Improving working capital performance with Supply Chain Finance

advertisement

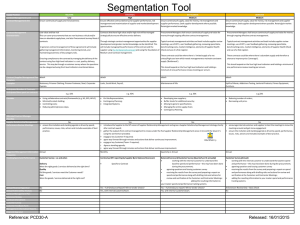

Improving working capital performance with Supply Chain Finance September 20, 2012 Big challenges to working capital performance “ Despite a global business environment where companies can be harshly punished by Wall Street for even small missteps in predicting revenue or earnings, most large companies say they cannot correctly forecast operational basics like inventory, receivables, payables, and the underlying cash requirements to support them…” “... typical large companies in the annual REL 1000 analysis could generate nearly $2 billion in additional cash annually by optimizing working capital management.” REL Consulting (a division of The Hackett Group, Inc.), Working Capital: Successes, Challenges, and 2012 Objectives, (April 26, 2012) “ Since, on average, roughly 50% of companies’ working capital is tied up in the supply chain, there are very significant benefits to taking a more holistic view of the supply chain...” Ernst & Young insight: Getting the most from your supply chain (March 12, 2012) How do you improve performance? Payables… Extend Days Payables Outstanding (DPO) Control financing costs Manage A/P processes more efficiently Receivables… Shorten Days Sales Outstanding (DSO) Improve “quality” of receivables Lower financing costs Expand sales markets (revenue growth) Reduce payment and FX risk Inventory… Lower Cost of Goods Sold (COGS) Align procurement terms to match sales terms Accelerate inventory turnover Ensure a predictable supply chain More efficient financing may be the solution 3 Peer comparison* Working capital benchmarking analysis — an example From a working capital perspective, how would you stack up against your peers? * Standardized in USD MM 360-day calendar, based on the latest FYE results and average two-year balances Source information: 2011 corporate annual reports (available online) Evolution of finance in the global supply chain Management of the Supply Chain has involved over time to a more holistic view Convergence of the physical and financial supply chains • Historically, the Supply Chain has addressed physical aspects: inventory flows, transportation spending • Supply Chain Finance (“SCF”) expanded the focus to Inventory control and A/R reduction • Today, efficiency in Payables has become a key component of Cash Conversion Cycle discussions Effect of Global Financial Crisis on Working Capital Optimization • The Global Financial Crisis illustrated that the cost and availability of capital can change dramatically in a short period of time and underscored the importance of counterparty and supplier risk management • As a result, working capital optimization became a renewed area of high interest Best in Class Companies • Today most Fortune 500 companies are using programs such as Card Solutions, ePayables, SCF that enable them to generate a value proposition from their payables: • Card solutions as a bottom up solution that can extend terms or more often generate fee rebates • SCF provides a top down, more cost effective, solution for larger suppliers 5 Overview of Supply Chain Finance Purpose • Provides a “Buyer” with a means to stretch out payables or reduce COGS while also offering suppliers the ability to receive payments as quickly as possible • Create a “value exchange” that can improve working capital or, alternatively, allow negotiation of pricing concessions Program • Suppliers can tap into funds earlier in their receivable cycle by allowing them to secure discounted funds against those receivables • Web-based technology can provide a seamless solution for both parties • Available to both domestic and international suppliers and can be used for foreign currency purchases Pricing • Suppliers bear the on-going cost of the program, at a cost of funds aligned with the Buyer, set as a per annum rate, fixed spread over the relevant LIBOR for the period of the discount • Discount rate charged to vendors incorporates the credit spread and the program’s administrative costs • Cost is generally lower than the suppliers’ cost of debt and well below their Cost of Capital, WACC or IRR SCF: who it benefits Buyers benefit by… Improving cash flow by extending DPO while maintaining trade payables classification Alternatively use a mechanism to negotiate better pricing Reduced administration through end-to-end payables reconciliation solution Strengthening supplier relationships/sustainability Can be part of an integrated payment network solution Suppliers benefit by… Improving cash flow by reducing DSO in an accounting neutral way Obtaining funding based on receivables as a financial asset, rather than supplier creditworthiness Obtaining financing at rates more favorable than those offered by alternative