Exporting, Importing, and countertrade

advertisement

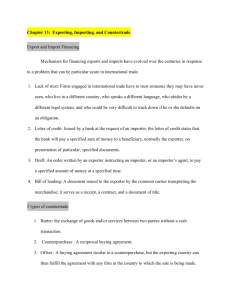

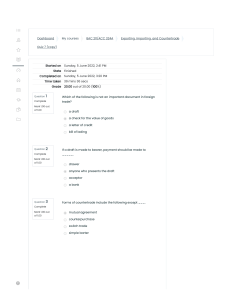

Exporting, Importing, and countertrade Chapter 15 Exporting, Importing, and countertrade Main objectives 1. Explain the promises and risks in exporting 2. How to improve export performance 3. Understand the information sources and govt programs that exist to help exporters 4. Check the basic steps involved in export financing. 5. Articulate how countertrade can be used to facilitate exporting. The promise and pitfalls of exporting The great promise of exporting is revenue and profit opportunities. And then economies of scale and cost reduction. Small and medium size reactive. Intimidated by complexities Ignorance of potential opportunities Poor market analysis and competitive conditions The promise and pitfalls of exporting Failure to customize Lack of effective distribution systems. Poorly executed promotional campaign. Paper work Poor negotiation abilities. Improving export performance Lack of knowledge of opportunities available. Collect information. The govt bodies help in providing information. Japan and Germany are role model countries in this regard. The promise and pitfalls of exporting -Information sources: US department of Commerce . Now the internet can be a source. Agencies and Govt agencies providing systematic, rigorous and useful information. Trade associations. Export Management Companies EMCs are export specialists who act as the export marketing dept or international department for its client firm. They have the knowledge and expertise Export Strategy 3M strategy Enter on a small scale to reduce risk. 2. Add additional product lines once exporting operations start to become successful. 3. Hire locals to promote the firm’s products. 4. New exporters can use EMCs 5. Building relationships. 6. Collecting information 7. Step to FDI 1. Export and Import Financing Lack of trust between the exporter and importer- payment against the shipment issue. Bank and letter of credit. A bill of lading: title of the products is given to the exporter by the carrier of the shipment as a receipt, a contract, and a document of title. Draft: the document for requesting the payment for the exporter. Exercise Play with your partner exporter, importer game using the text book example. Describe your experience as an exporter or importer or a bank. Final topic is countertrade. Countertrade When Govts restrict the convertibility of its currency, countertrade is the way out to this problem. Currency convertibility in chapter five. Countertrade: an agreement to trade goods for goods and services for services when they can not be traded for money. KSA agreed to buy 10 747 jets from Boeing with payment in crude oil, discounted at 10% Types of countertrade Barter: direct goods for goods Counter-purchase: A deal where RollsRoyce sold jet parts to Finland and agreed to use some of the proceeds from sale to purchase TVs from Finland and sell them in the UK. Offset: the same as the counter-purchase but you can buy TVs or any other product from any other firm in the country. Types of Countertrade Switch trading: occurs when a third party trading house buys the firm’s counterpurchase credits and sells them to another firm that can use them better. Compensation or buybacks: US and Venezuela agreed to build a huge refinery in exchange of supply of petrol for 50 years. Countertrade It can be a strategic competitive weapon or a strategic marketing weapon. Boeing and an Indian company- exchanging parts for jets countering Airbus and limiting Airbus compeitition. Its disadvantages: Lose of flexibility.