessment-prioritization of needsImplementation of action plan Problem Identification, need Assessment-Micro-plan Day-to-day management and financial management Collection of Thrift, Micro Credit & Repayment monitoring Regular weekly meetings and sharing of information Some initiatives undertaken by Kudumbashree Health enterprise: Santhwanam Lease land farming: Harithashree Microhousing: Bhavanashree Microenterprises- Garment manufacture, solid waste management, mosquito eradication Destitute rehabilitation: Ashraya Analysis of Kudumbashree Achievements Successfully reached out to many women living below the poverty line Initiated and carried out numerous developmental projects in different areas Reduced the gap between rich and the poor by improving the latter’s economic status Issues / Continuing problems Complicated organizational system leading to rift between higher authorities and groups at grassroots level Longer repayment period might lead to psychological tendency to hold on to money for longer Comparing and Contrasting Grameen Bank & Kudumbashree Grameen Bank Kudumbashree Only basic organisation into groups of 5 3-tier community based organization More bank-customer interaction Bank interaction more at higher level of organization No vocational training provided Vocational training provided for set up of micro enterprise Short repayment period Relatively longer repayment period High interest rate Relatively lower interest rate