ACCOUNTING for the “NON-ACCOUNTING PROFESSIONALS”

advertisement

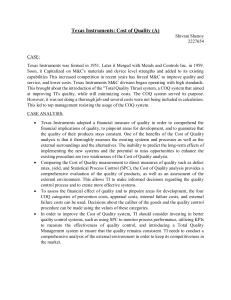

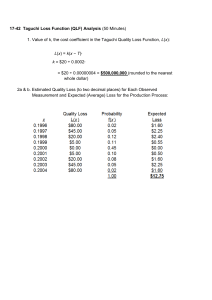

ACCOUNTING for the “NON-ACCOUNTING PROFESSIONALS” By: Tom Dlugopolski-President Thomas Business Solutions, Inc. Presented To: Membership and Guests Building a Business Cass for all Quality Initiatives A. Do we have knowledge of the Business Units Major Problems or Opportunities? 1. 2. 3. 4. 5. Capital Utilization Costs Finished Goods Inventory Improvement in throughput postpones improvement in capacity Reduce downtime of production equipment and eliminate late shipments Warranty Costs Building a Business Cass for all Quality Initiatives B. Financial Ratios Analysis (Does the Company have problems &/or opportunities? If so, where? 1. Net Working Capital (Current assets less Current liabilities) 2. Accounts Receivable Turnover (Net Sales divided by average Accounts Receivable) 3. Average Collection Period (365 days divided by accounts receivable turnover) Building a Business Cass for all Quality Initiatives B. Financial Ratios Analysis (cont.) (Does the Company have problems &/or opportunities? If so, where? 4. Inventory Turnover Rate (cost of goods sold divided by Av. Inv.) 5. Gross Profit Margin (gross profit divided by net sales) 6. Return on Total Assets (net income divided by Average total assets) 7. Earnings per Share (net income divided by number common stock shares outstanding) Building a Business Cass for all Quality Initiatives C. How is the Accounting Dept. interacting with other functions within the Business? ACCOUNTING PlantMgt. -Budgets -Lead Teams -Mat’ls. -Internal Audit Quality -Dept.Budget -Cust.Compla. ACCOUNTING Research & Development -Cost Analysis of Product Administrative Svs. -Customer Serv. -Scheduling -Human Resour. Manufacturing -Production -Process Engrg. -Shipping & Rec. Facilities -Engineering -Maintenance Cost of Quality (COQ) Definitions A. Price of Conformance (POC) (e.g.) inspection, calibration certs, gage R&R (Reproducibility & Repeatability) B. Price of Nonconformance (PONC) (e.g.) scrap, rework, delivery delays, etc. Cost of Quality Categories A. Preventive Costs 1. Marketing Research 2. Customer & user perception surveys/clinics 3. Contract & Document review 4. Purchasing 5. Operations Cost of Quality Categories (cont.) B. Appraisal Costs 1. External 2. Purchasing 3. Operations Cost of Quality Categories (cont.) C. Internal Failure Costs 1. Purchasing 2. Operations Cost of Quality Categories (cont.) D. External Failure Costs 1. Customer Complaints 2. Returned Goods 3. Recalls 4. Liability COQ Collection & Implementation-Plan A. Reference Activity Based Accounting (ABCM) 1. Highly effective management tool for accurate process costing as well as identifying the quantifying improvement opportunities. 2. Starts from the premise, as individuals, we make choices. 3. Choices create or eliminate activities that consume resources. 4. Resources cost time & money can be tracked to activities through processes. 5. ABCM-change the way you do business, helps you to indentify costs of quality items and cost reduction opportunities as well as actually do something about them. COQ Collection & Implementation Plan (cont.) B. Traditional Collection System Design 1. Measurement of quality costs an accounting function. 2. Development of the collection system requires close interaction of the Quality & Accounting departments. COQ Collection & Implementation Plan (cont.) C. Development of the System – – – Estimates used to allocate the proportion of an activity charged to a particular quality cost element. Controllers office must be directly involved in the design of the collection system. Quality costs should be collected by product line, projects, departments, operators, nonconformity classification, & work centers. Don’t Be Defensive About The COQ A. If in Doubt Put It In B. Develop trends C. Quality Profession opportunity D. Eliminate Costs End of Presentation Q&A Contact Information Tom Dlugopolski email: TomD@tbsinc.biz Phone: 540-798-3515