Reporting and Disclosure - Solvency II Forum

advertisement

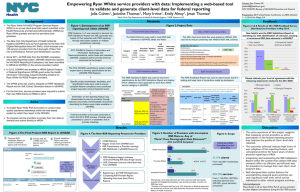

Solvency II Reporting & Disclosure Summary 1. General Framework 2. Narrative Reporting & Disclosure 3. Quantitative Reporting Templates 4. Frequency & Deadlines 5. Reporting & Disclosure Policies 6. Open issues General Framework Summary 1. General Framework 2. Narrative Reporting & Disclosure 3. Quantitative Reporting Templates 4. Frequency & Deadlines 5. Reporting & Disclosure Policies 6. Open issues Narrative SFCR & RSR => similar structure, with 5 parts, to enable comparability between SFCR and RSR Contents of SFCR and RSR A) Business, External Environment and performance B) System of Governance C) Risk profile 1. Business and external environment 2. Underwriting Performance 3. Investment Performance 4. Performance from other activities 1. Governance Arrangements 2. Fit and Proper 3. Risk Management & ORSA 4. Internal Control 5. Internal Audit 6. Actuarial 7. Outsourcing 8. Any other disclosures Following risks 1. Underwriting Risk 2. Market 3. Credit 4. Liquidity 5. Operational 6. Other material Risk Exposures 7. Any other disclosures Contents of SFCR and RSR D) Valuation for Solvency Purposes E) Capital Management 1. 2. 3. 4. 1. Own Funds - Structure, Amount & Quality 2. MCR and SCR 3. Use of duration based equity risk sub-module 4. SCR differences if standard formula or internal model used 5. Non-compliance with SCR/MCR 6. Other Disclosures Assets Technical Provisions Other Liabilities Other Disclosures Narrative Reporting & Disclosure • Specific information requirements for undertakings / groups using internal models • Groups – option to prepare a single group-wide SFCR (with agreement of supervisor). Must prepare group RSR and solo RSR • Narrative SFCR & RSR => additional group-specific information: – Group SFCR : • legal & organisational group structure • intra-group outsourcing arrangements • description of restrictions to fungibility & transferability of own funds – Group RSR : • contribution of each subsidiary to the group strategy Summary 1. General Framework 2. Narrative Reporting & Disclosure 3. Quantitative Reporting Templates 4. Frequency & Deadlines 5. Reporting & Disclosure Policies 6. Open issues QRTs – current status • CP 58 (mid-2009) – preliminary draft of QRTs included • Informal consultation carried out from April to September 2010 • “Pre-consultation” phase – from January to March 2011. EIOPA currently considering responses • Public consultation phase – Autumn 2011? Quantitative Reporting Templates • Number – 46 templates for solo entities – Most solo templates are also applicable to groups – 15 group specific templates. • Submission of templates : – Annual for all templates and all undertakings – Quarterly for “core” solo templates, with simplified presentation & possible exemption in certain cases – Quarterly or half-yearly for “core” group templates ? • Public disclosure of templates : – Public disclosure of some annual templates, within the SFCR – Possibility of simplified presentation Quantitative Reporting Templates - Solo Harmonised elements Balance sheet Assets (incl. detailed list) Technical provisions National specificities Variation analysis Capital requirements (SCR / MCR) & Own funds + Specific regulations or activities Reinsurance (Life & NonLife) Received in a harmonised format, capable of being shared automatically with EIOPA and/or other supervisory authorities Received in locally-defined format and not automatically shared Balance Sheet (3 forms) • Balance Sheet – based on Solvency II valuation rules • Off-balance sheet items – representing risks not captured by the balance sheet • Assets and liabilities by currency – to assess potential currency mismatches Assets (7 forms) • Detailed list of investments • Structured products • Derivatives • Return on investments • Investment funds (look through) • Securities lending and repos • Assets held as collateral Technical Provisions (15 forms) • Separate templates for life (7) and non-life (8) business • Give an overview of TP by line of business (LoB) for both life and non-life – split by best estimate and risk margin (with additional segmentation) • Also include information, amongst others, on: • development triangles for non-life (and premium and expense information) • movement in non-life claims provisions • projection of future cash flows for life and non-life • Variable annuities – guarantees by product and hedging of guarantees • large risks underwritten for