Choice of Business Entity

advertisement

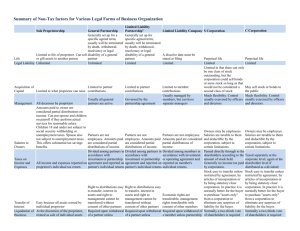

BUSINESS ENTITIES, FORMATION, AND TAXES, OH MY! May Lu, Esq. Tiffany & Bosco, P.A.* Camelback Esplanade II, Third Floor 2525 E. Camelback Road Phoenix, AZ 85016 (602) 255-6032 mlu@tblaw.com *Offices in: Phoenix, Arizona and Las Vegas, Nevada 1 Disclaimer Information presented here is general information. Choice of the right legal strategies for your specific situation depends on your fact situation and how the law and market conditions apply to that situation. Consult professional advisors such as your accountant, insurance professional, and business attorney. 2 Choice of Business Entity: Legal Forms (Pros and Cons) 3 Legal Forms a Business May Take Sole Proprietorship Partnerships General Partnership Limited Partnership Limited Liability Partnership 4 Legal Forms a Business May Take Corporations ‘S’ Corporation ‘C’ Corporation Limited Liability Company 5 Sole Proprietorship Sole Proprietorship Default for one person “owning” their own business Unlimited Personal Liability! Business not a “going concern,” nothing to sell at death or retirement Fictitious name filing No reason to use, considering allowance of one-member LLC in Arizona 6 General Partnership An association of two or more persons to carry on as co-owners a business for profit. All parties are equally “involved” All partnerships have the benefit of flowthrough taxation (i.e. entity does not pay tax itself, with some exceptions) 7 General Partnership In a general partnership, all partners subject to personal liability! Should create a written partnership agreement, otherwise at-will and subject to default rules of state of formation Revised Uniform Partnership Act (RUPA) in Arizona 8 Limited Partnership Still need at least one general partner (unlimited liability) Can be a corporation, another limited partnership, etc. Control issues (use of name) Usually a “money” person and a “manager” 9 Limited Partnership Some liability protection – still minimal Gives limited liability to the “passive investor” Only liable to extent of capital contribution Additional filing = additional cost Should create separate partnership agreement 10 Limited Liability Partnership If general partnership or limited partnership, easy and wise to switch to LLP Limited liability for all partners Generally, Limited Liability Company is the better entity form if you can afford to plan Cannot be partner of yourself 11 C Corporation Default whenever a corporation is created Taxed at corporate level – income, including dividend income, of shareholders is also taxed (Double Taxation!) Corporate Formalities 12 C Corporation Management structure fixed Shareholders, Board of Directors, and Officers Deductible Benefits to Employees Can cut tax liability Losses incurred by C Corporation do not flow through to owners Should form if plan to go public soon 13 S Corporation Tax Election of a C Corporation or Limited Liability Company Protection still the same 14 S Corporation Four relatively confining requirements Must be corporation of state or U.S. territory; Partnerships and corporations cannot be shareholders; No more than 100 shareholders; Only citizens or residents of U.S. may be shareholders; and Only one class of stock (can have voting/nonvoting) 15 Limited Liability Company Management – Members and managers Limited Liability – Even for one member Ability to Elect Federal Taxation as Corporation or Partnership Very Flexible Organization Some Risk Because Newer Entity Form No Annual Reports 16 Formation: Documents, Cost & Timeline 17 In General Takes approximately 1 week for the Arizona Corporation Commission to file Articles of Incorporation or Articles of Organization on an expedited basis. $35.00 to expedite filings. Other states will vary Should seek advice of local professionals Check/Reserve Name ($10.00) Name appropriately Do not forget the Internal Revenue Service (EIN, S Election) 18 Arizona Corporation Commission www.cc.state.az.us Search Corporations, LLCs, Trade Names, & Trademarks Check Name Availability Forms, Instructions, and Fees 19 Arizona Secretary of State http://www.azsos.gov/business_services/filings.htm Search Partnerships, Trade Names & Trademarks Checklist for Limited Partnership Filings Applications for Trade Names & Trademarks Forms, Instructions, and Fees 20 C Corporation Articles of Incorporation ($60) Statutory Agent Certificate of Disclosure Organizational Meeting Minutes (Attorney) Bylaws (Attorney) Certificate of Good Standing ($10.00) Shareholders’ Agreement (Attorney) 21 C Corporation Keep Originals – Corporate Book (approx. $80 for leather, with certificates, etc.) Employer Identification Number Publication of Articles – local newspaper; 3 consecutive weeks (Cost Varies) Get affidavits from each newspaper – at least two originals from each Annual Report ($45) 22 S Corporation Very Similar to C Corporation Tax Election – Flow-through Taxation Make Sure to Meet All Requirements 23 Limited Liability Company Articles of Organization ($50) Operating Agreement (Attorney/CPA) Member-Managed Manager-Managed Publish Articles – same requirements as corporation (Cost Varies) 24 Partnership Default entity for two or more persons “An association of two or more persons to carry on as co-owners a business for profit forms a partnership, whether or not the persons intended to form a partnership.” A.R.S. § 29-1012(A) Partnership Agreement! 25 Limited Partnership Certificate of Limited Partnership ($10 fee; $3.00 per page) File Certificate with Secretary of State (Two signed copies) Partnership Agreement (Attorney/CPA) 26 Limited Liability Partnership Partners Must Agree By Vote or Partnership Agreement If agree, file a statement of qualification $ 3.00/page A.R.S. § 29-1101(C) Annual Report – Simple ($3.00) 27 QUESTIONS? 28