Budget Management Counseling

advertisement

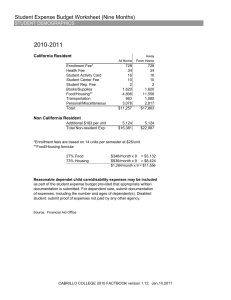

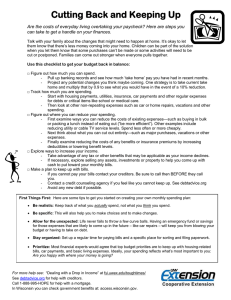

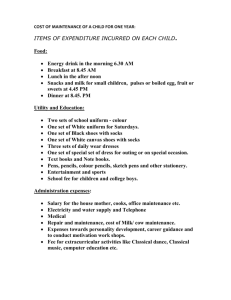

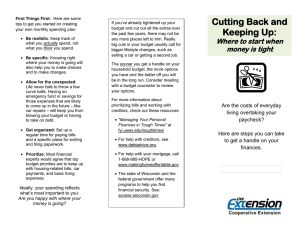

Budget Management Counseling What is a budget? Financial instrument used to plan and monitor the receipt and use of income Lists income and expenses for a particular period of time Primary purpose is to guide the allocation of income so that it will meet expenses and permit other uses, such as savings and investing Why do budgets fail? Not really wanted Not agreed upon Not realistic Not well designed Not well supported 10 most common budget problems Too little income Too much debt Too much spending Too little discipline Too many goals Too naïve Too little knowledge Too little management Too little communication Too little agreement Three most basic budget solutions Reduce expenses Restructure debt Increase income More personal budget solutions Resolve personal problems Reconcile competing goals Improve management Ways to stick to a budget Get rent out of way Stay away from the ATM Leave money at home Record credit card purchases Save automatically Keep money in large coins or bills Save your change Ways to stick to a budget Keep checkbook balanced Set goals Consider tradeoffs Take your lunch Pay yourself first Bank your refunds Continue paying a loan Shop second-hand Ways to stick to a budget Try crash savings – Zero based budgeting Save extra paychecks Break costly habits – consider trade-offs Reducing your spending http://www.calcbuilder.com/cgibin/calcs/SAV13.cgi/uiue Cost of smoking http://ashline.org/ASH/quit/contemplation/index. html Budget Challenges Cash or ATM withdrawals Variable income Impulse buying Gifts Bookkeeping errors Attitude challenges Budget Challenges Credit Types of credit cards Limited purpose credit cards National credit cards Bank credit cards Travel & entertainment charge cards Things to look for: Annual fee Interest rate Additional perks insurance, discounts, cash back bucks Cash advance Hidden fees transaction fees cash advance fees over credit limit fee late fee CAUTION! “No payment for 6 months” “Low introductory offer - 4.9%” “No fee” “Balance transfers” Loan sharks Tips to lower costs Switch to a lower rate card No annual fee Take advantage of your grace period Ask for lower interest rate Pay more than the minimum balance If paying interest, mail check as soon as you receive your statement Use savings to pay credit card bills Credit Problem Signs Not knowing how much you owe Making minimum payments Making cash advances to pay bills Working 2nd job to keep up with spending Being consistently late with bill payments Being denied credit To obtain a credit report Must be in writing: full name, address, old address - (2 years) social security number date of birth current employer telephone number $8.00 sign request Three major credit bureaus Equifax 1-800-556-4711 Experian 1-800-353-0809 Trans Union 1-800-680-7293 Assignment: Develop a Resource Section of money-saving tips Food Automobiles Insurance Recreation/entertainment Clothing Savings Variable household expenses