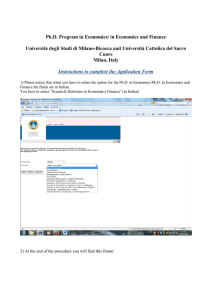

Behavioral Aspects in Macroeconomics and Finance

advertisement

DEPARTMENT OF ECONOMICS AND FINANCE Behavioral Aspects in Macroeconomics and Finance November 13 Welcome address 9.15-11.15 Behavioral Aspects of Households Finance 9.00 Institutional Quality, Trust and Stock Market Participation: Learning to Forget, Lu LIU, Lund University The case for incomplete markets, Viktor TSYRENNIKOV, Cornell University Portfolio Selection under Social Networks, Matjaz STEINBACHER, Kiel Institute for the World Economy Experimental Macroeconomics 11.30-13.30 Money is not memory: an experiment, Maria BIGONI, Università di Bologna An Experimental Search for Calvo, Marcus GIAMATTEI, University of Passau Managing Self-organization of Expectations through Monetary Policy: a Macro Experiment, Tiziana ASSENZA, Università Cattolica del Sacro Cuore and University of Amsterdam 14.30-15.30 Plenary Speech Sturdy Policy Evaluation, Steven DURLAUF, University of Wisconsin-Madison 16.00-18.00 Learning Sentiment and the US business cycle, Fabio MILANI, University of California, Irvine Learning about Trends and Business Cycle, Pei KUANG, University of Birmingham Asset Prices and Portfolio Choice with Learning from Experience, Alessandro GRANIERO, BI Norwegian Business School and London Business School November 14 9.15-11.15 Behavioral Aspects of Banks and Markets Comparing Different Regulatory Measures to Control Stock Market Volatility: A General Equilibrium Analysis, Adrian BUSS, INSEAD A wake-up call theory of contagion, Christoph BERTSCH, Sveriges Riksbank and Bank of Canada The Breakdown of the Interbank Market during the Financial Crisis: A Network Perspective, Celso BRUNETTI, Federal Reserve Board of Governors 11.30-13.30 Rational Inattention Asset Pricing with Heterogeneous Inattention, Omar RACHEDI, Universidad Carlos III de Madrid Capital-value busts as a source of rational pessimistic policy swings, Christos KOULOVATIANOS, University of Luxembourg Business Cycle Dynamics under Rational Inattention, Mirko WIEDERHOLT, Goethe University, Frankfurt 14.30-16.30 Experimental Finance The Role of Public and Private Information in a Laboratory Financial Market, Simone ALFARANO, University Jaume I Prior Outcomes and Instability in Experimental Credit Markets, Baptiste MASSENOT, Goethe University, Frankfurt Limelight on Dark Markets: Theory and Experimental Evidence on Liquidity and Information, Aleksander BERENTSEN, University of Basel and University of California, Irvine International Conference Milan, 13-14 November 2014 Cripta Aula Magna Università Cattolica del Sacro Cuore Largo A. Gemelli, 1 - Milano For more information please contact Eleni.Papageorgiou@unicatt.it