Rural Indebtedness in India

advertisement

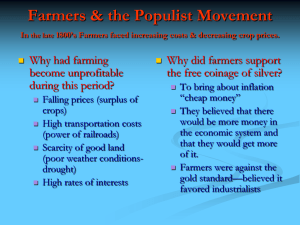

Rural Indebtedness in India Kamal Singh Lecturer in Economics GCCBA 42 , Chandigarh Rural Indebtedness means Inability of Rural people (Farmers) to pay their Debts . NSSO in its 59th round of survey (January –December 2003) covered indebtness of farmers. The reports say that 48.6 % percent of households were indebted. Of the total number of indebt farmers, 61 % had operational holding less than 1 Ha. Of the total outstanding amount, 41.6 % was taken for purpose other than farm related activities. 57.7 % of the outstanding amount was sourced from institutional channels and balance 42.3 % from money lenders, traders, relatives and friends. The expert group estimate that in 2003 non Institutional channels accounted for Rs 48,000 crore of farmers’ debt out of which Rs 18,000 crore was availed of at an interest rate of 30 % per annum or more. Causes of Rural Indebtedness: • • • • • • • • Poverty Ancestral debt Sub Division and fragmentation of holdings Increasing cost of Modern Agriculture inputs Extravagance of Farmers Litigation High Interest rate land revenue and other taxes Effects It can be broadly classified into 1)Economic effects 2) Social and moral Effect 3) and Political effect Economic Effects: • Loss in Productive efficiency • Transfer of land from Cultivators to Non cultivators • Terms of trade moves against the farmers • Loss of property Social and Moral effect • Birth of new class of landless proletariat • Frustration the minds of cultivators • Fall in incentive to work to make permanent improvement in land and increase in income Political effects • Leads to horse trading and selling of votes • Political freedom of indebted farmers is curtailed Remedies/Solution to the problem of Rural Indebtedness Two pronged strategy is needed • Reduction of Old debt • Check the burden of New debts Reduction of Old debt • Perpetual debts on which enough rate of Interest has already been paid should be written off. In this regards different state have passed Debt conciliation Act and have established various boards for mutual settlement between farmers and money lenders. In 1989 the Janta party Government had written off loans of the small and marginal farmers. In the 1990-91 government announced agriculture and Rural Debt Relief scheme. In 2005-06 the government provided Rs 2939 crore as debt relief to farmers. The various special relief packages have been announced which are as follow: • Special relief Package of 2006-07 for six debt ridden district of Vidarbha region of Maharashtra. • Relief measure for Distressed Farmers 2007-08 • Debt Relief package, 2008-09: UPA Govt. announced Rs 71,680 crore dent relief package for farmers. It included complete waiver of loan given to small and marginal farmers .One time settlement scheme has been launched for other farmers Check the burden of new Debts • • • • Reduction in Unproductive loans Encouragement to savings Check and control over money lenders New agencies for rural credit including regional rural banks and Micro Finance