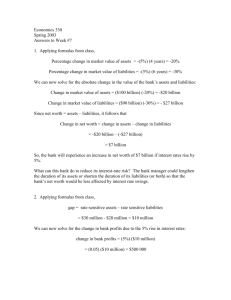

Chapter 2 Overview of Market Participants & Financial innovation

advertisement

Chapter 2 Overview of Market Participants & Financial innovation Learning Objective Participants in Financial Markets Business of Financial institutions Financial Intermediary Economic functions of Financial Intermediaries Asset & Liability management of Financial institutions Government Regulations Primary reasons for financial innovation Classification of Entities Central governments Agencies of central government Municipal governments Supranational Non- financial businesses Financial enterprises households Classification of Entities Central governments Debt obligations issued by central Governments carry full faith & credit of the borrowing Government. Agencies of central government Federally related institutions, Government sponsored enterprises Municipal governments Supranational An organization that is formed by two or more central governments through international treaties. Classification of Entities Non- financial businesses Corporations & non-corporate business Financial enterprises households Classification of Entities Financial intermediaries Depository institutions-commercial banks, S&L associations and credit unions Insurance companies Pension funds Classification of Entities Financial Enterprises Exchanging financial assets on behalf of customers. (Brokers) Exchanging financial assets for their own account. (Dealers) Assisting in creation of financial assets for their customers and then selling those financial assets to other market participants. (Underwriting) Providing investment advice to other market participants. Managing portfolios of other market participants. Role of Financial Intermediaries Obtain funds by issuing financial claims against themselves to market participants, then investing those funds. Direct investments- investments made by the financial intermediaries. (assets can be loans /or securities) Transform financial assets that are less desirable for a large part of the public into other financial assets(their own liabilities ) which are more widely preferred by the public. Role of Financial Intermediaries This transformation involves four basic economic functions: Maturity intermediation Risk reduction and diversification Reducing the costs of contracting and information processing Providing a payment mechanism Nature of Liabilities Liability Type Amount of cash outlay Timing of cash outlay Type I Known Known Type II Known Uncertain Type III Uncertain Known Type IV Uncertain Uncertain Nature of Liabilities Type I liabilities: Fixed deposit account Guaranteed investment contract (GIC) issued by the insurance companies Type II: Life insurance policy Nature of Liabilities Type III liabilities: Floating rate Certificate of deposits issued by the depository institutions Type IV liabilities: Automobile and home insurance policies Liquidity Needs Uncertainty about timing and amount of cash outlays Potential for the depositor or policy holder to withdraw cash early. Liquidity Needs Reduction in cash inflows: Depository institutions- inability to obtain deposits Insurance companies- reduced premium because of the cancellation of policies Investment companies- not being able to find new buyers for shares. Regulation OF Financial Markets Disclosure Regulation Financial Activity Regulation Regulation of Financial Institutions Regulation of Foreign Participants Financial Innovation Categorizations of Financial Innovation Market-broadening Instruments- Increase liquidity of markets and availability of funds by attracting new investors and offering new opportunities for borrowers Risk- management instruments reallocate risk to those who are less risk averse. Financial Innovation Arbitraging instruments and processesenable investors and borrowers to take advantage of differences in costs and returns between markets. Motivation for Financial Innovation Causes of Financial Innovation Increased volatility of interest rates , inflation , equity prices and exchange rates Advances in computer and telecommunication technologies Greater sophistication and educational training among professional market partcipants Financial intermediary competition Incentives to get around existing regulation and tax laws Changing global patterns of financial wealth..