Life Science Venture Investing

advertisement

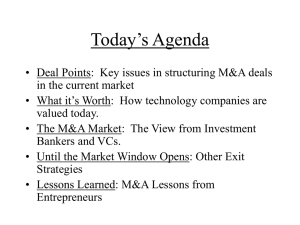

Nutter McClennen & Fish LLP Attorneys at Law MTTC Early-Stage Life Sciences Technology Conference IX Life Science Venture Investing Trends and Thoughts Jeremy Halpern Partner, Nutter McClennen & Fish LLP Jeremy Halpern Biography › Nutter, McClennen & Fish, LLP - Partner; Director of Biz Dev, Emerging Companies Team • Full service law firm • Top tier life science practice › MTDC– Director & Investment Committee Member • The Venture Arm of the Commonwealth-- catalyzing innovation in Massachusetts by providing seed and early stage venture funding to high growth technology startups. › The Capital Network – Director; Past Chairman • Providing education, resources and community to high growth entrepreneurs and angel investors as they navigate the early stage capital process. › Tufts University; Adjunct Professor of Entrepreneurial Leadership • Educating students in the art and science of leading ventures with limited resources. › Entrepreneurial Experience › UC Berkeley, B.A. (Go Bears!); UCLA School of Law, J.D. 2 Nutter’s Emerging Companies Group As a full service firm with a dedicated team of lawyers in the Emerging Companies Group, Nutter supports ventures across the innovation economy: • Biomedical Devices • Biotechnology • Pharmaceuticals • Life sciences • Software • Hardware • Information Technology • Cleantech • Mobile • Consumer Products • Analytics • New Media • Robotics We provide entrepreneurs will the full spectrum of support that they need to build their businesses and realize their visions: • Entity Formation • Founders Agreements • Financing Strategy and Key Introductions • Angel & Venture Capital • Debt Financing • Private Equity • Initial Public Offerings • Private Placements • Strategic Partnering • Mergers & Acquisitions • Employment support • Equity Compensation • Tax Strategy • Litigation • Licensing • Distribution • Manufacturing • Supply Agreements • Electronic Commerce • Patent and Trademark Strategy & Prosecution 3 Numbers that matter: National 2012 VCs invested $26.5b into 3,698 deals = 10% decrease in $; 6% decrease in deals VCs invested $4.1b into 466 deals in Biotech = 15% decrease in $; flat on volume VCs invested $2.4b into 313 deals in Medical Devices = 13% decrease in $; 15% decrease in deals VCs invested into 135 new companies in 2012 = lowest level since 2005 4 Numbers that matter: New England Q4 2012 › Seed: $16m in 7 deals (all verticals) › Early Stage: 339m in 54 deals (all verticals) › Biotech: $207m in 28 deals (down from $386m in 28 deals) › MedDevice: $138m in 11 deals 5 National Trends: 2012 › Seed stage deals declined 31% in $ and 38% in deals › Early stage deals decreased 11% in $; but increased 5% in deals = more deals with less capital per deal coming at a later stage 6 Contributing Factors - Biotech › Gross revenues and margins are declining on products › Development costs for biotech/pharma continue to rise – Average cost = $1b › Phase II success rate declined to 22% for trailing 5 years (a 12% drop) › Increased pressure from generic therapeutics › Increased regulatory pressure from FDA around comparative effectiveness › 2nd and 3rd world markets declining to protect patent status thereby reducing margins and penetration › Uncertainty around ObamaCare impact and implementation 7 Contributing Factors - MedTech › Continued regulatory uncertainty from FDA around comparative effectiveness (2012: 48 devices approved; a 5% decline from 2011) › Uncertainty around ObamaCare impact and implementation › Acquisitions happening later in venture life cycle (post market adoption and sales traction) › Reduces exit volumes › Reduces capital efficiency and creates the assumption of capital compression › Increases execution risks › Fewer acquirers reduces auction environment which depresses exit prices – lowering ROI expectations for investors 8 Is there Hope – Biotech? › FDA product approvals for biotech at 16 year high: 39 new molecular entities › Most venture deals were uprounds in 2012 › iShares Dow Jones U.S. Medical index continued to climb from ~$34 in 2009 to $76 in 2013 › Increased price pressure for therapeutics will drive acquirers to favor cost saving technologies › Acquirers looking to fill pipeline and stay competitive 9 Is there Hope – MedTech? › Big Data + Health IT + MedTech producing an entirely new category of diagnostic and data products › Companies using new business models to increase adoption and create early and recurring revenues. › Costs of building MedTech infrastructure continue to decline (incubators, IT infrastructure, prototyping, talent etc.) › Existing mobile platform technologies are decreasing costs and increasing adoption › Overhang from 2008 VC investments may be ending › Acquirers looking for high margin products that will still save payers long term costs 10 Investment Trends: Biotech – Single Asset › Supporting single asset virtual development with a capped investment amount › Typically not more than $20m (thinly capitalized at all moments) › Outsourced talent and CROs › Red Light/Green Light milestones: Research, In-Vitro POC, In Vivo, (Veterinary), Preclinical, Phase Trials › 2011: Exit at Phase II (or IIb) for Upfront + Milestone payments › 2012: Some appetite for earlier exists at lower prices (allowing investors to distribute upfront $ and “play with house money”) › Unclear if this will replace robust B rounds 11 Investment Trends: Biotech – Platform › Platform Development › › › › › Repeatable and scalable ability to produce drug candidates Larger infrastructure including full management team Disruptive technology Larger and unfixed capital raising strategies First product identified and in progress to market 12 Investment Trends: Terms › Fewer deals tranched to milestones › Nearly all lifesci deals have weighted average antidilution rather than full-ratchet › Participating preferred is on the rise, but many deals have caps resulting in an effective price adjustment › Lower Seed/A Round Values may better position a company for success 13 Investment Trends: Crowdfunding… sigh › Crowdfunding may supplement seed/angel/micro VC deals › Cause Marketing tie-in (“finding a cure for ________”) › Cannot replicate or replace the experience, judgment and relationships brought by traditional angel investors. › May damage ability to get follow on financing › Massive risk of lifesci investing may not be a good fit for crowd › Increased risks of litigation › Even worse ability of investors to diligence LifeSci investments › Mechanisms and Portals still not approved 14 Nutter McClennen & Fish LLP Attorneys at Law Jeremy Halpern Partner Director of Business Development Emerging Companies Team Nutter McClennen & Fish LLP T: (617) 439-2943 M: (617) 905-1893 jhalpern@nutter.com @startupboston www.linkedin.com/in/jdhalpern MTTC Early-Stage Life Sciences Technology Conference VIII: Life Science Venture Investing Trends and Thoughts