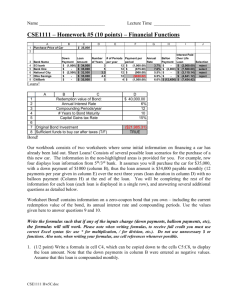

Loans

advertisement

Loans • When we calculate the annual payment of a loan (A), the payment is actually composed of interest and payment on principal. • The mechanics are best shown through an example. 1 Approaches… Loan problems can be worked two ways: 1. Create a Table… 2. Work problems in the same manner we’ve been using… 2 Perspective … Lender is indifferent between loan payments and investing loan amount at interest rate. Σ Payments = Interest Paid +(Beginning – Ending Principal) PW of Loans = PW of Payments 3 Create a Table… With the following column headings: • • • • • • Year or payment number Outstanding principal Payment Interest payment Principal payment Balance Remaining (next term’s principal) 4 Problem 1 You borrow $1,000 to help pay for rent, food, and books. It is to be repaid in 3 equal, annual payments starting one year from now. Interest on the loan is 12% per year, compounded annually. Determine the amount of the loan payments, and the corresponding principal and interest amounts in each payment. 5 Problem 2 You wish to payoff the loan at the end of 2 years after making your second loan payment. How much do you owe? 6 Problem 3 A student borrowed $5,000, which she will repay in 30 equal monthly installments. After making her 25th payment, she desires to pay the remainder of the loan in a single payment. At 12% per year, compounded monthly, what is the amount of the payment? 7 Problem 4 A company has obtained a $10,000 loan at an interest rate of 12% per year, compounded annually. The loan requires $500 payments at the end of each of the next 3 years (starting one year from now). Determine how much must be paid 4 years from now in order to payoff the loan. 8 Problem 5 If you have an interest-only loan, your regular payment only covers the interest on the original principle, and the final payment covers the rest. If you had an interest-only loan for $8 000, determine how much must be paid at the end of 4 years and at the end of 8 years from now in order to payoff the loan. Assume 8% APR, compounded yearly. What does the cash flow diagram for an interest-only loan look like? (term) 9