1) The statement of cash flows is used for _____. A. showing the

advertisement

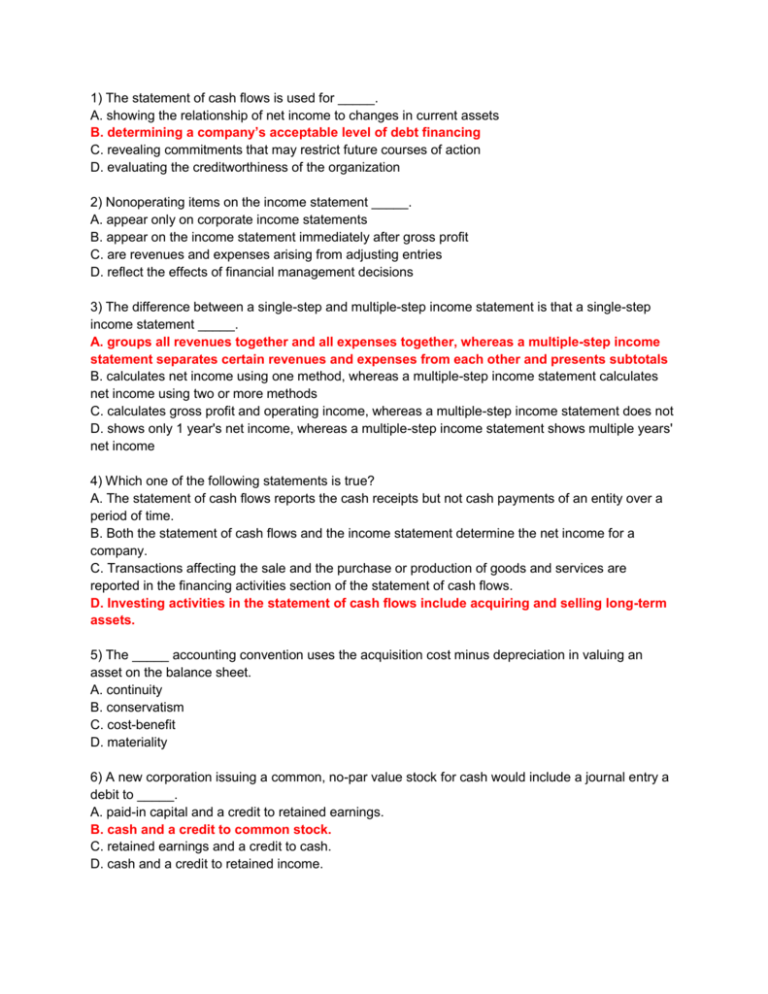

1) The statement of cash flows is used for _____. A. showing the relationship of net income to changes in current assets B. determining a company’s acceptable level of debt financing C. revealing commitments that may restrict future courses of action D. evaluating the creditworthiness of the organization 2) Nonoperating items on the income statement _____. A. appear only on corporate income statements B. appear on the income statement immediately after gross profit C. are revenues and expenses arising from adjusting entries D. reflect the effects of financial management decisions 3) The difference between a single-step and multiple-step income statement is that a single-step income statement _____. A. groups all revenues together and all expenses together, whereas a multiple-step income statement separates certain revenues and expenses from each other and presents subtotals B. calculates net income using one method, whereas a multiple-step income statement calculates net income using two or more methods C. calculates gross profit and operating income, whereas a multiple-step income statement does not D. shows only 1 year's net income, whereas a multiple-step income statement shows multiple years' net income 4) Which one of the following statements is true? A. The statement of cash flows reports the cash receipts but not cash payments of an entity over a period of time. B. Both the statement of cash flows and the income statement determine the net income for a company. C. Transactions affecting the sale and the purchase or production of goods and services are reported in the financing activities section of the statement of cash flows. D. Investing activities in the statement of cash flows include acquiring and selling long-term assets. 5) The _____ accounting convention uses the acquisition cost minus depreciation in valuing an asset on the balance sheet. A. continuity B. conservatism C. cost-benefit D. materiality 6) A new corporation issuing a common, no-par value stock for cash would include a journal entry a debit to _____. A. paid-in capital and a credit to retained earnings. B. cash and a credit to common stock. C. retained earnings and a credit to cash. D. cash and a credit to retained income. 7) Which type of organization would most likely have work-in-process inventory? A. A retail store B. A manufacturing company C. A service organization D. A real-estate investment trust 8) _____ is a measure of income or profit divided by the investment required to obtain that income or profit. A. Return on sales B. Return on investment C. Residual income D. Capital turnover 9) The following information is available for the Peter Company: Sales $150,000 Invested Capital 156,250 ROI 10% The return on sales is _____. A. 10.00% B. 62.50% C. 10.42% D. none of these answers is correct 10) The following information is available for the Peter Company: Sales: $500,000 Invested capital: $312,500 ROI: 10% The return on sales is _____. A. 10.00% B. 6.250% C. 1.000% D. 62.50% 11) Speedo Company's revenues are $300 on invested capital of $240. Expenses are currently 70% of sales. If Angelo Company can reduce its invested capital by 20%, return on investment will be _____. A. 75% B. 18.75% C. 93.75% D. 46.88% 12) When the variable costing method is used, fixed factory overhead appears on the income statement as a _____. A. component of cost of goods sold B. fixed expense C. production-volume variance D. component of gross profit 13) In absorption costing, costs are separated into the major categories of_____. A. fixed and variable B. manufacturing and fixed C. manufacturing and nonmanufacturing D. variable and nonmanufacturing 14) _____ is another term for