The Multiplier Long Run Economic Growth

advertisement

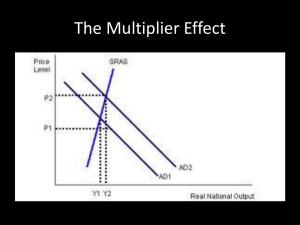

Multiplier Effect A2 Economics Lesson Objectives Understand the multiplier concept Utilise the multiplier formula Explain the multiplier determinants Analyse the interaction of the multiplier, accelerator and economic cycle Evaluate the significance of marginal propensity to save, tax and import A2 text p. 210 – p.212 The Multiplier effect Process by which any change in a component of AD results in greater final change in real GDP The size of the multiplier is determined by the size of the leakages from the circular flow of income A2 text p. 210 – p.212 The circular flow of income Firms Factor payments Consumption of domestically produced goods and services (Cd) Households A2 text p. 210 – p.212 The circular flow of income INJECTIONS Export expenditure (X) Investment (I) Factor payments Consumption of domestically produced goods and services (Cd) Government expenditure (G) BANKS, etc Net saving (S) GOV. ABROAD Import Net expenditure (M) taxes (T) WITHDRAWALS A2 text p. 210 – p.212 The Multiplier Effect Government increases spending on education, raising wages of teachers by £5 billion. (Injection) Teachers spend this money, which in turn becomes income for other people. The proportion of income that goes towards leakages is the Marginal Propensity to Withdraw. Let’s assume half the injection goes towards savings, tax or imports. That means the MPW is 0.5. What happens real GDP? A2 text p. 210 – p.212 This square represents the initial increase in income (£5bn) A2 text p. 210 – p.212 If marginal propensity to withdraw is 0.5; half is spent (MPC 0.5) spent A2 text p. 210 – p.212 The amount spent is income for other people Income for others A2 text p. 210 – p.212 Total income so far A2 text p. 210 – p.212 Half the new income is spent A2 text p. 210 – p.212 Total income so far A2 text p. 210 – p.212 Half the new income is spent and becomes income for other people A2 text p. 210 – p.212 Total income so far A2 text p. 210 – p.212 Eventually… The initial £5bn eventually becomes £10bn through the multiplier effect. National income has been multiplied by factor of 2. Formula K (multiplier) = 1/MPW (1/0.5 = 2) MPW = MPS + MPT + MPM A2 text p. 210 – p.212 MPW MPC +MPS + MPT + MPM = 1 The smaller the value of the withdrawals (and the larger the value of theMPC) the larger the value of the multiplier. MPS Change in S / Change in Y MPT MPM A2 text p. 210 – p.212 £6bn is due to be spent by the UK government in order to prepare London for the 2012 Olympics. This will bring a significant multiplier effect upon the UK Economy. MPW is 0.3, Calculate multiplier? Therefore change to national income following £6bn injection £6bn * 1/(0.3) = £19.9bn A2 text p. 210 – p.212 Activities If the multiplier is 2.5 and government wants to raise real GDP by £150bn. How much would it raise spending by. If exports revenue fell by £8bn and as a result real GDP declines by £12bn, what is the size of the multiplier? New Zealand’s trade balance deteriorated between ’03-’06. However, real GDP increased. Explain. A2 text p. 210 – p.212 Accelerator The theory of investment that states the level of investment depends on the rate of change of national income Recession Firms decrease invest Boom Firms increase invest Investment depends on RATE OF CHANGE OF Y, not on its actual level. A2 text p. 210 – p.212 Interaction of Multiplier & Accelerator This is a theoretical explanation of the Economic Cycle. Economy growing leads to investment which leads to a multiplier effect which leads to further economic growth However, if economy in recession the effect works in the opposite direction. A2 text p. 210 – p.212 Evaluating the Interaction of Multiplier & Accelerator Model Ignores the role of CONFIDENCE. Economy might be growing, but do businesses think it will be sustained? Investment decisions are large and complex, made well before changes in the economic conditions Exogenous factors just as influential ‘No more boom and bust’ – Governments can smooth out the economic cycle through fiscal and monetary policies However, investment is an important component of AD and firms do respond to consumer demands. The multiplier model is not the only force behind the economic A2 text p. 210 – p.212 cycle. Plenary International comparisons of multiplier values reveal significant variations between countries. One estimate suggested that the multiplier values were 1.42 for the UK, 1.13 for Germany and 1.76 for Japan. Explain why the multiplier may vary between countries Explain how a change in the rate of income tax is likely to affect the size of the national income multiplier A2 text p. 210 – p.212