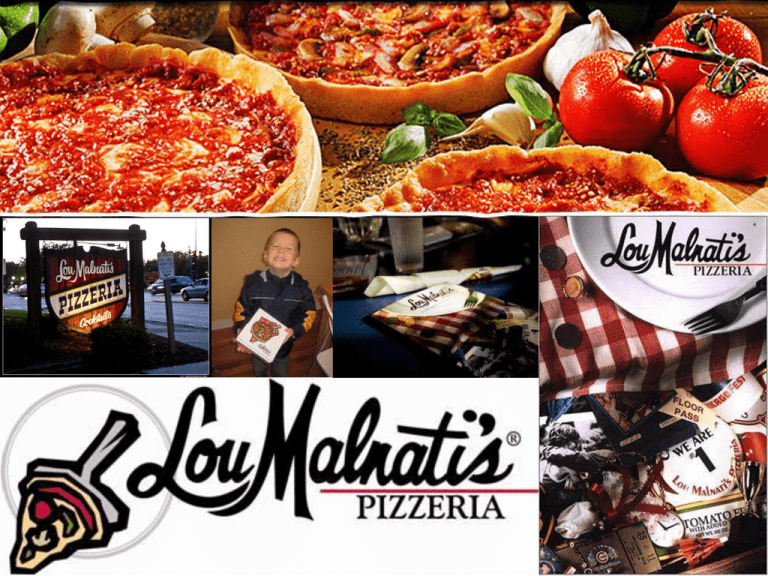

Lou Malnati`s Pizzeria

advertisement

Did you know that deep dish pizza is only made in Illinois? Lou Malnati’s is a well-known pizzeria throughout the entire city of Chicago. Our success is tied to our commitment to quality. Every pizza is handmade from scratch using the finest and freshest ingredients. Every year, the Malnati team hand picks California vine-ripened tomatoes for the perfect sweet and tangy taste. The exclusive sausage blend is seasoned perfectly and the fresh mozzarella cheese comes from the same place which has supplied Lou Malnati’s for over 40 years. The secret to creating our one-of-a-kind pizzas involves making every pizza with a flaky, buttery crust that has been in the family for generations. Our Proposal Because our business has been doing extremely well in Chicago and the United States, we feel that Dublin, Ireland is an excellent place to open a new Lou Malnati’s on a different continent. The 2008-2012 Business Environment Ranking of the Economist Intelligence Unit placed Ireland 11th globally out of 82 countries, naming it as one of the most attractive business locations in the world. Ireland Offers Investors… • A politically stable country and respected regulatory regime • A thriving RD&I sector, with strong Government support for productive collaboration between industry and academia • A strong legal framework for development, exploitation and protection of Intellectual Property rights • Strategic location with easy access to the EMEA region • Excellent IT skills and infrastructure • An advanced telecommunications infrastructure, with state-ofthe-art optical networks and international connectivity • Strategic clusters of leading global companies in Life Sciences, ICT, Engineering, Services, Digital Media, and Consumer Brands • An established reputation as a hub for business process improvement across EMEA Land of the Celts 2009/2010 saw Irish competitiveness improve significantly: - Business costs including energy, private rents, office rents, services, construction and labor have all become more competitive - Ireland isn’t nearly as densely populated as America is means that the population of the people are dispersed throughout as vast majority of land “Our workers prioritize their values by using the freshest ingredients and regularly researching our competitors to bring you the absolute best kind of Chicago-style deep dish pizza and other mouth-watering homemade edible goods at a reasonable price.” Gino’s East Target market is kids and adults Delivery, catering and parties Famous for deep dish pizza Multiple locations in the suburban and urban areas Hosts fundraisers Idea of restaurant Opened in 1966 Giordano’s Catering and deliveries “Ship a pizza” program Famous for deep dish pizza Florida location Multiple locations in the suburban and urban areas Opened in 1974 Lou Malnati’s is a family-oriented restaurant! The targeted age group is mostly 15-65 years of age which is the majority of the Dublin population. • Youngest workforce in Europe, with 35% under 25 years of age. • An excellent educational system and a Government strategy committed to securing the highest-level research talent from Ireland and abroad and to a doubling in the number of PhDs by 2013. • Total spend on higher education increased by an average of 10% per annum over the 10 years to 2008 (compared to a European average of 3%). • Wide skills base in high value manufacturing, global business services and RD&I. • English mother tongue and ready supply of multilingual skills. • Workforce with an excellent reputation for customer service, flexibility and creativity. • Demographic forecasts show the population growing by 30% to over 5.3 million by 2020: this means sustained strong growth in the labor supply that will far outstrip that in other EU countries. • In the 2011 IMD World Competitiveness Yearbook, Ireland was ranked fourth in the world in terms of availability of skilled labor and openness to new ideas. The regulations and rules Ireland enforces an EUR 1 form, which is required for goods under formal entry claiming preferential duty or exemption under various bilateral agreements. The