private use monitoring compliance

advertisement

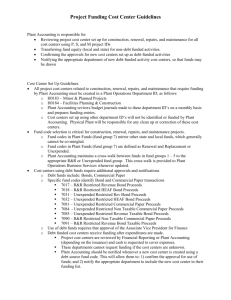

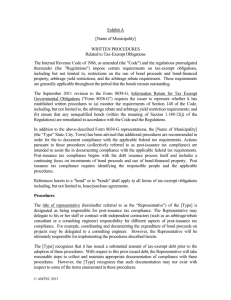

by Law Offices of Wayne D. Gerhold One Gateway Center, 18th Floor Pittsburgh, PA 15222 (412)298-5804 wayne.gerhold@gerholdlaw.com Effective April 2011 Line 43 – Check the box if the issuer has established written procedures to ensure that nonqualified bonds of this issue are remediated in accordance with the requirements under the Code and Regulations. Line 44 - Check the box if the issuer has established written procedures to monitor the requirements of Section 148. (Arbitrage Rebate) Identify clearly what building or project site is involved in each financing. If there were different buildings involved in different financings, only the building involved in a particular financing is taken into consideration related to that particular financing. Measure the square footage of each building and parking area if applicable. If all of the building is used by a “qualified 501(c)(3) corporation or a governmental entity compliance is achieved. What if there is a change of use, sale or a portion of the property is leased to a for-profit. Total proceeds of a tax exempt issue. See Part III, line 21(b) of the 8038 for bond proceeds. This is usually not the total aggregate principal amount of a bond issue. “Proceeds” are the aggregate principal amount of a bond issue plus original issue premium, minus original issue discount. $10,000,000 $50,000 original issue discount Proceeds equal $9,950,000, not $10,000,000 Then add investment earnings of the bond proceeds. Subtract proceeds used for reserve or replacement funds. Issuance costs do not include costs related to credit enhancement of the bonds. This would normally include bond insurance premium or letter of credit related costs, including the fees and expenses of LOC bank counsel. This question is very complex and relates to Section 141 if the Internal Revenue Code of 1986, as amended and Treasury Regulations §1.141. Bottom line-Do not have a determination that the use of the bond proceeds was for a “private business use”. The facility may not be used in a manner that will benefit a for-profit entity or individual. The facility may not be owned or leased to a for-profit entity or individual. The 5% exception rule. Basically if more than 5%, including the % of proceeds used for costs of issuance, of the space allocated to a for-profit use is found to exist the financing could be determined to be taxable. $9,950,000 bond proceeds from a $10,000,000 bond issue. 1.5% used for costs of issuance. Therefore no more than 3.5% of the space may be allocated to a private use. For multiple bond issues that finance the same facility, the percentage of space that may be used by a for-profit entity is separate calculation for each financing. Establish a uniform and rational system, for example: ◦ A. Calculate the total square footage of useable space of the facility. ◦ B. Calculate the square footage of the area used for private use purposes. ◦ C. Determine if the private use area has general access from all of the common areas of the facility or if there is a limited area of general access devoted to the entrance to the private use area. The other areas of general access may then be added to the other public purpose use areas. ◦ D. Divide the private use area by the total area of the facility. This is the percentage of private use and must not exceed the private use allocation based upon the proceeds percentage net of costs of issuance. If it is 3.5% the private use area must not exceed 3.5%. If the current use of the facility financed with tax exempt obligation(s) exceeds the private use test you may cure the non-compliance through compliance with the Remedial Actions Treasury Regulations § 1.141-12. Eliminate the “private use”. Payoff or defease the bonds or note principal attributed to the “private use” based on the % in excess of the 5% test. The existence of a management or service contract could result in a determination that the use of a facility was a “private use” unless the contract fits within the “safe harbor” provisions of Rev. Proc. 97-13 There is also a Private Letter ruling, PLR 200926005 that provides for an exception and guidance for permitting certain professional service agreements with certain contracting physicians. Generally the yield restriction rules of section 148(a) of the Tax Code provide that the investment of the gross proceeds of an issue in investments earning a yield materially higher than the yield of the tax exempt obligation. First determine the yield. This is provided for on the 8038. If the yield is variable a “look back” calculation will have to be made. Construction proceeds – Does it meet the Spending Exceptions. ◦ 6-month ◦ 18-month ◦ 2-year The 2 year Exception is most commonly used and it holds that certain available construction proceeds are actually spent based upon the following schedule from the date of the closing: ◦ ◦ ◦ ◦ 10% in 6 months 45% in 12 months 75% in 18 months 100% in 24 months with a 5% retention exception if the last 5% is spent within the 3rd year. Section 148(f) of the Tax Code provides that certain arbitrage earnings must be paid to the U.S. Department of the Treasury within 60 days every 5 years. The 8038- T does not have to be filed if there is no positive arbitrage to report. 1. Identify who will be responsible for post-issuance tax compliance. 2. Coordinate record-keeping and review with other staff or professionals. 3. Determine the frequency of review. * Source: Advisory Committee on Tax Exempt and Government Entities 1. Get a copy of the closing book documents from bond counsel. 2. Confirm with bond counsel that the 8038 has been filed 3. Establish a plan for keeping relevant books and records concerning investment and expenditure of proceeds. 1. Obtain the “yield’ of the tax exempt obligation and establish a procedure to track investments and returns. 2. Monitor compliance with the “temporary period” expectations, i.e. the spend down compliance and 3 year expenditure rule. 3. Arrange for timely completion of rebate liability, and if necessary, timely filing of the 8038-T and payment of rebate. 4. Consider the engagement of an outside arbitrage rebate consultant. 1. Keep track of which outstanding financings financed which facilities, this includes any refundings. 2. Establish controls to monitor “private use” of a facility to ensure compliance with the applicable % of use permitted. 3. Establish procedures to identify, in advance, management contracts. 4. If a question occurs, contact bond counsel before entering into such lease or management contract. 5. With bond counsel, determine whether any “remedial action” in connection with a “change of use” will need to be taken. The End