MANIAS, BUBBLES, AND PANICS IN WORLD

advertisement

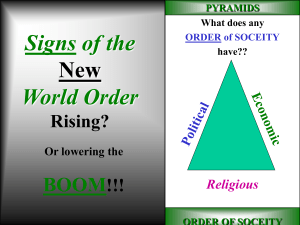

MANIAS, BUBBLES, AND PANICS IN WORLD HISTORY THE PSYCHOLOGY OF THE MARKETS BUBBLE QUOTES “There is nothing as disturbing to one’s well-being and judgment as to see a friend get rich.” Charles P. Kindleberger “The four most expensive words in the English language are, this time it’s different.” Attributed to Sir John Templeton ECONOMIC ANALYSIS ASSUMES PEOPLE ARE RATIONAL AND RESPOND TO INCENTIVES LOGICALLY • • • • • • • • • • • • • TULIP MANIA SOUTH SEA BUBBLE RHODIUM BUBBLE RAILWAY MANIA ROMANIAN PROPERTY BUBBLE MISSISSIPPI BUBBLE FLORIDA LAND BOOM POSEIDON BUBBLE DOT-COM BUBBLE URANIUM BUBBLE JAPANESE ASSET BUBBLE ROARING TWENTIES GLOBAL HOUSING BUBBLE A BUBBLE IS A PERIOD OF SPECULATIVE MANIA SURROUNDING A PHYSICAL OR FINANCIAL ASSET THE WORK OF HYMAN MINSKY A TYPICAL BUBBLE EVENT ARRIVES IN THESE PHASES 1. DISPLACEMENT 2. BOOM 3. EUPHORIA 4. PROFIT-TAKING 5. PANIC 6. BAILOUT DISPLACEMENT AN OUTSIDE SHOCK TO THE ECONOMY: 1. 2. 3. 4. 5. 6. WAR NEW INVENTION POLITICAL EVENT FINANCIAL SUCCESS CHANGE IN POLICY ANYTHING THAT ALTERS THE ECONOMIC OUTLOOK BOOM THE OPTIMISM FROM THE CHANGE LEADS TO A RAPID RISE IN PRICES OF A PHYSICAL OR FINANCIAL ASSET AS INVESTORS AND SPECULATORS ATTEMPT TO EARN PROFITS EUPHORIA • LENDERS OFFER MORE CREDIT AT LOWER RATES • PEOPLE TAKE INVESTMENT RISKS • DEMAND INCREASES, DRIVING UP PRICES AND PROFITS WHICH DRIVES UP DEMAND-PRICES-PROFITS • NEW FINANCIAL INSTRUMENTS ARE CREATED • PEOPLE SEE OTHERS MAKING MONEY AND ARE DRAWN IN • THE BUBBLE IS INFLATED PROFIT TAKING • A FEW INSIDERS BEGIN TO TAKE THEIR PROFITS AND PRICES BEGIN TO LEVEL OFF • LARGE INVESTORS BEGIN TO REALIZE THEY MAY BE OVEREXTENDED AND ARE TAKING UNDUE RISK PANIC • A LARGE INSTITUTION FAILS, A SWINDLE IS DISCOVERED OR AN INCREASE IN SUPPLY RETURNS PEOPLE TO THEIR SENSES • PEOPLE START SELLING IN AN ORDERLY FASHION BUT SOON CHAOS REIGNS • PEOPLE SCRAMBLE TO SELL AND PRICES FALL RAPIDLY BAILOUT • A CENTRAL BANK MAY BEGIN TO EXPAND THE MONEY SUPPLY TO SAVE THE FINANCIAL SYSTEM • THE ENTIRE ECONOMY PAYS FOR THOSE DIRECTLY INVOLVED IN THE BUBBLE CYCLE • THE ANTICIPATION OF A BAILOUT MAY LEAD TO PEOPLE TAKING BIGGER RISKS • THIS DISREGARD FOR CONSEQUENCES IS KNOWN AS A MORAL HAZARD JOHN KENNETH GALBRAITH SAID: “Investors have a short financial memory (or ignorance of history) that makes them oblivious to previous financial disasters.” “ Investors have a tendency to attribute greater intelligence to individuals, the more income or assets they control.” WHAT WAS THE EVENT THAT CREATED THE CLIMATE FOR SPECULATION IN THE HOUSING MARKET? • PURSUIT OF SAFER INVESTMENTS AFTER THE DOT-COM BUBBLE BURST • THE ILLUSION THAT HOUSING PRICES ALWAYS RISE • THE BROAD AVAILABILITY OF CHEAP CREDIT WHY DID THE COUNTRY FALL SO QUICKLY FOR ANOTHER SPECULATIVE FASCINATION? • THE REDUCTION OF INTEREST RATES • THE ENCOURAGEMENT OF HOME OWNERSHIP BY THE WHITE HOUSE • THE FINANCIAL INNOVATIONS THAT EXPANDED ACCESS TO CREDIT • THE APPARENT WILLINGNESS OF WALL STREET TO BET HEAVILY ON HOUSING • THE FACT THAT SOME OF OUR NEIGHBORS WERE GETTING RICH AND WE WERE NOT WHY DO INVESTORS IGNORE THE WARNINGS FROM ALAN GREENSPAN AND OTHER ECONOMISTS ABOUT “IRRATIONAL EXUBERANCE”? • THE GENERAL BELIEF THAT “THIS TIME IS DIFFERENT” • YOU DON’T WANT THE DOOR OF OPPORTUNITY SLAMMED IN YOUR FACE • THE CONTRADICTION OF RISING VALUES DESPITE THE ALARMS • TYPICALLY THE DOOMSAYERS ARE FAR OUTNUMBERED BY THE OPTIMISTS WHAT CAUSED THE REALIZATION THAT THIS TIME WAS NO DIFFERENT THAN ANY OTHER? • RISING INTEREST RATES • THE INCREASING SUPPLY OF HOUSES • THE GROWING NUMBER OF MORTGAGE DEFAULTS • THE FAILURE OF HIGH PROFILE FINANCIAL INSTITUTIONS, SUCH AS LEHMAN BROTHERS AND BEAR STEARNS WHY IS IT LIKELY THAT ANOTHER SPECULATION BOOM AWAITS US? • HUMAN NATURE SEEMS TO LEAD US DOWN THE PATH TO EUPHORIA • THE NATURAL PURSUIT OF SELF-INTEREST • OUR EAGERNESS TO EARN PROFITS WE SEE OTHERS EARNING • DESIGNING AND ENFORCING EFFECTIVE REGULATION IS DIFFICULT