variable costing. A. Full costing B. Direct costing C. Traditional costing D. Absorption costing 15) The use of budgeted service department cost rates protects using departments from _____. A. all of these answers are correct B. service outages C. price fluctuations D. service department efficiencies 16) _____ is an example of the external financial-reporting purpose of the cost management systems. A. The cost of a manufacturing process B. The product mix to optimize profitability C. The amount of inventory that should appear on the balance sheet D. Budget reporting 17) The level of sales at which revenues equal expenses and net income is zero is called the _____. A. margin of safety B. contribution margin C. break-even point D. marginal income point 18) Output measures of both resources and activities are _____. A. cost drivers B. stages of production C. fixed activities D. variable activities 19) The break-even point is where _____. A. total sales revenue equals total cost plus desired profit. B. the contribution margin equals net income plus fixed costs. C. total sales revenue equals total cost. D. the variable cost equals total cost. 20) _____ budgeting is when budgets are formulated with the active participation of all affected employees. A. Financial B. Team C. Participative D. Shared 21) _____ is the logical integration of management accounting tools to gather and report data and to evaluate performance. A. An internal control system B. A quality control system C. A financial-reporting system D. A management control system 22) _____ are components of a master budget. A. A strategic plan and an operating budget B. An operating budget and a capital budget C. A continuous budget and a static budget D. A cash budget and an activity budget 23) Important factors considered by sales forecasters include all of the following except _____. A. past patterns of sales B. competitors' activities C. the desired level of sales D. marketing research studies 24) _____ models are mathematical models of the master budget that can react to any set of assumption about sales, costs, and product mix. A. Futuring B. Accounting C. Budgeting analysis D. Financial planning 25) Which of the following is an objective of budgeting? A. Budgeting provides benchmarks against which performance can be measured. B. Budgeting provides a fixed fiscal plan that should not be changed during the year. C. Budgeting helps managers build favorable variances into the performance-evaluation process. D. Budgeting is done exclusively by the chief fiscal officer for control purposes 26) An organization's budget program should be used A. to have power over employees. B. to assign blame to managers that do not meet budgetary goals. C. to help managers plan and control the organization’s performance. D. to help the chief fiscal officer to allocate resources to the favored projects of the executives. 27) The activity-based costing may reveal _________, whereas traditional costing cannot. A. high-volume products are overcosted B. low-volume products are overcosted C. both high- and low-volume products are overcosted D. both high- and low-volume products are undercosted 28) _____ is a method of approximating cost functions. A. Cost-driver analysis B. Transaction analysis C. Product analysis D. Account analysis 29) In relation to a cost function, the term reliability refers to _____. A. whether the costs and activities can be easily observed B. whether the cost function conforms to a given mathematical model C. how well the cost function predicts future costs D. how well the cost function explains past cost behavior 30) One of the simplest methods to measure a linear cost function from past data is the _____. A. regression analysis method B. high–low method C. least squares regression method D. visual-fit method