Supplier hold

advertisement

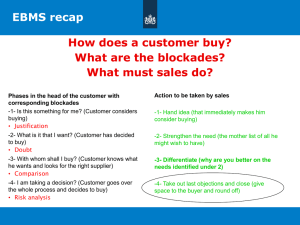

Supplier hold-up problem • If one company is supplying another company a good used in production (such as a supplier of coal to an electric company), then the supplier can hold-up the buyer company. • This works if the buyer company decides to make an investment to adjust its products to make better use of the supplier’s product. • Once the investment is made, the supply can raise its prices. Supplier hold-up problem • • • • • The investment by the buyer costs him 500. The gross gain to the buyer is 1500. The net gain is 1500-500=1000. The supplier can raise the price by 750 This would reduce the net gain of the buyer by 750 to 250. • If the buyer switches to a new supplier, the buyer’s investment (of 500) is lost to him and the supplier loses 1000 worth of previous business with him. Holdup payoffs:(Buyer, Supplier) Keep Price Make investment Supplier Raise price Buyer Don’t invest (keep Supplier) (1000,0) Keep Supplier (250,750) Buyer New (-500,-1000) Supplier (0,0) Buyer’s investment costs 500 – only useful for that supplier. Saves buyer 1500 (net 1000). Supplier can raise price by 750. Supplier losing the Buyer’s business costs him 1000. Supplier hold-up problem • • • • • Now the investment is 1000 (instead of 500). The gross gain to the buyer remains 1500. The net gain changes to 1500-1000=500. The supplier can still raise the price by 750 This would reduce the net gain of the buyer by 750 to -250. (rather than +250) • If the buyer switches to a new supplier, the buyer’s investment (of 1000) is lost to him and the supplier loses 1000 worth of previous business with him. Holdup payoffs:(Buyer, Supplier) Keep Price Make investment Supplier Raise price Buyer Don’t invest (keep Supplier) (1000,0) (500,0) Keep Supplier (250,750) (-250,750) Buyer New (-500,-1000) Supplier (-1000,-1000) (0,0) What if investment now costs 1000? Potential savings 500. What happens? Another reason for a government to allow Vertical Integration. General payoffs Payoffs: (Buyer, Supplier) Keep Price Make investment Supplier Buyer Don’t invest (keep Supplier) Raise price (P - C, 0) Keep Supplier (P - C - R, R) Buyer Change (-C, -B) Supplier (0, 0) Buyer’s investment costs C – only useful for that supplier. Increases buyer’s profits by P (net P - V). Supplier can raise price by R. Loss of business costs supplier B. Example: Soviet Military • State forced to buy arms from specific manufactures. • Arms manufacturers were able to cut costs by substituting goods of inferior quality. • The state attempted to counter this by employing a small army of inspectors. • Many items: tanks. Expensive to monitor during production. • Inferior quality was readily observable once delivered. • A compromise reached: the inspectors overlooked shortfalls in quantity and late deliveries, in return for improvements in quality; • More efficient outcome because lowest quality items cost more to produce than they were worth to the army. Example: Fischer Body. • GM signed a contract with Fisher Body to provide it with closed metal bodies. • Early 1920s: unexpected increase in demand. • The contract was cost-plus: GM pays 17% over and above any non-capital costs. • Fisher had incentive to build new plants further away from GM’s plants, so that they could profit from the transportation costs. • Solution: a merger between GM and Fisher. Training and Skills Shortages • New employees require training before they are fully productive. • Training may be firm specific or more general. • If the employee pays for the training (reduced wages), the firm has an incentive to offering them a different contract on less favourable terms; the company may also cherry-pick the best workers: workers can be exploited. • More difficult to recruit. • If company pays, workers can threaten to leave and work for a competitor. The company may counter this by making exemployees sign a contract that they will not work for a direct competitor for a certain period of time. The contract may or may not be enforceable. • Both cases, there is a disincentive to make investment in skills (in particular general skills) which would benefit both parties. Other Hold-ups • Standards in IT. – A standard may form before a license agreement. – The patent holder can hold up the adopters. • Car body design. – Car manufacturers had in-house programming teams. – They could demand high pay/job security. – This broke down thanks to software for Hollywood used to design prototypes and software for aerodynamics. Why are there hold-up problems? • (a) unforeseeable external factors: global technology shifts or changes in consumer lifestyles, • (b) lack of trust, difficulty the buyer has in reassuring the supplier that the money has been invested properly or indeed that it has been invested at all, • (c) asymmetric information, for instance the supplier may over-estimate the cost of the investment to the buyer or ascertaining quality at points of time. • (d) monitoring quality/effort is difficult. Contracting around hold-up? Could the contract could specify that the work will be done at a fixed price, thereby eliminating the problem? • Difficult to write contract that anticipates every possible situation that may occur during a length project. • Loopholes may allow the supplier to default on the contract in subtle ways or take advantage of unforeseeable external events. • Proving quality/effort in court can be difficult. Avoiding hold up problem • Mergers – GM eventually bought Fischer body • Long-term contracts for workers. – ROTC requires longer service • Repeat game – Reputation • Behavioral traits – Ethics/fairness