Lender Environmental Training

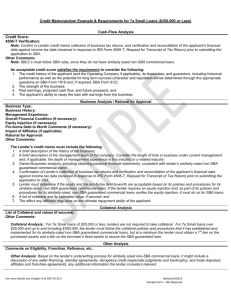

advertisement

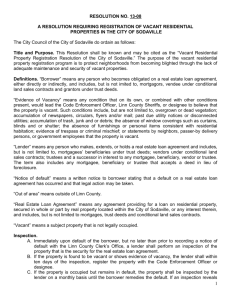

Lender Environmental Protection Hosted by UCPM, Inc. Presented by: Bart Jarman John Farinacci Discussion Topics • Environmental Due Diligence • Lender Environmental Protection – Benefits – Lender Coverage – Portfolio Process • Alternatives to LE Portfolio • Q&A Environmental Due Diligence • Commercial Lenders Require Environmental Due Diligence • Needed to preserve certain immunities granted by CERCLA • Lenders create their own due diligence protocol • Attempt to Minimize Risk Through: Environmental Due Diligence – Loan Underwriting Guidelines – Transaction Screens/Environmental Database Reports – Phase I ESAs – Environmental Questionnaires – Environmental Policy & Procedures – Financial Collateral (Indemnification, Escrow Funds) Two Major Concerns Remain with Traditional Environmental Due Diligence: 1. Retention of Potential Liability 2. Compromise of Collateral Historically Lenders Have Retained the Risk of Environmental Loss Lender Environmental Protection Lender Environmental Liability Developed as an Alternative and/or Enhancement to Traditional Due Diligence and to Address Previously noted Concerns Lender Environmental Protection Lender policies are intended to provide coverage to protect the collateral value in the event of a loan default and a pollution event that is first discovered on or at the covered location during the policy period Insurance Benefits • Reduce or eliminate the Cost of Traditional Due Diligence • Streamline Loan Process • Protect Bank Assets by Protecting Against Loss of Collateral Value Insurance Benefits • Insure Lender Liability on Collateral or REO Property • Reduce Risk Associated with Financing Commercial Real Estate Insurance Benefits • Provide Cash Flow Management in the Event of a Claim • Enhance Capital Market Deals • Provide Competitive Advantage Lender Coverage • Structure – Portfolio (New or Existing) – Single Site • Policy Payout Options – Lesser Of – Outstanding Loan Balance & Extra Expense Lender Coverage • Insuring Agreements – Default: Pays Lesser of the Cost of Cleanup or Loan Balance Depending on Policy Form – Third Party Claim – Provides Legal Defense and Indemnification – Foreclosure – Pays Cost of Cleanup Lender Coverage • Underwritten to Financial & Environmental Considerations • Financial evaluations: – Portfolio assesses Lender guidelines – Single site assesses borrower strength for each deal • Environmental Evaluations done for each Loan Customer Profile • • • • • • Commercial Banks Mortgage Bankers Lenders & Loan Originators Financial Institutions & Investors Life Insurance Companies Pension Funds Lender Coverage - Portfolio • Portfolio Policy – Provides Pre-determined pricing – For a group of loans that grows from inception for a specific period of time – Loans categorized as Non-Suspect or Suspect Portfolio Process • Application – Carrier Application – Sample Loan Documents – Lender Financials – 2 years – Loan Underwriting Guidelines Including Minimum DSCR & Maximum LTV – Environmental Policy/Procedures Portfolio Process • Pricing Considerations: – Number of Loans to be Included – Make-up of Portfolio – Limits (both per incident & aggregate) – Term – Deductible Portfolio Process • Quote/Binding – Quote includes 2 premiums: • Non-Suspect Loans • Suspect Loans – Premiums good for defined period – Deposit Premium to bind – Deposit Premium is a credit against future premiums Portfolio Process • On-Going Processing – The Lender enters loan specific information electronically direct to the carrier – Lender receives response from the carrier generally within 24 hours – Lender Collects Insurance Premium at Loan Closing – Monthly Reconciliation Portfolio Process • Monthly Reconciliation – Carrier generated monthly agent report – Prior month activity: loans approved for coverage, loans declined – Reconciliation with lender to determine which approved loans have closed – Closed loans reported to carrier Portfolio Process • Monthly Reconciliation – Closed Loans Endorsed to Policy per Monthly Reconciliation – Invoice for Additional Premium After Reconciliation Other Options • Lender Environmental Protection – Single Site • Environmental Site Liability with Borrower as Named Insured & Lender as Additional Insured Lender Coverage – Single Site • Process – Application – Copies of Environmental Reports – Borrower Financials – PSA – Loan Documents – DSCR Analysis – Appraisal Confirming LTV Lender Coverage – Single Site • Pricing Considerations • Limits • Current & Historical Property Use • Clean or Dirty • Neighboring/Regional Issues • Borrower Financial Strength/ Dynamics of Deal • Term & Deductible Borrower Coverage • Environmental Site Liability with Borrower as Named Insured • Possible Alternative for Some Lenders for Strong Borrowers • Lender Included as Additional Insured • Also Available When Borrower wants Coverage in Addition to Lenders Coverage Questions? UCPM Follow-up John Farinacci (949)629-3850 jfarinacci@ucpm.com Bart Jarman (480) 682-1562 bjarman@ucpm.com