finance mechanisms Avoiding use of often limited credit availability from their bank Improving cash flow forecasting and flexibility A win-win Having a tool to manage the concentration of receivables for both buyers and suppliers SCF: how it works 1. Buyer transmits purchase orders to Supplier 2. Supplier submits invoices to Buyer 3. Buyer reconciles and feeds approved invoice file into Bank’s platform (webbased) 4. Supplier selects and requests discount of approved invoices (or auto-discount) – all or part Bank System 5. Bank discounts invoices and remits proceeds to Supplier 6. Bank debits Buyer account on invoice maturity date for total due and remits amounts not discounted. Invoice Purchase order Buyer Supplier Traditional negotiation of terms - “zero-sum game” Buyer receivables are a substantial part of its suppliers’ working capital costs Supplier Buyer Objective: Increase DPOs Objective: Decrease DSOs Assets Equity & Liabilities Assets Equity & Liabilities ABC A/R = Buyer A/P Buyer A/R ABC A/P Supply Chain Finance offers a “win-win” solution SCF enables Buyer suppliers to discount approved invoices at a very competitive rate ABC Company Benefit: Decreased DSOs Assets E&L Buyer A/R Supplier DSO = 10 (unlock cash flow) Bank Buyer Benefit: Increased Lending Assets Buyer A/R Bank owns A/R 41 E&L Benefit: Increased DPOs Assets E&L ABC A/P Buyer DPO = 51 (reduce working capital) 14 8% 12 7% 6% 10 5% 8 4% 6 Many buyers enjoy… Low cost of financing Investment graded Strong balance sheet Access to low cost capital Many banking options 3% 4 B- B B+ BB- BB BB+ CCC+ Suppliers by S&P BBB- Non-investment graded BBB 0% BBB+ 0 A- High cost of debt or other capital alternatives A 1% A+ 2 AA- While many suppliers face… AA 2% AA+ Quantity of Suppliers Typical financing inefficiencies – both domestically and internationally A/R concentration limit issues Restrictive or limited bank credit lines Est. Rate by S&P* SCF Rate A Supply Chain Finance (SCF) program can help allocate financing more efficiently to the benefit of both parties * Based on S&P 2012 rating scale Cash flow improvement — an example Supply Chain Finance Benefits Calculator Improved cash flow Supply Chain Finance Benefits Calculator Supplier Name Supplier Sales to Buyer Current Terms Target Terms Invoice Approval Days Supplier's Capital Rate SCF Rate LIBOR Supplier Name Supplier Sales to Buyer Current Terms Target Terms Invoice Approval Days Supplier's Capital Rate SCF Rate LIBOR $25,000,000 30 59 5 5.00% 2.00% 0.30% $25,000,000 60 115 5 5.00% 2.00% 0.49% Today Today's Terms Target Terms Paym ent Term s 60 60 115 5 DSO 60 5 5 2.30% 2.30% Supplier's Interest Rate 5.00% 2.49% 2.49% $104,167 $57,292 $103,611 Supplier's Interest Cost $208,333 $112,465 $207,569 Supplier's A/R $2,083,333 $347,222 $347,222 Supplier's $4,166,667 A/R $347,222 $347,222 Buyer's A/P $2,083,333 $2,083,333 $4,097,222 Buyer's A/P $4,166,667 $7,986,111 Supplier's Break-Even Rate 2.30% Supplier's Interest Savings ($) $46,875 Supplier's Interest Savings (%) 0.1875% Supplier's Cash Flow Increase $1,736,111 Buyer's Cash Flow Increase $0 4.97% $556 0.0022% $1,736,111 $2,013,889 Supplier's Break-Even Rate 2.49% Supplier's Interest Savings ($) $95,868 Supplier's Interest Savings (%) 0.3835% Supplier's Cash Flow Increase $3,819,444 Buyer's Cash Flow Increase $0 4.98% $764 0.0031% $3,819,444 $3,819,444 Today Today's Terms Target Terms Paym ent Term s 30 30 59 DSO 30 5 Supplier's Interest Rate 5.00% Supplier's Interest Cost $4,166,667 Example of successful application of Supply Chain Finance Company A multinational company with over $2BN in revenues in the wholesale manufacturing market Objective Dramatically extend its very short supplier terms and improve its Cash Conversion Cycle. Situation Company was well below its peers in both DPO and CCC, had already extracted all possible benefits in inventory control and was being pressed to extend sales terms to its customers Response Through our recently established program the Company expects to achieve the following: Dramatically extend its DPO, which will approach industry leaders Generate approximately $60mm in additional cash flow by year end 2011 and increasing to $150mm by year end 2012 Set a new standard for negotiations with new suppliers as to terms Seek to further extend supplier terms in the future In Summary Corporate focus on working capital metrics can be a more cost-effective effort than capital raising or increasing bank debt Solutions that benefit both a buyer and a supplier are an easier sell Payables programs can often be easily implemented and should be targeted where supplier adoption is most likely and provides the most benefit Can be part of an overall streamlined and automated payment process designed to generate capital/revenue and reduce administrative burden and cost