Cash flow is

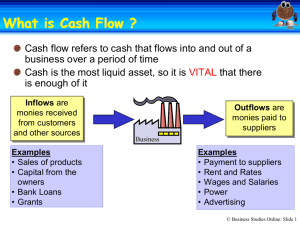

advertisement

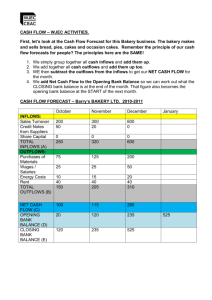

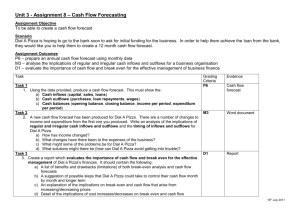

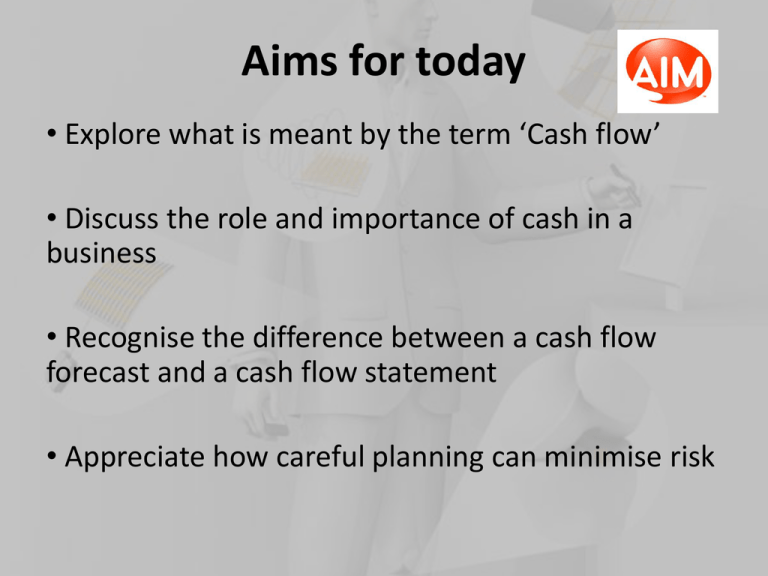

Aims for today • Explore what is meant by the term ‘Cash flow’ • Discuss the role and importance of cash in a business • Recognise the difference between a cash flow forecast and a cash flow statement • Appreciate how careful planning can minimise risk Cash and cash flow • Cash is vital to a businesses success and includes notes, coins and money in the bank. Cash flow is: The flow of money into and out of a business Cash inflows Cash Inflows are the cash coming into a business Cash from the individual Loan from the bank Cash from sales Cash outflows Cash outflows is the cash going out of a business (the payments it makes to others) Wages & training Telephone, gas, electric & other bills Equipment & Stock Interest on loans Advertising Maintenance & repairs Cash flow example Think about Nestles new Milkybar Moments... yummmmmmm... • In your groups, make a list of the all the cash inflows and cash outflows that Nestle may have. •Best answers MAY get a taster... Net cash Flow • Net cash flow is the money left over when a business takes its outflows from its inflows. • In other words, NET CASH FLOW IS: the receipts of a business minus its payments Example: If Nestle have £30,000 per month coming in and pay out £10,000 in costs, their NET CASH FLOW is £20,000. The importance of cash • Why is cash important in a business? • Cash flow is essential to prevent a business becoming INSOLVENT. Insolvency is when a business can no longer pay its debts. Can you think of any recent examples? Companies that no longer exist... 1. MFI 2. Royal Doulton (Waterford Wedgewood) 3. Zavvi Entertainment 4. HBOS Bank– but rescued by government 5. Adams (children's clothing retailers) 6. Barratts and Priceless (shoe shop chain) Companies that no longer exist... 7. Viyella (clothing business) 8. Passion for Perfume (retail chain) 9. Land of Leather (furniture) 10. Newcastle Productions (distributor of Findus foods) 11. Blooming Marvellous, (maternity-wear retailer) 12. XL Airlines And of course...Woolworths Joes Bar – Debt Management http://clipbank/espresso/c lipbank/servlet/link?macro =setresource&template=vi d&databaseType=cms&res ourceID=33&taxonomyNo deID=542 3 mins Cash Flow Forecasts • The cash flow forecast allows businesses to plan their finances. It is a prediction of the money that will come into and out of the business. They use them to: 1. See how well they should be performing 2. To see if action needs to be taken to avoid a cash crisis 3. Help them apply for/secure loans from the bank Over optimistic forecasting • Businesses are sometimes over optimistic when forecasting their cash flow. What impact could this have? • Essentially, they could end up spending money they don’t have because they think they will make it back in the future (according to their forecast). Forecasts need to be done CAUTIOUSLY. Cash flow forecast for Floral Events The OPENING BALANCE is: The cash balance at the start of the month The NET CASH FLOW is added to the opening balance to get the CLOSING BALANCE. The CLOSING BALANCE will become the opening balance for the next month Lets look at the example... Floral Events £ Receipts January February March April May June 2,400 2,400 3,000 3,400 4,500 5,00 Payments 2,200 2,500 3,400 4,000 4,200 4,200 Net cash flow 200 -100 -400 -600 300 800 Opening balance 0 200 100 -300 -900 -600 Closing Balance 200 100 -300 -900 -600 200 Cumulative cash flow The CLOSING BALANCE shows the CUMULATIVE CASH FLOW Cumulative