Show me the money… - Green Mountain Power

advertisement

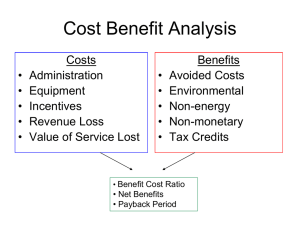

“Show me the money…” $$$ Efficiency Vermont’s 2006-08 Investment Plan Q. What IS money, anyway? A store of value; A means of exchange; Not everything, but a great way of keeping score; and Unlike electricity, not necessarily fatal if consumed directly (hence the “derived” demand for energy)…. Time is money… Q. Do you believe a dollar in the future is worth MORE because of future generations? A. If yes, I want to borrow as much money as you’ll lend me right now for as long as possible. Q. Which would you rather have, $1,000 today or $1,000 in ten years? A. Duh! You and Your Discount Rate… Money’s worth today depends on when you get it. You (and every member of species homo economicus) implicitly or otherwise apply an annual DISCOUNT RATE to future money outlays and income (even if you’re certain to spend or receive it). Until yesterday, Efficiency Vermont calculated our PRESENT WORTHS of future money (benefits and costs) using a 6.8% discount rate. From now until the DPS changes it again (with PSB approval), we’re using a 5.8% discount rate. This is the OPPORTUNITY COST of investing the public’s money somewhere else, i.e., in some other “public good”. Not all money is the same… Q. A. How do we count money at Efficiency Vermont (and VEIC)? Let me count the ways…. Different Ways of Counting Money at Efficiency Vermont Societal Benefits and Costs • • Total Resource Benefits and Costs – per contract • • • Benefits: Societal minus externalities Costs: Not including CRA Total Resource Benefits and Costs – per 5270 and PIP • • Costs: with Comparative Risk Adjustment Electric System Benefits and Costs • • • • All costs and benefits, including externalities, comparative risk adjutment Benefits: TRB without fossil, water Costs: TRC minus participant, third-party cost “GMP Value Test” The Color of Money…. BENEFITS Environmental externalities Water Fossil fuel savings COSTS Comparative Risk Adjustment (10% of EE costs) Avoided T&D costs Participant O&M and other costs (savings) Participant and third-party costs Avoided electric generating capacity costs EVT Expenditures Avoided electric energy costs COLOR KEY Electric system (aka utility) test TRC test (in addition to components of EST) Included in TRC in levelized cost PIP, and in societal test (on top of TRC) Societal test only (on top of EST and TRC) DSM Cost-Effectiveness Indicators Net benefits = PW Benefits – PW Costs Benefit/Cost Ratio = PW Benefits / PW Costs (>>1.0) Simple comparative indicator Misleading Cost of saved electric energy ($/kWh) The economic “bottom line” (>>0) Measure of increase in wealth PW costs / PW lifetime kWh for comparison with avoided supply Like “yield”, except inverse, and accounting for lifetime Net cost of saved peak demand ($/kW-yr) = (PW costs minus PW electric energy benefits) / PW kW-yr Supply Curves for Energy Efficiency Savings Total Resource Costs vs. Administrator Costs of Electric Energy Savings 10 9 Levelized avoided energy cost 8 Cost of Saved Electric Energy 7 6 5 4 3 2 1 0 Limit of TRC cost-effective savings 10,000 20,000 30,000 40,000 -1 -2 -3 MWh/year Total resource costs of electric energy savings EVT costs of electric energy savings 50,000 60,000 The Money Show for Efficiency Vermont 2006-2008 Societal Total Resource (per Contract) Total Resource With CRA per PIP Cost of saved electric energy Net cost of saved peak demand Total Resource With CRA per PIP and 5270 Comparison of benefits and costs Cost of saved electricity Electric System Comparison of benefits and costs Cost of saved electric energy per kWh Net cost of peak demand savings GMP Value from Energy Efficiency Fund Net Resource Benefits divided by EVT costs (NRB/EVT) >>1.0 Conclusions Prospective performance Everything pretty much cost-effective from all perspectives. A few red flags. What about the future? Prospective initiative economic assessment New avoided costs. Using analysis to make decisions about budget allocation over time. Portfolio economic performance. Where are we on the supply curves for residential efficiency?