Potential Incentives and Schemes

advertisement

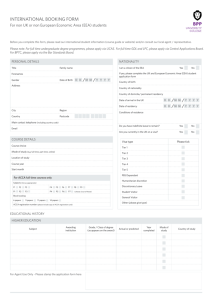

Potential Incentives and Schemes Krista Farrugia Director of Studies BPP Professional Education Malta Incentives • Two available schemes: – Malta Enterprise Tax Credit – Training Aid Framework (TAF) Malta Enterprise Tax Credit • Being offered by the Malta Enterprise • 80% Tax Credit calculated on individual’s chargeable income • Tax credit granted over a maximum of 36 months • Incentive will remain available until 31 December 2013 What do I need to do? • The applicant must fill in the application form which can be downloaded for the Malta Enterprise website http://support.maltaenterprise.com/myp/ • The application must be completed online and print a completed typed copy What documentation do I have to attach to the application form? • BPP will provide students with : – an official letter confirming that ACCA is a recognised qualification by the Malta Qualification Recognition Information Centre (MQRIC) and – A certificate from ACCA confirming that BPP is a Gold Approved Learning Partner • All receipts to date are also to be attached What costs do I have to include in the application form? • All fees payable to the Training Provider including course fees, any additional material purchased and your annual MIA and ACCA Subscription fees for 3 years • All examination fees for 3 years • The total must include all relevant fees, including an estimate for future periods until 2013, if applicable. • Total cost must not exceed €10,000 Points to note • Students who are being reimbursed for study costs from any other sources are not eligible to apply for this scheme • Students who have registered in 2008 and prior will not be eligible for the tax credit on payments during that period • Students will only be able to claim tax credit on course fees paid in 2009 onwards • Students commencing courses in 2010 onwards will only be able to claim credit for courses paid till 2013 • Students who have registered before 2009 must submit their application form to BPP as soon as possible prior to 15 February 2010 • Students who receive a percentage of reimbursement from other sources must declare the amount • Study leave will not be considered as reimbursement When will I get the tax credit ? • Students will only be able to claim the tax credit in their income tax return once the course has been completed • Any unutilised tax credits will be carried forward What documentation do I have to attach to the income tax return? • Students will have to attach a completion letter/ certificate from ACCA • Copies of all receipts for study costs Training Aid Framework (TAF) • Scheme partly funded through European Fund in collaboration with ETC • Eligible applicants will receive part reimbursement of training costs on completion of course Who is eligible to apply? • All employers with 1 or more employees or self employed persons whose self employment is their primary employment • Available to companies in private sector both full time and part time (more than 20 hours/week) • Course can be in-house, out-sourced and can be given in Malta or abroad through distance learning • Each company is eligible for a maximum of €250,000 up to maximum of €10,000 per employee per annum • Public sectors are not eligible for this scheme but are eligible to apply under other schemes such as Malta Enterprise Incentives • The employer must apply on behalf of the applicant • A fully completed application is to be submitted to ETC at least 3 weeks before commencement of course • For employees on a definite contract the contract must exceed 3 months • The course must be successfully completed by June 2013 • To apply for re-imbursement of February 2010 courses, one has to apply immediately and the application should include an estimate of course costs till June 2013 How much will be reimbursed? • This depends on the type of course, size of company and turnover and/or balance sheet total • A self-employed person is considered as a company How much will be reimbursed? Enterprise Size Large % reimbursed 60% 1. Number of workers is more than 250 Medium 70% 1. Number of workers is less than 250 2. Turnover does not exceed €50m 3. The Balance Sheet total does not exceed €43m Small 1. Number of workers is less than 50 2. The turnover and/or BS total does not exceed €10m 80% Study costs eligible for TAF • 100% of course and material fees • 100% of travel expenses if applicable (excluding accommodation) • Costs related to the course such as subscription fees and examination fees may be included Application form • Application form can be downloaded from the ETC website: http://www.etc.gov.mt/ • The following are to be submitted to ETC: – Completed application form – Grant Agreement – Copies of invoices and receipts – Attendance sheets of courses Documentation available from BPP • • • • • Course timetable Course prices Course syllabus Lecturer’s particulars (CV) Student’s confirmation of course attendance Any Questions kfarrugia@bpp.com sborg@bpp.com mtabone@bpp.com