cash is the build up of cash in a firms bank account Task • Look at the Floral Events Case study p77. • Does the company have a cash flow problem? • If so, what action can Holly take to overcome this? Cash flow problems What affects cash flow? Factors affecting cash flow Sales Stock levels Factors affecting cash flow Credit terms Costs Factors affecting cash flow • Sales can change • Costs can change • Credit terms can change • Stock levels can change Negative cash flow • In the case study, Floral Events had NEGATIVE CASH FLOWS in March, April and May. • Negative cash flow is also known as being ‘IN THE RED’. It happens when a businesses OUTFLOWS are greater than its INFLOWS. Cash Flow Exercise The table on the next slide shows a cash forecast for a new nightclub started with £250,000 of CAPITAL. The forecast is based on some key points: • Building work will be finished by September so customers can come in October. • A launch party will bring the customers and publicity needed for success. • Costs will be as predicted so the company will not have to dip into their OVERDRAFT facility. Club Woo Woo Figures in £0000’s Aug Sept Oct Nov Dec Jan Cash at start 250 65 10 20 25 55 0 0 85 65 115 55 185 55 75 60 85 60 Net monthly cash (185) (55) 10 5 30 (5) Cumulative cash 65 10 20 25 55 50 Cash in Cash out Answer the questions 1. Give 2 benefits of cash flow forecasting for a new, small firm. (2) 2. Using the table; (a) explain briefly 2 reasons why the firms cash flow has fallen from £250,000 in August to £10,000 by September. (4) (b) Explain the likely effect on the firms cash position if the building work was not completed until November. (4) The importance of planning • Planning will help businesses to avoid cash flow problems. A strategy to avoid problems is GET IT • Get the help/support of banks/investors • E – Ensure market research is thorough • T –Thoughtful cash flow planning will help • I – investigate where you get help spreading payments more evenly • T – Track the ACTUAL cash flow against the FORECAST Now for a game... Cash flow drag & drop and cash flow model http://www.businessstudiesonline.co.uk/live/index.php?option=com_content &view=article&id=2:edexcelgcse-activities&catid=3:gcse-businessactivities&Itemid=5 Homework – Due Thurs 3rd Dec 1. Answer ALL the questions on page 79 2. Pocketbook Revision: pages 51-54 & 56-58 Mr Elephante says “Don’t forget to remember to: •Use FULL sentences •Use FULL STOPS at the end of your sentences • Use CAPITAL letters at the beginning of sentences and for the names of people & places. • Date and title your homework Topic 1.3 Chapter 16 The Business Plan Page 80-81 The Business Plan • A business plan is a detailed development plan for a business. It includes information about the company’s: • • • • • • • • Location Ownership Products/services Resources Production methods Marketing Financial details It is usually completed on a 2-5 year basis Group Task • In your groups decide on a company that you will start up. • Using the example, draw up a business plan and include a cash flow forecast. • Next week you will deliver a presentation to a very important panel (the bankers, who will decide whether or not to give you a loan). • You must be able to justify your business plan details, decisions and forecasts. You should dress appropriately. The Business Plan The plan must include: Section 1: The business idea Section 2: Resources and quality issues Section 3: Financial resources Section 4: Feasibility and evaluation Quick Quiz • What is the opening balance? • What is the closing balance? • What does the Net cash flow mean? • What is the cumulative cash flow?