PowerPoint-presentasjon

Infrastructure for Development

Investing in Financial Institutions

Rationale for Financial Institutions Investments

Development

Rationale

• Private sector development is dependent on access to capital.

• Borrowing and saving money reduces vulnerability of households.

• Large number of enterprises and individuals lack access to basic financial services, such as banks accounts, insurance and credit.

Investment

Needs

• Financial institutions need capital to develop products and increase market outreach.

• Banks are dependent on debt in order to extend loans to their customers, especially longer tenure local currency debt.

• Capital investments are also necessary to build infrastructure to expand service offering to unbanked.

Financial Institutions Strategy

Profile

• High financial returns and strong development effects.

• Focus on SME’s and unbanked.

• Mainly local owned with promising growth potential.

Institutions

Instruments

• Banks.

• Micro finance companies.

• Non- deposit taking and other financial institutions.

• Equity

• Debt (USD and local currency)

• Mezzanine

Existing Financial Institutions Portfolio

NOK 2,4 billion committed

FI Portfolio per Region

19%

15%

22%

44%

Africa

Asia

Central America

Global

FI Portfolio per Instrument

9% Debt

42%

Equity

49%

Mezzanine debt

Development Effects of Financial Institutions Portfolio

FI Jobs per Region

Customers:

52.9 millions

Jobs (Direct):

130 183

Female Jobs:

38%

Taxes:

NOK 1,942,219,630

62%

12%

26%

Africa

Central

America

Asia & Pacific

1 000 000

500 000

Taxes NOK '000

-

Africa

Taxes NOK '000 946 405

Asia

583 159

Central

America

410 222

Highlights 2013 - 2014

SUMMARY

HIGHLIGHTS

Committed NOK 627 million to 12 investments

NORFINANCE

(“NF”)

• Investment company targeting

African financial institutions with equity investments.

• Main rationale to mobilize private Norwegian capital for investment in the Financial institution sector in Africa.

• Investors:Norfund,KLP,

Perestroika AS; Skagen Kon-

Tiki Verdipapirfond ; Solbakken

AS.

• First close USD 136.5 million.

PROXIMITY DESIGNS

• First investment in Myanmar.

• PD provides crop loans to small and rural farmers.

• The organization boasts the most extensive rural network, covering

80% of rural population.

• Loan will provide more access to finance to rural farmers.

• Convert from a NGO to a commercial company.

Key Next Steps

Fully Invest

NorFinance

• Invest available capital and possibly raise additional capital.

Scale up NMI

• Scale up Norwegian Micro Finance Initiative (”NMI”) and possibly obtain more Nordic investors.

Scalable banking models

• Invest in scalable banking models with innovative distribution channels like agency business models and mobile money transfers.

• Examples of Brac Bank, Bangladesh and Equity Bank, East

Africa.

Innovative business models

• Invest in innovative business models outside traditional banking sector addressing needs of SME’s and unbanked

Bank: DFCU Limited Uganda

Company Background

Was founded in May 1964 as a Development Finance

Bank and converted to a commercial bank in 2000 and listed on the Uganda Security Exchange on 2004.

Is Uganda’s 5 th largest bank, with 34 branches countrywide.

We are an investor since 2004 and have increased our shareholding in 2012 from 10% to 27.5% . This investment has now been transferred to NorFinance.

We have also provided debt capital

The bank has transformed several private enterprises in

Uganda through provision of funding for projects using products like Term Loans, Home Loans, Commercial

Mortgages and Leasing.

In 2013 we initiated a strategic alignment of shareholders with the introduction of Rabobank as a new shareholder.

Shareholding Structure

27.5%

Other

30%

27.5%

Performance

– Total Assets

15%

Unit: Shs million

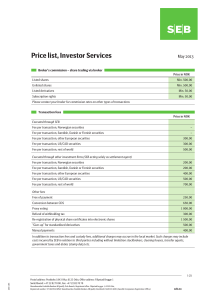

Microfinance : Hattha Kaksekar Limited, Cambodia

(HKL)

Company Background Shareholding Structure

Started as an NGO food project in 1994 and a

Microfinance operator in 2001.

Norfund has been invested since 2007.

Is among one of the top 4 MFIs in Cambodia and is moving towards being the leading, sustainable microfinance provider, helping clients to succeed in their businesses.

Employs 1872 people, of which 541 are female.

We have provided equity funding, loans in both local currency and in US dollar and an emergency liquidity credit line, when there was political turmoil.

Strategic plan initiated to transform to a fully fledged

SME/ Micro finance banking group.

17.49%

19.87%

19.73%

19.75%

23.16%

Local

SH

Strong shareholder group who have been consistently supportive to HKL’s growth.

Performance - Loan portfolio

Unit: USD million

250

200

150

100

50

0

2007 2008 2009 2010 2011 2012 2013 1H

2014

As of June 2014, loan portfolio stood at USD 194 million with PAR>30 of only 0,04%.