both life and non-life Reinsurance (4 forms) • • Templates cover: • the reinsurance programme; and • the exposure to reinsurers. Specific template for SPVs Capital requirements (12 forms) • Templates provide the main outputs of the SCR and MCR calculations • For undertakings using the standard formula, outputs are further detailed by module (market risk, counterparty risk etc.). • Freedom of format for SCR reporting by risk categories for undertakings using an internal model (to be determined with supervisor). Own Funds (2 forms) • Templates give a detailed view of own funds by instrument and tier • Additional elements for certain specific instruments such as ancillary own funds or subordinated liabilities Variation Analysis & miscellaneous (3 forms) • Variation Analysis template analyse changes in own funds from one reporting period to another (since no Income Statement in Solvency II templates) • Miscellaneous forms cover: • Activity by country under Freedom to Provide Services / Branch : information requested under art. 159 of L1 • Premiums, claims & expenses Group specific templates (15 forms) • Aim is to cover group specific issues that cannot be directly covered by the solo templates • Different categories of group templates, including: o Description of scope of group for supervisory purposes o Group specific issues – group own funds etc. o Reporting of intergroup transactions and risk concentrations QRTs are very detailed but…… • Reporting burden is often due not to reporting itself, but to new requirements of Solvency II, e.g.: – New segmentation by LoB – Cash flow approach for BE – Economic valuation of BS items • Less information in templates means : – More ad hoc requests – More national specificities Summary 1. General Framework 2. Narrative Reporting & Disclosure 3. Quantitative Reporting Templates 4. Frequency & Deadlines 5. Reporting & Disclosure Policy 6. Open issues Process of Reporting – Frequency & Deadlines SFCR RSR Frequency Annual 1) “Full” report at Quarterly and least every 3 years Annual or when required by Supervisors 2) Material Updates Annually Submission Date Solo* 14** weeks after year end 14**weeks after year end * Group templates – as per the solo reporting period extended by 6 weeks ** Until 2015 there is a limited extension for both annual and quarterly submissions Quantitative Forms Quarterly 5** weeks after end. Annual 14** weeks after year end Process of Reporting – Frequency & Deadlines SFCR Format RSR Quantitative Forms Common Template Common Template Common Template as developed by as developed by as developed by EIOPA EIOPA EIOPA Sign off -internal – Yes administrative or management body Yes Yes Sign off – external auditing or verification No To be determined No Reporting required on other occasions? • “Day 1 reporting” – • S2 balance sheet and SCR at 1 January 2013 is proposed – submission date? Predefined events – Report any information necessary for the purpose of supervision after the occurrence of any event that could effect protection of policyholders – Include any event that can lead to material changes to an undertaking’s risk profile – May require supervisory authorities to reassess the frequency and intensity of supervisory actions. • Supervisory Enquiries – Supervisors may request any information required to assess the situation of an undertaking Summary 1. General Framework 2. Narrative Reporting & Disclosure 3. Quantitative Reporting Templates 4. Frequency & Deadlines 5. Reporting & Disclosure Policy 6. Open issues Reporting & Disclosure Policy • Obligation for undertakings to have written Reporting & Disclosure policies, approved by administrative, management or supervisory body (AMSB) • Possibility for undertakings not to disclose confidential information in SFCR, upon permission of supervisor • Possibility for undertakings to disclose additional information • Approval of SFCR by AMSB (L1) and of RSR (L3) Summary 1. General Framework 2. Narrative Reporting & Disclosure 3. Quantitative Reporting Templates 4. Frequency & Deadlines 5. Reporting & Disclosure Policy 6. Open issues Open issues • Outcome of ORSA reported separately from RSR? • External audit of templates? • National specificities? • Use of proxies for quarterly templates? • Simplified format for public disclosure? Conclusion • Reporting and Disclosure provisions of Solvency II represent a significant change to the existing framework • Concerns all supervisors and companies across Europe • Requires significant preparation and adaptation