15-17

Countertrade

Trade carried out wholly or partially

in goods rather than money.

McGraw-Hill/Irwin

© 2003 The McGraw-Hill Companies, Inc., All Rights Reserved.

15-18

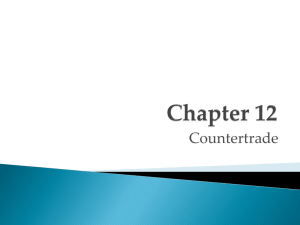

Countertrade as a Share of World Trade

Value

50

%

40

30

20

10

0

1975

McGraw-Hill/Irwin

1985

1990

1992

2000

© 2003 The McGraw-Hill Companies, Inc., All Rights Reserved.

Types of Countertrade

) Barter-

direct exchange of goods or services

having equivalent values without a cash

transaction

) Counterpurchase: involves 2 simultaneous

separate transactions between 2 parties with

or without cash

) Buyback or compensation: involves

repayment in the form of goods derived from

directly from, or produced by, the

technology, plant, or equipment provided by

the seller

1

Types of Countertrade

) Offsets:

involves an arrangement whereby

the seller is required to assist in or to

arrange for the marketing of products

produced by the buying country or to allow

some portion of the exported product to be

assembled or manufactured by producers

located in the buying country.

) Switch-trading: refers to a switch in the

country of destination goods

15-19

Countertrade Practice

100

Percent of

companies

engaged in each

countertrade

practice

80

73

60

60

19

20

McGraw-Hill/Irwin

Switch Trading

Barter

40

Figure 15-5

Offset

Buyback

22

Counterpurchase

3

0

O ffse t

S w itc h T ra d in g

B a rte r

B u yb a c k

C o u n te rp u rc h a se

© 2003 The McGraw-Hill Companies, Inc., All Rights Reserved.

Why countertrade?

) shortage

of hard currency

) lack of credit

) BOP problems

) low commodity prices - low export income

) surplus capacity

) arms trade

) lack of a well developed private sector

) lack of international trading experience

) LDCs - low share of manufactured goods I

intl trade

2

Benefits of Countertrade

) Allows

entry into difficult markets

) Increases company sales

) Overcomes currency controls & exchange

problems

) Increases sales volume

) Overcomes credit difficulties

) Allows fuller use of capacity

) Allows disposal of declining products

) Provides sources of attractive inputs

) Gain competitive edge over competition

Disadvantages of Countertrade

) No

“in house” use of goods offered by

customers

) Time consuming and complex negotiations

) Uncertainty

) Increase costs

) Difficult to resell goods by offsets

) Brokerage costs

) Getting businesses in which firm may have

no knowledge

) Risky if commodities are involved

15-22

Pros and Cons of Countertrade

) Gives

firms a way to finance an export deal

when other means are unavailable.

) Foreign governments may require it.

– Helps countries that don’t have sufficient foreign

currency reserves.

) However:

– May involve defective goods.

– Must invest in in-house trading department expensive and time consuming.

) Most

attractive to large, diverse multinational

enterprises.

McGraw-Hill/Irwin

© 2003 The McGraw-Hill Companies, Inc., All Rights Reserved.

3