customs and excise tariff of Ireland is also to be printed. Dangerous goods certifications Import taxes which includes value added tax VAT. The government Ireland contains a government similar to that of the United States which includes a legislative, executive, and judicial branches. The have a voting system and it consists of national elections main political parties. Individual members of the government are designated as the ministers with a sole responsibility for the administration of the various departments of state Age structure 1-14 years old is 21.1% (male 503,921/female 1,560,238) Irish 87.4%, other white 7.5%, Asian 1.3%, black 1.1%, mixed 1.1% Investment Highlights 2010 Ireland is using its growing status as a knowledge-based economy to open new doors and avenues for investors. The sharp increase in RD&I projects is proof of our success and confidence in this area and its excellent fit with the Irish business and academic landscape. • Investment Highlights 2010: • Almost 11,000 new jobs created • A total of 126 foreign direct investments won • 47 companies investing in Ireland for the first time, up 20% on 2009 • Investment in Research, Development and Innovation (RD&I) over €500million • 62% of investments from existing companies • Over 60% of corporation tax in Ireland paid by IDA clients • Exports from IDA client companies account for over 75% of total Irish exports • Renewed investment in manufacturing partly due to Ireland’s improving competitiveness • Strong growth in employment intensive services investments Ireland’s main tax advantages for holding companies are: • Capital gains tax participation exemption on disposal of qualifying shareholdings; • Effective exemption for foreign dividends via 12.5% tax rate for qualifying foreign dividends and a flexible foreign tax credit system; • Double tax relief available for tax suffered on foreign branch profits and pooling provisions for unused credits; • No withholding tax on dividends paid to treaty countries (or intermediate non-treaty subsidiaries) under domestic law; • Access to treaties to minimize withholding tax on inbound royalties and interest, and further domestic provisions to minimize withholding tax on outbound payments; • Extensive treaty network and access to EU directives. Imported goods from non-EU countries are subjected to VAT at the same rate as applies to the sale within the state of familiar goods. The key features of Ireland’s tax regime that make it one of the most attractive global investment locations include: • a 12.5% corporate tax rate for active business; • a 25% Research & Development (R&D) tax credit which may be refundable over a three year period; • an intellectual property (IP) regime which provides a tax write-off for broadly defined IP acquisitions; • an attractive holding company regime, including participation exemption from capital gains tax on disposals of shares in subsidiaries; • an effective zero tax rate for foreign dividends (12.5% tax rate on qualifying foreign dividends, with flexible onshore pooling of foreign tax credits); • an EU-approved stable tax regime, with access to extensive treaty network and EU Directives; • generous domestic law withholding tax exemptions. Cultural background The way of life in Ireland is very peaceful. Irish people are hard-working, very honest and known for their friendliness, hospitality, sense of fun and wonderful humor. They like to eat out during special events and holidays which Lou Malnati’s can satisfy their hungry needs. Gaelic language Transportation Air transportation from the U.S. to Ireland Land transportation to get the products the the restaurant Air fee Gas fee Fed ex UPS The environment Temperature remains relatively moderate throughout the year, never getting too hot or too cold. Temperatures typically range between 40 and 50 degrees Fahrenheit in the winter months 60 and 70 degrees Fahrenheit in the summer months. Ownership Our type of ownership is the limited liability corporation which is a combination of a partnership and a corporation that provides limited liability to the owners of the LLC for the business liabilities, including debts judgments and others.